Home » Wage increases likely to beat inflation this year

Wage increases likely to beat inflation this year

Outlook improves after higher prices outpaced 2022 income growth

October 12, 2023

“It’s not what you earn. It’s what you keep.” That advice from my mother about saving has been ringing in my ears lately as I look at Spokane earnings data. In 2022, we didn’t “keep” as much as before. And it’s not necessarily due to profligate spending.

If you had a frown about the reach of your paycheck last year, it’s understandable. Spokane Trends indicator “Overall Average Annual Wage” makes this clear. Spokane County’s nominal earnings, the sum on our paychecks, climbed over $2,250, or 4%. But “real,” or inflation-adjusted, wages declined by $1,826 last year over 2021, or a minus 3.8%.

An outright decline in purchasing power has happened only a couple of times this century in Spokane, notably in 2001 and 2003. For some in our workforce, those experiences are likely distant memories; for others, it’s something learned about from one’s parents. And these prior declines were more modest than last year’s slump.

It was unusually high inflation that was responsible for the drop in real wages. The urban consumer price index hit nearly 8% year over year, a spike not seen since the 1980s. That doubled the 4% increase in nominal wages, which in most years would leave us with a smile.

Inflation was also a factor in 2021, as the CPI rose 4.7%. But during that pandemic year, average nominal earnings in Spokane, at 6.7%, chalked up their biggest increase in recent history.

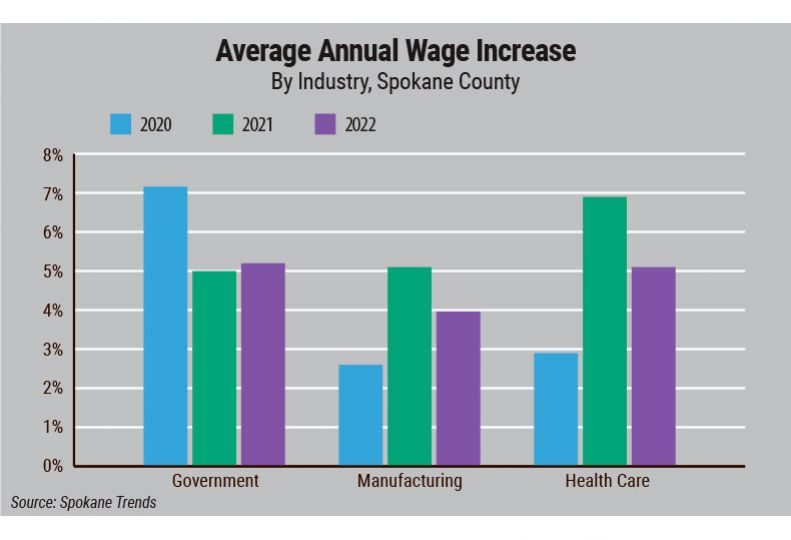

Averages, of course, typically mask considerable variation among their components. So too, with the real average annual earnings of the largest sectors in Spokane, as measured by headcount. These sectors ranked by size are health care and social assistance, government including school districts, retail trade, hospitality, and manufacturing.

In contrast to other regional metro areas, such as Tri-Cities, Washington, the variation in earnings wasn’t too pronounced among these sectors. Annual nominal increases ranged from 3.9% in manufacturing to 5.2% in government including school districts and health care/social assistance. Administrative workers—largely temps—ranked seventh largest, on the other hand, claimed a 10% increase.

For the nominal average to be 4% then, other sectors must have experienced smaller gains in earnings. When other large sectors are scrutinized, this proves to be true. Workers in construction, ranked sixth largest, experienced a 3.1% increase.

Average earnings in technical and professional services—the eighth largest sector—advanced only 1.1%. This high-paying sector includes accountants, engineers, lawyers, and pharmaceutical professionals.

The highest-paying of the large sectors—finance and insurance—claimed one of the lowest earnings increases, at 0.6%.

The decline of your “real” paycheck depended on where you worked.

How might this year shape up for real wage gains or losses? If the first quarter is any guide, much better. Recently released preliminary first-quarter earnings data show that average earnings in Spokane County soared 9.3%. This increase is well above the CPI increase for the first quarter of 5.8%. The CPI for the second quarter is currently running at a 4% rate.

Average inflation for the year likely will end up slightly less than that. The Washington Economic and Revenue Forecast Council, responsible for outlooks for state government, recently put the 2023 inflation rate at 3.8%. The measure the council uses is the personal consumption expenditure price index, which is a bit different than the CPI, but both trend closely together.

Should average annual earnings for the year tilt upward by more than say, 4%, Spokane workers will once again enjoy some purchasing power gains in their paychecks. But I wouldn’t count on a huge “real” increase in earnings, as the huge nominal wage gains of the first quarter are unlikely to repeat themselves the rest of the year.

Still, retaining more of one’s earnings than inflation takes away will be a welcome return to normalcy.

Latest News Education & Talent Insights

Related Articles

Related Products

![Brad head shot[1] web](https://www.spokanejournal.com/ext/resources/2025/03/10/thumb/Brad-Head-Shot[1]_web.jpg?1741642753)