Banking & Finance

Credit union expands

services through aid

of mergers, acquisitions

Read More

More financial institutions to branch out to South Hill

Members are driving two organizations to create a physical presence in the area

Read More

Slower rate of growth anticipated for Spokane-area financial institutions

Deposits, loan demand have declined industrywide

Read More

Hub International acquires Longbow Financial

Spokane-based office to retain staff, continue serving clients here

Read More

Multipronged plan can help fund child’s education

Long-term strategy aims to ease burden of rising college costs

Read More

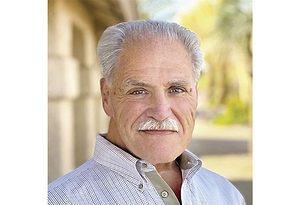

Wealth managers help clients reach financial goals

Situational awareness said to be important attribute for adviser

Read More