Banking & Finance

Rate cuts to boost short-term lending, penny production to cause headaches in new year

Read More

Bankers preserve relationships amid tech advances

Personal connections remain essential to meet evolving customer demands

Read More

Guest opinion

Spokane-area developments leave federal funds on the table

Failure to leverage New Markets Tax

Credit program costs jobs, investment

Read More

Payroll Vault location opens in Coeur d'Alene

Services will complement entrepreneurs' existing tax preparation business

Read More

Spokane advisers see upside of investing WA Cares funds

Diversified portfolio with mix of equities, bonds likely to be employed

Read More

ICCU triples membership, grows commercial team

Credit union expanding in Tri-Cities with three new branches

Read More

Small credit unions double down on accessibility, empathy

Leaders prepare to embrace new technologies while maintaining human connection

Read More

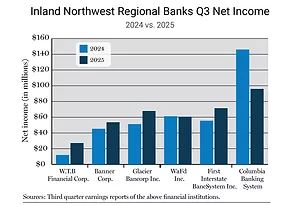

INW banks report varied Q3 earnings

Net income projected to decline if Federal Reserve lowers interest rates

Read More

Washington Trust Bank builds new branch, lobby

Remodel is underway at former Wells Fargo Center

Read More

_web.webp?height=400&t=1762416074&width=300)

_web.webp?height=400&t=1762416074&width=300)

_c.webp?t=1763626051)

_web.webp?t=1764835652)