Despite many auto thefts here, car insurance costs less

Comprehensive coverage rates are 17 percent below Washington state average

Despite an increase in auto thefts in the Spokane area last year, auto insurance companies say drivers here most likely won't notice a difference in their premiums.

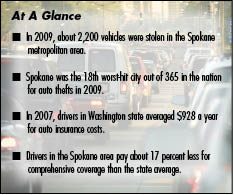

Recent reports from the National Insurance Crime Bureau (NICB) list Spokane as having the second highest rate of stolen cars in the state, just behind Yakima. Nationally, Spokane is the 18th worst-hit city out of 365 metro areas in the U.S., the report says.

Last year, about 2,220 vehicle thefts occurred in Spokane. The city jumped 17 spots on the national list last year, despite a 15.8 percent decrease in auto theft in Washington state, the NICB says.

Comparatively, Washington's annual average for auto insurance premiums, including liability, comprehensive, and collision coverage, was about $928 in 2007, the most recent year for which data are available, says the Washington state Office of the Insurance Commissioner. That's about $16 more than the national average of $912, it says.

Despite having Spokane, Yakima (ranked 6th), and the Seattle-metro area (37th) all listed within the top 40 cities in the nation for auto theft, Washington still falls near the middle of the pack for insurance rates, says Rich Roesler, spokesman for the insurance commissioner's office.

Meanwhile, Spokane's rate for comprehensive coverage, which includes vehicle theft, is still 17 percent less than the statewide average, says Pemco Insurance spokesman Jon Osterberg.

That's because insurers measure total claims losses for specific geographic areas to establish a "territory factor" rate to help determine the end cost of insurance for drivers in that area, Osterberg says. Claims losses can include far more than just theft.

"Risk is typically higher for people who live in densely populated areas. Crowding equals a higher likelihood for accidents and even for things like comprehensive losses caused by vandalism or accidental damage," he says.

In addition to location, auto insurers typically take into account such factors as age, gender, marital status, vehicle type, driving patterns, driving record or claims history, and a driver's credit history when determining rates, the insurance commissioner's office says.

It's estimated that less than 12 percent of the cost of the comprehensive coverage portion of an insurance policy, or just over 1 percent of a consumer's total policy cost, is based on auto theft risk, Osterberg says.

In Washington state, drivers that have comprehensive coverage, which also includes such things as windshield repair or other vehicle body damage, pay about $120 a year, or $10 a month, says Karl Newman, president of the NW Insurance Council, based in Seattle.

Of all five of the major types of auto coverage—bodily injury, physical damage, personal injury, comprehensive, and collision—comprehensive is the least expensive, Newman says.

Says Osterberg, "Theft is only one element of comprehensive, so as a subjective opinion, we doubt Spokane customers will detect any noticeable rate increase driven by increasing theft crimes."

Also released recently by the NICB was a list of the top 10 most commonly stolen cars in Washington state. Topping that list are 1992 Honda Accords, 1995 Honda Civics, and 1990 Toyota Camrys.

Yet, even drivers here who own one of those models most likely won't pay much more than someone who drives a different car, insurers say.

The prevalence of auto theft in a certain area is only one of many factors that insurers look at when setting premiums, and is usually considered after age, driving record, and the type of vehicle a person drives, says Allstate Insurance spokeswoman Megan Brunet, based in Seattle.

"Theft rate in a particular city is one of many things that we look at when deciding how much consumers pay," she says. "If theft rates go up in a certain city, consumers won't see an increase immediately, but if theft continues to increase, this may influence rates over time."

Washington's average auto insurance rates remained mostly stable between 2003 and 2007, the most recent time frame for which information is available.

National data from the Bureau of Labor Statistics for the last 10 years shows about a 39 percent increase in the cost of motor vehicle insurance, compared with an about 25 percent increase in the cost of living during that time.

Auto theft, however, still directly costs consumers money, the insurance council's Newman says.

"When auto theft jumps, it ends up costing all of us more money," he says. "We want to make sure people are alert about this crime, no matter what car they drive."

Newman says consumers can help by reporting suspicious incidents and being aware of increases in theft, which can be a result of tough economic times.

"Some people have their car stolen purposely to report it as a claim, which is a form of insurance fraud," he says.

To help prevent a vehicle from being a target to car thieves, Brunet says to always lock doors, stash away any valuable items, and park in a well-lit area.

"This is a message we want to make consumers aware of that can prevent their car from being stolen," she says.

Related Articles