Home » Real estate said poised for slow rebound in 2011

Real estate said poised for slow rebound in 2011

December 16, 2010

The residential and commercial real estate markets here are expected to turn around slowly in 2011, perhaps finally curbing protracted recession-related sales declines, industry sources here say.

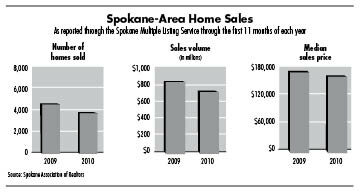

In the first 11 months of 2010, 3,913 homes were sold here through the Spokane Multiple Listing Service, down 9.4 percent from the already lackluster year-earlier period, making 2010 likely the fifth consecutive year of declining home sales here, says Rob Higgins, executive vice president of the Spokane Association of Realtors.

Higgins says the residential market recovery here will be slow, and likely won't pick up noticeably until the third quarter of 2011.

"Then, the first-time homebuyer comparisons will be flushed out, and we'll be comparing true market to true market," he says.

During the first half of the year, when the $8,000 first-time homebuyer tax credit and the $6,500 move-up tax credit were in effect, homes were selling at a faster pace than in the year-earlier period, Higgins says. The slowdown in sales since then, however, has more than offset the earlier increase, he says.

"Once the first-time homebuyer tax credit expired, the market here in Spokane reflected what was going on nationally, and sales slowed significantly for the second half of the year," Higgins says.

The median price for homes sold in the first 11 months of 2010 was $164,000, down 2.3 percent from $169,000 in the year-earlier period.

"I think we've seen the biggest part of prices coming down, and they're getting close to leveling off," Higgins says.

Dave Black, CEO of the NAI Black commercial real estate brokerage here, says 2010 hasn't been much better than the difficult 2009 in terms of commercial sales.

The office, retail, and industrial occupancy rates in 2010 have been fairly steady compared with 2009 in most market segments, although rents have been soft in some market segments, he says.

Rents will firm up in 2011, assuming lenders get out from under excess real estate holdings they acquired due to problem loans, Black says.

"I see the market at the bottom," he says. "I'm thinking it will be better in 2011."

It won't be a quick turnaround, he says, adding, "It could take three years to get out of this hole."

Black is encouraged, though, that some vacated retail space filled up in 2010.

"A lot of video stores went dark, and a lot of that space has been leased," he says. "A lot of good deals have been snapped up."

Ken Lewis, broker at Prudential Spokane Real Estate, of Spokane Valley, says the economic downturn has been unique, but has a potential silver lining.

"Usually, downturns are accompanied by high unemployment and high interest rates," Lewis says. "This time, it's high unemployment, but low interest rates."

A better employment picture coupled with continued low interest rates could help drive the market out of the doldrums, he says.

"When the economy starts to improve, people will start feeling better about the jobs they have, and the decision to buy is much easier when the interest rate is at 4.5 percent than when interest is at 7.5 percent," Lewis says.

—Mike McLean

Latest News

Related Articles

![Brad head shot[1] web](https://www.spokanejournal.com/ext/resources/2025/03/10/thumb/Brad-Head-Shot[1]_web.jpg?1741642753)