Home » Foreclosure ascent rate slows sharply

Foreclosure ascent rate slows sharply

Filings still increased at double-digit pace here; slow turnaround foreseen

January 13, 2011

The number of foreclosures in Spokane and Kootenai counties continued to rise in 2010, although not at the skyrocketing annual rate of increase that occurred the two previous years. Economic analysts here say it likely will take years for foreclosures to drop to more typical levels.

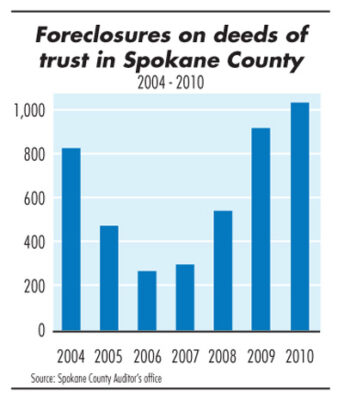

The Spokane County Auditor's Office reported 1,040 foreclosures on deeds of trust in 2010, up 12 percent from 925 foreclosures in 2009 and the highest level since foreclosures peaked at 1,152 in 2002 following the last recession. The rate of increase here in 2010, though, wasn't nearly as steep as in 2009, when total foreclosures climbed 65 percent, or 2008, when they soared 84 percent.

Randy Barcus, chief economist at Spokane-based Avista Corp., says he wouldn't have been surprised to see more foreclosures due to economic factors such as high unemployment and declining home values that often are linked to foreclosures. Unemployment reached double digits in early 2010, and the median home sales price has fallen in each of the last three years, potentially increasing the number of homeowners who owe more on their mortgages than they could bring in by selling their homes, Barcus says.

Rob Higgins, executive vice president of the Spokane Association of Realtors, says foreclosures are contributing to declining sales prices.

The median sales prices for homes reported sold through the association's Multiple Listing Service in Spokane County in 2010 was $163,400, down 3.3 percent from the median sales price in 2009 and down 12 percent from its peak of $185,400 in 2007.

The total number of homes sold through the MLS fell 9.1 percent to 4,239 in 2010, he says.

Despite the increase in foreclosures here, Higgins says the Spokane market is faring better than other parts of the country.

"Our numbers are better compared to even other parts of the state," he says. "Spokane has a more fiscally conservative type of environment."

The Spokane market consistently has a lower foreclosure rate than Washington state as a whole, which had the 17th highest foreclosure rate of all states in November, according to RealtyTrac Inc., an Irvine, Calif., company that compiles a database of foreclosure properties. Nevada, Utah, California, and Arizona had the highest foreclosure rates in the country as of November, according to RealtyTrac.

Barcus says, "Every foreclosure is a tragedy, but I'm relieved to a certain extent that we don't have rates like we've seen in the rest of the country."

Kootenai County's foreclosure problem is more pronounced than in Spokane County, although foreclosure numbers also might be approaching an apex there, he says.

The latest Real Estate Report, compiled by the Spokane-Kootenai Real Estate Research Committee, says 1,767 notices of foreclosure had been filed on deeds of trust in that North Idaho county in the first seven months of 2010 and estimates the year-end total at 3,029, or 11 percent higher than in 2009.

As in Spokane County, that rate of increase appears to be slowing rapidly there, following jumps of 79 percent in 2009 and 98 percent in 2008. Kootenai County's mortgage loan defaults are reported differently than Spokane County's and not all of the notices reported in Kootenai County result in foreclosure.

Kim Cooper, of the Coeur d'Alene Association of Realtors, says foreclosure sales accounted for 25 percent of residential real estate sales in Kootenai County in 2010.

"Banks are looking for cash reserves as opposed to real estate holdings," Cooper says. "They are selling houses at discounts, and that puts downward pressure on all prices."

The median home sales price in Kootenai County for the first 11 months of 2010 was $165,000, down 2.3 percent from the year-earlier period and down 19 percent from the peak annual median sales price of $204,427 in 2006, Cooper says.

In a healthy economy, Spokane County's annual foreclosure numbers would be below 500 consistently, Barcus says. He predicts, however, that foreclosures here will remain above 1,000 for at least another year or two. That, he says, doesn't bode well for homebuilders in the near future.

"Foreclosures are going to be competing with new construction," Barcus says. "Often a foreclosed home is going to sell at a substantial discount. That's one of the drags on housing values."

Stronger job markets will be instrumental in reducing foreclosures in both counties, he says.

Spokane County's unemployment rate remained elevated at 8.4 percent in November, the same rate as in November of 2009, says Doug Tweedy, Spokane-based regional economist for the Washington state Department of Employment Security.

Although preliminary figures are still being calculated, Tweedy says he expects that Spokane County had 220,000 jobs in December, a decline from 227,650 jobs in December 2009.

"In 2010, we did lose jobs—mostly in the first half of the year," he says. "In the second half, we started to see some recovery."

The 2010 unemployment rate here peaked at 11.2 percent in February and has been dropping since then as a number of employment sectors have added jobs, Tweedy says.

"Health care, manufacturing, transportation, finance, and professional and technical sectors are starting to gain traction," he says.

The recovery, however, will continue to be slow, and the unemployment rate here will remain between 8 percent and 9 percent in 2011, Tweedy predicts.

"We do have some ground to make up," he says. "We won't be near top employment for several years."

Kootenai County's unemployment rate in November was 10.8 percent, up from 10.5 percent in November 2009, says Alivia Body, the Idaho Department of Labor's Coeur d'Alene-based labor economist.

Body says she anticipates job gains in 2011, starting in the second quarter.

"We're seeing more job openings this year, particularly in the health-care and manufacturing sectors," she says.

Latest News

Related Articles

![Brad head shot[1] web](https://www.spokanejournal.com/ext/resources/2025/03/10/thumb/Brad-Head-Shot[1]_web.jpg?1741642753)