Home » SBA lending activity skyrockets here

SBA lending activity skyrockets here

Infusion of federal stimulus money, expansion of eligibility requirements lead to surge to start fiscal year '11

January 27, 2011

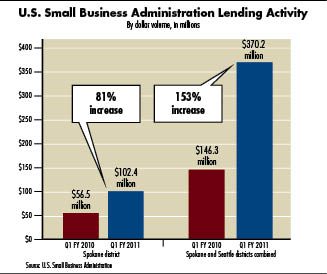

The U.S. Small Business Administration's lending program started strong here in the fiscal year that began in October, with an 81 percent jump in loan volume in the first quarter, compared with the year-earlier period.

That increase occurred largely because of a short-term infusion of federal stimulus money that made the SBA lending program more attractive both to lenders and small businesses, says SBA Spokane branch manager Ted Schinzel. Even before the stimulus became available, however, lenders were making more such federally insured loans than they had in recent years.

"We had our second highest year last year (in fiscal 2010, which ended Sept. 30)," Schinzel says. "Even before the stimulus money, lending to business was already starting to make a turn toward the positive."

In the first fiscal quarter, which ended Dec. 31, lenders made 217 SBA loans worth about $102.4 million in the SBA's Spokane district, which consists of 20 counties in Washington east of the Cascade Mountains and the 10 northernmost counties of Idaho. That's up sharply from the year-earlier quarter, during which there were 174 SBA loans for $56.5 million in the Spokane district.

If that pace were to continue, lenders would make more than 860 loans in the district this fiscal year with a total volume nearing $410 million, but Schinzel says the market isn't likely to sustain that level of activity. Many businesses rushed to finalize loans while the stimulus money was available. Those federal dollars—$14 billion nationwide—allowed the SBA to raise its loan guarantee to 90 percent, from 75 percent, and to waive a 3 percent-of-loan-value fee that borrowers typically pay.

"I'd be glad if we came back to around 700 loans," Schinzel says. At that level, SBA lending would be approaching a record year.

During the first fiscal quarter, SBA lending volumes grew dramatically for a number of individual banks. Coeur d'Alene-based Panhandle State Bank increased its SBA lending activity to 28 loans for $14.1 million during the quarter, from 15 loans for $4.1 million in the year-earlier quarter. The Eastern Washington and North Idaho offices of Minneapolis-based U.S. Bank boosted that bank's SBA lending activity in the region to 17 loans for $4.1 million, up 20-fold in value from eight loans for $200,000 during the year-earlier quarter.

While the rate of growth wasn't as dramatic for Coeur d'Alene-based Mountain West Bank, it maintained its top spot in the SBA lender rankings, with 59 loans for a total of $27.9 million during the quarter.

Linda Elkin, president of U.S. Bank's Spokane region, says that in addition to the stimulus money, other changes in SBA lending practices have made the program open to a broader range of companies.

"We saw that and were able to put some energy behind it," Elkin says.

Specifically, she points to the fact that the lending limit increased to $5 million from $2 million, which makes the loan program more attractive to some of the larger small businesses.

In addition, Schinzel says SBA tweaked its definition of what's considered a "small business" so that more companies fit that description. The agency's small-business definition varies from one industry to another, but generally, manufacturing operations with 500 or fewer employees and non-manufacturers with less than $7 million in average annual sales are considered small businesses. Now, if a company's sales or employee count come in above the small-business standard, businesses can use what's referred to as alternative size standard, which is less than $15 million in equity position and $5 million in profits, to qualify.

"There are more mid-sized businesses that qualify for a SBA loan," Schinzel says.

While a big burst in lending activity occurred in the first fiscal quarter, lenders also made a healthy number of SBA loans in fiscal 2010. During that year, 612 loans worth $165.5 million were made in the Spokane district, which Schinzel says is the second-highest level of SBA lending activity behind 2007, when the number of loans topped 700.

With a healthy 2010 and a strong start to 2011 in regards to SBA lending, the Spokane district is returning to pre-recession levels more quickly than many other districts throughout the U.S., Schinzel says. That's partly because SBA lending in the district didn't drop off as badly here as it did elsewhere.

In some parts of the U.S., SBA lending declined by as much as 50 percent in 2009, compared with 2008. In the Spokane district, the decline in activity at that time was closer to 20 percent, Schinzel says.

"We're just not taking the hit the same way," he says. "That's positive going forward."

Latest News

Related Articles

![Brad head shot[1] web](https://www.spokanejournal.com/ext/resources/2025/03/10/thumb/Brad-Head-Shot[1]_web.jpg?1741642753)