Home » Franchisee-friendly statutes dominate here

Franchisee-friendly statutes dominate here

Washington among 12 states in which franchises must register

June 2, 2011

Entrepreneurs who are considering a franchise opportunity, take note. According to franchise-law experts here, Washington state has some of the most franchisee-friendly statutes in the U.S.

For companies that want to expand through franchising in Washington, there are a couple of steps that must be taken that aren't required in other states.

"All of this is very much pro-franchisee," says Ted Stiles, an of-counsel attorney with Spokane-based Lukins & Annis PS who is involved in the American Bar Association's Forum on Franchising. "It's tougher (for a franchise) to get going in Washington or California than in most states."

Of course, this doesn't deter companies from offering franchise opportunities in Washington. Statistics provided by the Washington state Department of Financial Institutions show that 1,065 companies currently are registered as active franchises in the state.

And while experts say the laws have reduced the cases of fraud and unfair practices in franchise relationships, Stiles says it hasn't reduced the number of legal disputes between companies that offer franchise opportunities, or franchisors, and franchisees. He says he consistently is working on three or four lawsuits involving franchise disputes and has represented both franchisors and franchisees in different cases.

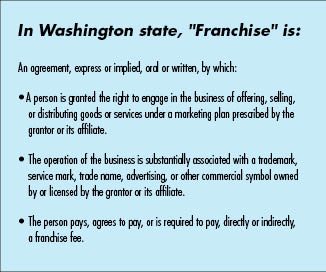

Martin Cordell, financial legal examiner for the state Department of Financial Institutions' securities division, says a franchise occurs when one company licenses another company to sell goods or services under a trademark or trade name and provides a marketing plan for that business.

In a typical franchise relationship, a franchisor provides the business concept and marketing plan to a franchisee for an upfront fee and a percentage of gross sales. Stiles says the franchise fee can vary widely—he's heard of them being anywhere from $2,500 to $250,000—and the percentage of sales varies from one industry to another. For example, he says, a fast-food franchise typically will charge a franchisee 5 percent or 6 percent of gross sales.

The franchisee typically covers all costs involved in making the business operational and profitable.

In all states, a franchisor must provide a franchise disclosure document, also known in some circles as a uniform franchising offering circular. Similar in nature to documentation required from a company offering stock for sale, the disclosure includes financial information about the company, and background information on the individuals involved, as well as summaries of risks, costs, obligations, and fees, among other items, Essentially, Stiles says, such a document—commonly 30 to 60 pages long—spells out the risks and costs involved.

In addition, Washington state requires franchisors to register with the Department of Financial Institutions. Cordell says it's one of 12 states that requires franchises to register before offering franchise opportunities in the state. The others mostly are more populous states, such as California, New York, and Illinois.

Cordell says the franchise-registration process allows the state to review the offerings and stop them from being offered if problems arise.

Sometimes, Stiles says, the state will require a new franchise to put the first franchise fee it receives in the state into trust until certain requirements involving support of its franchisee are met.

In addition to registration requirements, Washington state has a group of what are referred to as relationship laws governing franchising. One example of such a law, Cordell says, is that a franchise can't arbitrarily terminate a relationship with a franchisee. Similarly, Stiles says, a franchisor must give a franchisee one year's notice and waive its no-competition clause if it decides not to renew a relationship with a franchisee. Otherwise, he says, the franchisor must pay fair-market value for the terminated franchisee's operation.

Other relationship laws protect franchisees' rights to join trade organizations and prohibit a franchise from requiring franchisees to buy supplies or products from a specific vendor, unless it can prove that a specific product is essential to the company's successful formula.

Such laws are strongly in favor of protecting franchisees, but Stiles points out, "These laws are all developed from abuses of the past."

Cordell concurs, but adds that fraud, unfair practices, and other abuses aren't as prevalent as they were in the 1960s and 1970s.

"It's a mature industry, and most franchises are familiar with the requirements," he says.

That said, Cordell points out that some businesses operate as franchises and aren't aware that they are doing so. One example would be a housecleaning company that relies on independent contractors. If those contractors are trained by the company and pay to use its branding, that relationship could be operating as a franchise.

Another example is a business relationship involving a business system. Cordell gives the example of an auto-body shop that develops a system for painting cars, and in turn sells the rights to use that system and its trademarked name to another company.

"Depending on the marketing system, the combination may make it a franchise under franchise law," Cordell says.

Gray areas aside, Stiles says the franchise relationship can be beneficial to all parties when approached above board and fairly.

"The successful ones are treating their franchisees fairly," Stiles says. "It can be a perfect opportunity. If you treat franchisees fairly, it's mutually profitable."

Latest News

Related Articles