Tax-relief measures set to expire; big changes loom

This year's reprieve from major revisions said calm before reform

Federal rules for the current tax year are loaded with reprieves and compromises on many of the measures that were up in the air at this time last year, although many of those concessions likely are temporary, tax planners here say.

Expect big changes, however, in 2013, some of which already have been enacted and others that are on the table, they say.

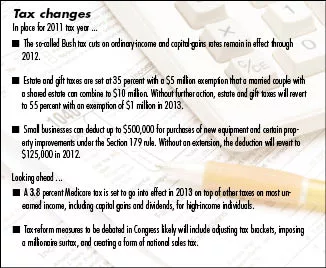

For the 2011 and 2012 tax years, tax rates remain unchanged while the Bush tax cuts remain in effect, although some of the brackets bumped up slightly to account for inflation, says David Green, principal at the Spokane accounting firm David Green CPA PLLC. The income tax rates tops out at 35 percent. For married couples filed jointly, the top bracket starts with taxable income of $379,150 for 2011.

The tax rate on capital gains remains at 15 percent through 2012.

William Braunberger, a tax partner in the Spokane office of Seattle-based Moss Adams LLP, says this year's reprieve from major changes to the federal tax code won't last.

"If there's anything of certainty it's that change is coming," Braunberger says. "Everything's on the table for review."

Reforms under discussion include broader ordinary income rates, revamping corporate taxes, imposing a millionaire surtax, and adding a new type of tax, such as a national sales tax, he says.

Changes for the 2011 tax year, though, include two provisions that allow small businesses to deduct from their taxable income the cost of qualifying equipment and certain improvements.

The Section 179 provision allows small businesses to deduct up to $500,000 for qualifying equipment and real estate. A bonus depreciation provision allows businesses to write off 100 percent of the cost of qualifying equipment and improvements.

Chris Hesse, a principal at the Spokane office of Minneapolis-based CPA firm LarsonAllen LLP, says some clients in the agricultural industry have high taxable income this year, because of good yields and crop prices.

"Those people who have equipment needs are looking at buying it and getting it on their places by Dec. 31," he says.

The Section 179 provision reverts to $125,000 in 2012.

Hesse says there's some talk of extending bonus depreciation, but he encourages clients who need qualifying equipment to buy it sooner rather than later.

"The whole purpose of bonus depreciation is to stimulate investments for people to do something right now," he says.

The bonus depreciation, which applies to certain property, utility improvements, and software purchases with a recovery period of less than 20 years, reverts to 50 percent in 2012.

Taxpayers who take advantage of full depreciation now, though, won't be able to spread out normal depreciation for that equipment in future years, when tax rates might be higher, Hesse says.

Tax preparers say people with sizable estates might want to take advantage of the lifetime gift exemption before 2013, when gift and estate tax are set to revert to 2009 levels.

The estate tax currently allows an exemption of up to $5 million. For a married couple with a combined estate, the exemption is $10 million. Estates are subject to 35 percent federal tax on values exceeding the exemption.

The tax also exempts lifetime gifts of up to $5 million—or $10 million for a married couple—meaning someone, while still living, can give away that much of an estate without it being subject to the federal estate tax, Green says.

"For 'high net' people in Washington that's a great deal because Washington state doesn't tax gifts," he says.

Washington state does, however, have an estate tax with a graduated rate of up to 19 percent on estate values above $2 million.

Green says one client, who gave away a significant portion of an estate while living, avoided a tax liability of $600,000 that would have been owed to the state had the recipient inherited the estate after the client died.

After 2012, however, the federal estate tax is set to revert to 55 percent with a $1 million exemption.

Another provision that's set to expire this year is a deduction for direct payout of up to $100,000 to charities from IRA distributions, says Andrew McDirmid, tax partner at Spokane-based accounting firm McDirmid, Mikkelsen & Secrest PS.

"Folks who have required IRA distributions are taking advantage of that," McDirmid says, adding that such charitable contributions also can reduce the taxable portion of their Social Security benefits in some cases.

Beginning in the current tax year, stockbrokers are required to report original purchase prices as well as sales prices when their clients sell stock, Hesse says.

While that doesn't affect the tax liability for someone who reports gains honestly, the time it takes to compile the documentation will cut into tax-preparation time, he says.

"We lose a couple of weeks on that," Hesse says. Because of that, more taxpayers will have to file for extensions because they won't be able to complete their returns by the tax deadline, he says.

Looking ahead, McDirmid says the Joint Select Committee on Deficit Reduction appears to be looking at tax proposals in which the early consensus would be to create three ordinary income rates and one corporate tax rate.

Such proposals typically would reduce deductions for corporations and high-income filers, and capital gains would be subject to ordinary income rates, McDirmid says.

Hesse says the health-care package approved in 2010 has a funding provision that includes a 3.8 percent Medicare tax on capital gains and most other unearned income for high-income individuals beginning in 2013. For instance, a married couple with taxable income higher than $250,000 would be subject to the Medicare tax on capital gains.

"There might be some planning a person can do to bring in that income in 2012 so it won't be subject to the higher rate in 2013," Hesse says.

Green adds that if a person has a large amount of unrealized capital gains, "It's probably wise to start to strategize to what might happen. Sometimes it's best to be ready to act as opposed to react. It's always worth talking with tax advisers and financial planners about 'what ifs.'"

Braunberger says he's expecting the top tax rate to increase by about 5 percent, in addition to the potential reduction or elimination of the Bush tax cuts and the added Medicare tax on unearned income.

Under such a scenario, federal personal income taxes could add up to more than 48 percent for top-income individuals in Washington, he says.

In states such as California and Idaho, which have state income taxes, the tax rate would be well over 50 percent, he says.

That would be comparable to the United Kingdom, where the combined income tax rate tops out at about 50 percent, Braunberger adds.

"Everything in my gut tells me the average combined federal, state, and local rates in the U.S. will go over 50 percent," he says. "Unfortunately there will be pain for everybody."

The full brunt of that pain, though, won't be felt this year or next.

"Congress is in the mode of pushing anything that's a tax increase out until after the election," Braunberger says.

He doesn't expect to see as much of an increase in corporate income tax rates, although some deductions likely will be eliminated, he says.

In the U.S., the combined federal, state, and local corporate tax rate averages roughly 40 percent, Braunberger says. The corporate tax rate is lower in many European countries. The rate in the U.K., for example, is expected to hold flat at 25 percent for at least a few years.

"To stay competitive, the U.S. can't push corporate income tax rates up," Braunberger says. "There is no question there would be a flight of corporations out of the U.S."

Related Articles

_c.webp?t=1763626051)

_web.webp?t=1764835652)