Home » More vets rely on VA loan program

More vets rely on VA loan program

Lenders say advantages for veterans outshine other mortgage types as zero-down options dwindle

November 3, 2011

The U.S. Department of Veteran Affairs home-loan program is gaining in popularity among people eligible for it, mostly because it's one of few remaining options for zero-down-payment, fixed-rate mortgages, lenders here say.

Jackie Cardle, real estate manager at Spokane-based Global Credit Union, says she's seen a steep rise in the percentage of mortgages backed by the VA home-loan program.

"Years ago, I might have seen one out of 100 loans going through the VA program," she says. "Now, 10 or 15 out of 100 are VA."

The percentage of VA-backed loans also is trending upward nationwide, the VA says. VA loans accounted for 10.8 percent of all home loans originated nationwide in 2010, up from 9.5 percent a year earlier. The agency estimates that rate will increase to 11.5 percent this year.

Perhaps more telling, total VA loan originations in the first half of the year were almost triple what they were three years earlier, while loan originations in the rest of the mortgage industry was down more than 25 percent, the Washington Post reported in August.

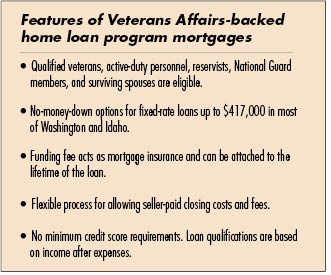

Veterans, active-duty personnel, reservists, National Guard members, and some surviving spouses are eligible for the program.

Mike Fredericks, real estate lending department production manager at Spokane Valley-based Horizon Credit Union, says the financial institution turns to the program as the primary option for veterans seeking home loans.

"Some veterans depart from active duty not fully realizing what's available to them," Fredericks says.

Cardle says one reason she's seeing a significant increase in the number of veterans contacting Global Credit Union is because the rental market is tight.

"Veterans' access to good housing at low rental costs isn't what it used to be," she says. "A good percentage of borrowers we help put into modest housing get permanent homes for less than comparable rent."

Conventional home loans usually require a borrower to buy private mortgage insurance when paying less than 20 percent down. During the foreclosure crisis, private mortgage insurance providers tightened restrictions by raising credit-score and down-payment requirements, compelling potential buyers to turn to government-backed options.

Instead of mortgage insurance, the VA program charges a funding fee that most borrowers attach to the loan, says Katie Marcus, residential sales manager at Coeur d'Alene-based Mountain West Bank.

Marcus says more than 10 percent of Mountain West's loans are VA loans, and she would expect that only to increase as more troops are discharged and return home and as young veterans enter the home-buying market.

Debra Goodrich, executive vice president of the home-loan division at Spokane-based Sterling Savings Bank, says corporatewide VA loan production so far this year totals $141 million, which is just over 30 percent of Sterling's government-backed loan volume. Last year, VA loans made up 22 percent of the government-backed loan volume at Sterling, she says.

Goodrich says the dollar volume of VA loans appears to be on track to hold steady at Sterling this year, while total government-backed loans are expected to drop in number, in part because the mortgage-insurance premiums on Federal Housing Administration-backed mortgages are scheduled to increase.

The FHA program offers an option that requires a 3.5 percent down payment. That program also requires an up-front mortgage insurance premium that can be spread over the life of the loan. FHA loans are attractive to low-income and young borrowers who don't have as much money for a down payment as borrowers in the conventional loan market, and such loans have grown into a major sector of the mortgage market, Fredericks says.

About 35 percent of Horizon Credit Union's home loans that originated this year are government-insured FHA loans and up to 15 percent are VA loans, he says.

While FHA loans have grown at the faster rate, VA loans have more advantages for most veterans, especially because they don't have to bring a lot of cash to the table, Fredericks says.

In addition to the zero-down option, VA loans usually are structured so that the seller pays closing costs and loan fees, which can save the borrower thousands of dollars and eliminate most up-front costs, he says.

"We have veterans who can get into a home for as little as $550 or $600 out of pocket," Fredericks says.

Also, the VA funding fee will drop on Nov. 18 to 1.4 percent of the borrowed amount for veterans and to 1.65 percent for reservist and National Guard members, Marcus says. The fee currently is set at 2.15 percent for veterans, and 2.4 percent for reservist and National Guard members.

The VA program doesn't require a credit check, but it does try to determine that borrowers have enough income after other expenses to meet the loan payments, which generally means it encourages homebuyers to buy modest, affordable homes, Marcus says.

Unlike other government programs that are designed to increase housing access for people with low to moderate incomes, however, the VA home-loan program has no upper income limit.

Depending on the buyer's income, the zero-down option can be used to buy homes valued at up to $417,000 throughout the Inland Northwest, she says.

Marcus says foreclosure rates are lower among borrowers with VA-backed loans than other types of home loans.

"We don't hear as much about bank-owned VA homes," she says. "We don't see them too often around here."

The Mortgage Bankers Association reported in its most recent mortgage delinquency survey results that 2.3 percent of VA loans were in foreclosure nationwide in the second quarter, compared with 4.4 percent rate of homes in foreclosure for all types of mortgages.

Latest News

Related Articles