Home » Montanore moves closer to permit

Montanore moves closer to permit

Silver-copper project would create hundreds of jobs

December 15, 2011

Spokane-based Mines Management Inc. says it anticipates federal approval as soon as next year of an exploratory mining permit that could lead to a large silver and copper mine, creating hundreds of jobs in northwest Montana.

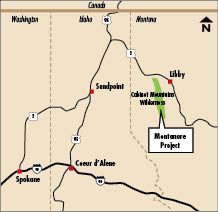

Mines Management's Montanore project would be located about 18 miles southwest of Libby, Mont., beneath the Cabinet Mountains Wilderness, just east of the Rock Creek Mine proposed by Revett Minerals Inc., of Spokane Valley.

Montanore would be accessed via an adit, or tunnel, with an entrance outside of the wilderness area near Libby Creek Road, which connects to U.S. 2, about 11 miles south of the town of Libby, says Mines Management's Douglas Dobbs.

Dobbs is the company's vice president of corporate finance and development, and his father, Glenn Dobbs, is its president and CEO.

Noranda Inc., the former Canada-based mining conglomerate, had drilled an exploration tunnel 14,000 feet toward the ore deposit before withdrawing from the project in 2002, about 4,000 feet short of the deposit.

Mines Management has been maintaining that adit since it took over the mineral rights to the project. The company began the federal permitting process to restart exploratory mining activities in 2005.

The U.S. Forest Service recently updated a draft environmental impact statement, a move the company calls a major step forward in the final phase of the permitting process.

Dobbs says the company is hopeful a permit will be issued within 12 to 18 months, although the Forest Service website says the agency could reach a decision as early as June 2012.

"We're optimistic we will begin advancing the tunnel and could have 25 employees as soon as the record of decision is granted," he says.

Mines Management currently employs eight people in Spokane, where it occupies 1,700 square feet of office space on the third floor of the Great Western Building, at 905 W. Riverside, downtown. The company has five other employees at the adit site.

Dobbs says a three-year construction project to open up the mine would create about 500 jobs and cost an estimated $552 million.

The mine would have about 350 long-term employees, he says.

As for exploration activities, Dobbs says the company plans to continue drilling the adit toward the deposit and plans will fork the tunnel to access two other portions of the deposit, which is estimated at roughly 12,000 feet in length and as wide as 3,000 feet.

It also plans to complete a drilling program to better define the mineralized zone and estimate expectations for the first five years of production, he says.

The mine would average 3,000 feet in depth, Dobbs says.

Preliminary data indicate the deposit contains more than 230 million troy ounces of silver and 1.7 billion pounds of copper. Dobbs says the company would expect to extract about 55 percent of the ore at best. "We need to leave pillars to hold up the roof," he says.

The mine is expected to have a production life of at least 15 years, resulting in an annual positive cash flow of more than $100 million, Dobbs says.

"That's the sort of thing that encourages us to persist through the complicated permitting process," he says.

The publicly traded company has raised its capital from investors.

"Occasionally, we have to go out to the market and raise additional capital," he says.

The company raised $15 million earlier this year, and Dobbs says it has $20 million cash on hand, "which is good for a year or two."

Mines Management, which has no other operations outside of its wholly owned subsidiary Montanore Mineral Corp., reported a net loss of $2.8 million for the quarter ended Sept. 30, level with a loss reported in the year-earlier quarter.

While there is some longstanding, organized environmental opposition to the project, Dobbs says it has the support of many elected officials in northwest Montana, as well as the local chambers of commerce and hundreds of people within the surrounding communities, which have an unemployment rate exceeding 15 percent.

Despite being beneath a wilderness area, Dobbs says the proposed mine location is ideal for a large mining project. "The infrastructure is in the area," he says. "So many mines today are in remote parts of the world; they've got to build their own railroads and roads."

Dobbs says the company emphasizes clean practices and worker safety.

"We're taking a benign approach rather than fighting agencies," he says. "It takes a long time to get through the permitting process, but I think we're doing it right."

Mines Management was founded in 1947 by a group of families led by William R. Greene, a developer of small lead and zinc mines in northeast Washington, Dobbs says.

In 1980, Mines Management merged with a smaller company that had overlapping claims with U.S. Borax to the Montanore deposit.

"The claims were inextricably linked," Dobbs says.

U.S. Borax later sold its interests there to Noranda, which received a permit to develop the exploration adit in 1990. Noranda, however, withdrew from all U.S. operations in 2002, after investing more than $100 million in the Montanore project, Dobbs says.

A unique clause in the mining lease stated that if the operator withdrew, it had to deed all claims to Mines Management at no cost to the recipient, he says.

Latest News

Related Articles