Steady SBA loan demand expected

Recently implemented incentives encourage post-recession growth, Inland Northwest lenders say

New loan incentives available through the U.S. Small Business Administration are keeping the total SBA loan volume here above pre-recession levels, despite the depletion of stimulus measures that spurred lending in 2010, some lenders here say.

Even without stimulus incentives, recently-implemented SBA programs increase borrowers' options, says Bob Beck, vice president of Coeur d'Alene-based Mountain West Bank, a perennial leading SBA lender in the SBA's Spokane District.

The SBA backing is a government guarantee on portions of certain loans that reduce lenders' risks as an incentive to extend credit to qualified businesses.

"A couple of things changed recently in the regulation and type of loans that greatly enhanced the ability to help small businesses," Beck says.

The changes include higher borrowing limits, refinancing options, simplified credit for working capital, and liberalized size-based restrictions that allow more business to qualify for loans.

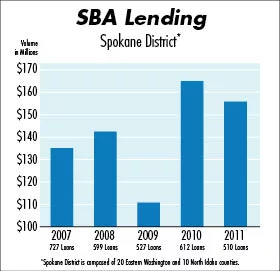

While the annual number of SBA-backed loans in the Spokane district peaked before the recession took hold, the total dollar amount increased dramatically even during the recession, says Ted Schinzel, manager of the SBA office here. SBA's Spokane district includes 20 counties in Eastern Washington and 10 counties in North Idaho.

In 2011, SBA backed 510 loans in the Spokane district, the lowest annual number since loans peaked at 727 in 2007. The dollar volume in 2011, however, was $156.9 million, second only to 2010 when SBA backed 612 loans totaling $165.5 million in the Spokane district. Loans in 2010 were aided by a federal stimulus measure that waived loan fees, saving a typical borrower as much as 2.75 percent on the total loan.

"In 2007, the average loan size was about $200,000," Schinzel says. "Today, it's about $400,000."

In 2011, the SBA increased the maximum loan amount to $5 million from $2 million.

"The maximum amount isn't necessarily available for a startup company, but it's a reasonable loan amount for a company that has survived the economic downturn and is ready to grow," Beck says. "They need capital to expand."

The old $2 million limit restricted growth opportunities for companies that would invest in new equipment and real estate. Additionally, expanding companies have a "desperate need for working capital," Beck says.

SBA tools called CAPLines had been available for qualified borrowers to use as a revolving account to cover working capital, Beck says, but until recently, it was too cumbersome for many businesses to bother with.

SBA recognized that CAPLines were underused and streamlined the application process, while increasing the maximum amount of credit for qualified businesses to $1 million from $350,000, Beck says.

CAPLines also allow companies to use collateral other than accounts receivable and inventory to secure working capital.

"That enhanced it a lot," Beck says.

Debbie Lawton-Shipman, senior vice president and chief operating officer at Northwest Business Development Association, says SBA's expansion of the debt limit to $5 million is providing expansion-plan assistance to small businesses that already have SBA loans on their books.

Another recent development allows businesses to refinance debt using SBA 504 loans, Lawton-Shipman says. The NWBDA is one of three nonprofits, called certified development corporations, in the state that arranges 504 loans under the SBA's job retention program.

SBA 504 loans had been limited to buying or improving land or buildings or acquiring long-term equipment. The new refinancing option enables businesses to apply equity in commercial real estate to eligible business expenses beyond mortgage debt. Such applications include maintenance costs, payroll payments, and lines of credit.

"Debt refinancing also can be used to refinance equipment," Lawton-Shipman says.

About a third of the recent 504 loan applications are for debt refinancing, she says.

"There has been interest in it, and people are still learning about it," Lawton-Shipman says. That option is temporary, though, and expires Sept. 27, she says.

Unlike the district's total loan volume, the number of NWBDA's 504 loans is trending upward, while the average loan size is down.

"As the value of commercial properties go down, so does the loan size for our projects," Lawton-Shipman says, adding that she expects the dollar volume of NWBDA loans this year to remain level with last year.

"I think we're going to be on track with where we were last year," she says.

A change in the definition of small businesses that includes alternative size standards has increased the number of businesses that can qualify for SBA loans, Schinzel says.

The alternative size standard allows some businesses to qualify if they have less than $5 million in equity and not more than $2 million in annual profit in the last two years.

"That increases the pool to include certain businesses that really weren't large businesses, but couldn't qualify for SBA loans," Schinzel says.

Prior to the change, for example, services and retail businesses that had annual revenues greater than $6.5 million couldn't qualify as small businesses.

SBA guarantees 85 percent of qualifying loans up to $150,000 and 75 percent of loans up to the $5 million limit, Schinzel says, and that guarantee is attracting more lenders to the program.

He says, "Why wouldn't they want to put a guarantee behind the loan?"

Schinzel says he expects to see increased competition among lenders vying for loans with the SBA guarantee.

"Banks could lose business if they don't have an SBA presence," he says.

Spokane-based Washington Trust Bank is forming a new SBA department and has hired former NWBDA officer Doug Wolford to manage it.

Wolford says the new SBA provisions expand the market for potentially eligible borrowers in two significant ways.

First, Wolford says the alternative size standards cover a great number of businesses here. Second, the new maximum loan amounts greatly increase the size of potential projects.

"With a standard loan structure of 50 percent for the lead lender and 40 percent for the certified development corporation, we can envision $10 million and $12 million projects," Wolford says. "That's quite a different profile than we had historically with SBA customers."

SBA loans also can offer the borrower advantages compared with conventional commercial loans.

"Customers have the benefit of superior quality financing with longer amortization, longer maturity, and certainly competitive rates," Wolford says.

Also, he says, the borrower's equity in a project can be as low as 10 percent under the SBA program, while conventionally financed commercial projects typically require a borrower to come up with 25 percent of the capital for the project.

Mountain West's Beck adds, "Other banks are beginning to realize the importance of the SBA guarantee.

The growing competition among SBA lenders will benefit the business community, he says.

"If we're going to have economic recovery, it's going to come through small businesses," Beck says.

Related Articles

_c.webp?t=1763626051)

_web.webp?t=1764835652)