Home » Inland Northwest executive pay jumps again

Inland Northwest executive pay jumps again

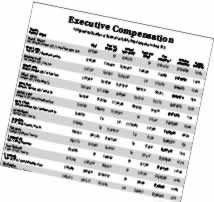

Average compensation rose by 13.3 percent in 2011

September 13, 2012

For the second consecutive year, executive compensation at Inland Northwest-based publicly traded companies increased by double digits in 2011.

The 13.3 percent rise in average total compensation was lower than the 17.9 percent increase in 2010, but still well ahead of the 3.6 percent average annual growth in 2009, the Journal of Business' annual analysis of executive pay shows.

This year's analysis includes 75 executives from 15 publicly traded companies based in the Inland Northwest, using information those companies must disclose to the U.S. Securities and Exchange Commission in their annual proxy statements.

Those executives received average total direct compensation of $1,106,604, compared with average compensation of $976,693 in 2010. Thirty of the 75 executives had total compensation that exceeded $1 million. Just over 60 percent of the executives had an increase in total direct compensation, while just under 30 percent of them witnessed a decrease. The balance involved people who were newly listed as named executive officers and didn't have comparative figures for 2010.

While total compensation increased substantially, an analysis of salaries and bonuses paint a different picture. Total compensation includes salaries, bonuses, stock and stock-option awards, and miscellaneous compensation. The analysis shows that all of the growth in 2011 was due to increases in stock and stock-option awards and other compensation, and that average salary-and-bonus compensation actually decreased by 4 percent.

For 2011, the average annual executive salary and bonus was $492,272, down from $511,009 the previous year. The median salary-and-bonus pay remained steady for both years, at $400,000.

The top earner on the list is no longer an active executive in the Inland Northwest. Dennis E. Wheeler resigned as chairman, president, and CEO of Coeur d'Alene Mines Corp. in July 2011 and received total compensation of $7.15 million that year.

Wheeler's compensation includes about $3.9 million in other compensation. According to Coeur d'Alene Mines' proxy filed with the SEC, the other compensation included a $2.8 million lump-sum payment as part of a separation package and a $1 million consulting agreement.

In 2010, Wheeler earned about $3.2 million and landed fifth on the list.

Of the active executives, Spokane-based Clearwater Paper Corp. President and CEO Gordon L. Jones was the top earner, with $4.4 million in total direct compensation, including $1.5 million in salary and bonus. Clearwater reported net income of $39.7 million, or $1.66 a diluted share, for 2011 and record net sales of nearly $2 billion that year.

The previous year, Jones finished third on the list with just under $3.6 million in total compensation, and he took the top spot on the 2009 list.

Among the fastest rising executives was Dennis C. Pence, chairman, president, and CEO of Sandpoint-based women's apparel retailer Coldwater Creek Inc. In 2011, Pence earned $2.3 million, a 284 percent increase compared with the previous year, finishing eighth on the list. Pence, who co-founded Coldwater Creek in 1984, had appeared at the bottom of the list the previous couple of years. Both of those years, he had taken an annual salary of $1 and accepted no bonus.

One reason for 2010's sharp increase in executive pay was the jumps in total compensation for executives at Itron Inc. Those increases ranged from 95.1 percent to 438.6 percent per person. Each of those Itron executives saw their pay decrease by double digits in 2011, with the declines in total compensation ranging from 7.5 percent to 27.8 percent.

Even so, all of the company's executives finished among the top 15 top-paid executives for 2011. Former President and CEO Malcolm Unsworth, who left the company in August 2011, ranked third with about $3.7 million in total compensation, after finishing at the top of the list in 2010. LeRoy Nosbaum, who came out of retirement to return to the top post after Unsworth's departure, ranked ninth on the list, with about $1.9 million in total compensation.

CEOs who didn't make the top 40 include Red Lion Hotels Corp.'s Jon E. Eliassen (45th), Revett Minerals Inc.'s John G. Shanahan (49th); Idaho Independent Bank's Jack W. Gustavel (51st), and Northwest Bancorp.'s Randall L. Fewel (61st).

At the bottom of the list was Northwest Bancorp. Senior Vice President and Chief Financial Officer Holly A. Poquette, who had total direct compensation of about $137,000, up 2.3 percent from the previous year.

For purposes of the analysis, total direct compensation includes salary, bonuses and annual cash incentive pay, the annual value of long-term incentives such as stock option and restricted share grants, and perquisites.

The total compensation listed for executives is dramatically higher than what they actually pocketed. Disclosure rules approved by the SEC in 2006 require companies to divulge more information about the compensation packages provided to their top executives, but they also include estimates of what some forms of the compensation are worth—or will be worth in the future. For example, amounts listed for grants of restricted stock and stock options use formulas to determine what the stock could be worth in the future for the executive.

The Journal doesn't include the gains executives earn in a single year from having past restricted-stock vest or from exercising past stock options. By adhering to the more stringent SEC disclosure rules, companies now include the current-year cost of such gains in their filings, so adding them in again would be duplicative.

That said, executives in this year's analysis exercised stock options worth a total of about $500,000 and had vesting gains of about $39.5 million.

Latest News

Related Articles

![Brad head shot[1] web](https://www.spokanejournal.com/ext/resources/2025/03/10/thumb/Brad-Head-Shot[1]_web.jpg?1741642753)