Home » Guarding your 401(k) nest egg takes some active steps

Guarding your 401(k) nest egg takes some active steps

Target date funds gain popularity with account holders who have little investing savvy

December 6, 2012

Safeguarding a 401(k) account goes beyond making a few fund choices and then glancing occasionally at statements, financial advisers here say. Plan participants can take steps to ensure that balances don't erode.

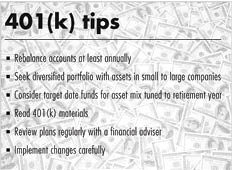

The tips include rebalancing accounts at least annually to ensure choices still reflect risk tolerance and nearness to retirement, keeping a diversified portfolio of stocks and bonds in small to large companies, reading 401(k) documents, and reviewing plans with a financial adviser.

Because a large number of people tend to set and subsequently forget about their 401(k) plans, investment professionals in the Spokane area also say that retirement target date funds are increasingly popular vehicles in employer-sponsored retirement plans.

The target date funds are set with an asset mix based on expected years until retirement, and the mix slowly becomes more conservative toward bond- and cash-equivalent investments, versus stocks, as a person gets closer to retiring. The target funds also can be set to rebalance automatically, says Chris Codd, a Spokane-based 401(k) adviser with Mercer Health & Benefits LLC.

For example, a 2040 fund that would apply to someone planning to retire near the year of 2040 typically has 20 to 25 percent of investments in bonds or cash investments and about 75 percent in stocks. A 2015 fund might have about 40 percent in the stock market and the balance in bond- or cash-type investments.

"The average 401(k) participant is drifting toward using retirement target date funds," Codd says. "The reason many people like them is it gets set today, and it's diversified, it gets rebalanced, and it gets more conservative as you get closer to retirement. The issue is some people aren't tolerant of the risk, and some people feel they're too conservative."

Brad Dugdale, a Coeur d'Alene-based D.A. Davidson & Co. senior vice president, agrees that the investment industry has recognized that many people contributing to retirement accounts don't spend much time monitoring them, and developed target date funds as a result.

"I'd say 97 percent of participants we enroll into 401(k) plans don't have immense financial investment knowledge," Dugdale says. "Target funds are a way to help people make choices so they don't overthink something they don't understand."

While target date funds aren't the best solution for everyone, he says, the more automatic approach may be better for people who fear the ups and downs of the market.

"People get afraid and go to all cash," he says. "We see it all the time."

Plan participants who would rather have a more self-directed approach and build their own portfolio need to understand what they're investing in and consider their tolerance for risk, Codd adds.

For all 401(k) participants, he says people should "run the number on how much they should be saving, and set it."

He adds, "One of the things people should look at is using tools with their plans through 401(k) providers that offer projections for employees, often free of charge, on how much to set aside and run the numbers for what they need in retirement. They can go online or call the provider for the projection report."

Among mistakes, people may select only a few funds for a 401 (k) because they performed well, rather than seek diversification. They don't realize the selected funds are in the same category, such as small-cap funds invested in small companies, says Paul Olsen, a Spokane insurance agent and investment representative with H. Beck Inc., the securities arm of The Capital Financial Group Inc.

"People should have a mixture of small-cap, large-cap, international, and mid-sized company investments," Olsen says.

Dugdale says another mistake people make is switching in and out of funds after they read mutual fund reports, perhaps moving into a fund that's up and out of a fund that's down.

"Then it turns around in the next six months," he adds. "There's a tendency for people to do opposite what they should do. It's like a bar of soap, the more you touch it, the smaller it gets."

If the overall 401(k) investments are well-diversified, a better strategy is putting away as much as possible toward retirement savings, Dugdale adds.

"I've never switched out of a fund, and I won't," he says. "I believe in the markets long term."

"It's more about, how much do you stick in the account," he adds. "That's 100 percent more important than trying to figure out how to manage your 401(k). In my opinion, a 401(k) is one of the greatest wealth-building tools any American can have, because people take a percentage out of their paycheck before they can touch it."

Olsen says 401(k) participants sometimes lose sight of long-term retirement saving goals because of what they hear in financial news about losses in the current markets.

"I think the press does some disservice because they tend to focus on the short term rather than the long term," he says. "As people tend to live longer, that presents some additional issues of how long of a period people should be thinking about as far as their retirement accounts and IRAs."

Dugdale adds, "Don't be asleep at the wheel. Having a successful retirement plan is something that's not an accident. It's because somebody had a goal and knew where to pick their finish line."

He and other advisers say that the dilemma is that most people don't spend a lot of time reading account information, or asking questions of advisers.

Meanwhile, some concepts—such as fee costs in 401(k) plans when shares are bought and sold—can be confusing, they say.

But Dugdale and others add that the fee charges are mostly out of the hands of participants.

"Most people have no choice," Dugdale says. "It's your employer who is selecting the funds."

Mark G. Powers, president of Spokane's NAS Pension Consulting Inc., consults with employers regarding the terms and structure of retirement plans, both for pensions and 401(k)s offerings.

Powers says fees are a hot topic, but he agrees they are set when plans are structured, and adds that different share classes of funds have different fees. The fees often equate to a small percentage that may go toward paying a financial adviser or recordkeeping expenses.

"Certainly, someone knowledgeable and influential with an employer might be able to do something about the expenses in a 401(k) plan, but they are what they are," Powers says.

He adds, "It's not like the individual has a choice. I can tell you all funds have different amounts of fees."

He cites a long-popular mutual fund, Growth Fund of America, which he says has eight or nine share classes, and each one of them has different expenses associated with them.

The employer decides whether to use fees toward expenses, such as hiring a financial adviser to help employees make choices, as well as recordkeeping, transfer expenses, and retaining legal expertise, Powers adds.

He says, "People don't understand that. All retirement plans cost something."

Codd also says whether people select target date funds or build a portfolio of selected funds, they need to be mindful of longevity and inflation risk. "Some people get nervous and want it more conservative than it should be statistically," he says. "There are risks that individuals don't always realize, and that is outliving your money, or inflation."

Some employers allow their employees to do what's called an in-service rollover to place part or all of their 401(k) assets into a separate IRA that offers a wider array of choices, and the employee can then continue making contributions to a workplace 401(k).

Powers says he is seeing this practice increase in recent years, but that the number of companies that allow it is still limited.

"That is because employee contributions under a 401 (k) plan cannot be distributed before age 59 by law," he adds. "They could do it for the employer-contributed portion, but most employers don't mess around to distinguish different sources."

Powers adds, however, "I'd say they're becoming more popular. Traditionally, it used to be a retirement fund was for retirement, but now it's maybe because an employee wants to make a Roth out of it, or they want to partially retire. We're doing more in-service withdrawals now than we did 10 years ago."

Up Close

Related Articles