Home » Foreclosures in Spokane County fall to four-year low

Foreclosures in Spokane County fall to four-year low

Job growth, stable prices help drive downturn in defaults

January 17, 2013

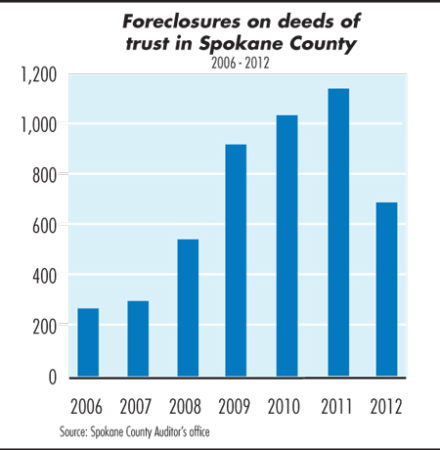

After several years of steeply rising mortgage defaults in Spokane County, foreclosures on deeds of trust plummeted to a four-year low in 2012, while foreclosure numbers in Kootenai County were tracking downward as well in the latest available figures.

Last year, the Spokane County Auditor's Office recorded 685 foreclosures on deeds of trust, down a whopping 38 percent from 1,112 foreclosures a year earlier, and the lowest annual total since 2008, when the county recorded 560 foreclosures on deeds of trust. A deed of trust is a document that pledges real property to secure a loan.

The reduction in foreclosures partly reflects a regional improvement in the economy, especially in the second half of the year, says Grant Forsyth, chief economist for Spokane-based Avista Corp.

"The worst part of the housing market decline and the worst part of the recession is pretty far behind us," Forsyth says. "The biggest wave of foreclosures has gone away."

Forsyth says he expects foreclosure numbers to continue to improve in 2013. "If the forecast is right, the economy is going to be a little better this year than last," he says.

In his role with Avista, Forsyth provides economic forecasts in the energy company's service area in Eastern Washington, North Idaho, and parts of southern and eastern Oregon.

Overall home sales are improving just as foreclosure numbers are falling, says Rob Higgins, executive vice president of the Spokane Association of Realtors.

The total number of homes sold in 2012 through the association's Multiple Listing Service was 4,521, up 12.3 percent from 4,025 homes sold in 2011.

Higgins says 14 percent of those homes were bank-owned or short-sale properties, most of which were subject to foreclosure actions. That's an improvement over 2011 when 22 percent of home sales involved such distressed properties.

"The build-up of foreclosures has worked its way through the inventory," Higgins says, noting that the number of active listings also fell to 1,994 at the close of the year, down from 2,325 at the end of 2011.

The median sales price for homes sold through the MLS in 2012 was $160,000, up 3.7 percent compared with the 2011 median price.

The upward price movement appears to be accelerating, though, Higgins says. The median sales price for the month of December alone was $167,000, up 15 percent from December 2011.

"These numbers are all positive," Higgins says, adding that continued improvement in the foreclosure rate also hinges on a positive job market.

"With job growth, we're going to see those numbers look better," he says.

The Washington state Employment Security Department reported that the Spokane County unemployment rate in November was 7.7 percent, the lowest November rate since 2008.

"Usually the November and December have the lowest unemployment rate of the year," says Doug Tweedy, the department's Spokane-based regional economist.

"We do expect that to go up to around 8 percent in January and February, but it won't be as high as last January and February," Tweedy says. Unemployment rates in Spokane County last January and February were 9.7 and 10.1 percent, respectively.

Tweedy says he's optimistic that job numbers will continue to improve.

"In the last half of 2012, we gained 2,200 jobs that are paying good wages," he says. "We're gaining jobs in higher paying occupational categories."

While people currently employed likely will see slow increases in wages, Tweedy says, "New jobs that are paying better are changing the wage base."

Such jobs are in the fields of health care, finance, insurance, science, professional services, and advanced manufacturing, he says.

Kootenai County also is seeing some job growth and a stabilizing housing market, which should bode well for continued improvement in foreclosure numbers there, says Kim Cooper, a broker with Select Brokers LLC, of Coeur d'Alene, and a spokesman for the Coeur d'Alene Association of Realtors.

In Kootenai County, bank-owned properties accounted for 20 percent of home sales in 2012, down from 33 percent in 2011, Cooper says.

The fall 2012 Real Estate Report, compiled by the Spokane-Kootenai Real Estate Research Committee, said 1,315 foreclosure actions were reported in Kootenai County in the first 10 months of 2012. That's a drop of 17 percent from 1,589 foreclosure actions in the year-earlier period, and the lowest total for the months of January through October since 2008. Year-end numbers for 2012 weren't immediately available.

Kootenai County's foreclosure activity is reported differently and isn't directly comparable to Spokane County's foreclosures, because not all of the actions reported in Kootenai County result in foreclosures on deeds of trust.

The November unemployment rate in Kootenai County was 8.1 percent, down from 9.9 percent a year earlier, according to Idaho state Department of Labor figures, which also showed Kootenai County gained 1,900 jobs between November of 2011 and December of 2012.

"If we can maintain interest rates below 4 percent and continue to chip away at the rate of unemployment, we're going to continue our long, slow climb out of the hole that was 2008," Cooper says.

He says 2012 marked the third consecutive year of increases in the number of homes sold in Kootenai County, while median sales prices rose throughout the year in Coeur d'Alene and in the second half of the year in Post Falls.

The median home sales price through the first 11 months of 2012 was $157,000, an increase of 6 percent compared with the year-earlier period.

Latest News

Related Articles