Home » Navigating the Medicare Haze

Navigating the Medicare Haze

Health insurance experts say beneficiaries don't have to go it alone

September 26, 2013

It can be a daunting task for an individual to enroll in Medicare and stay abreast of annual premium and benefit changes that occur in dozens of plan options in any given year, say sources here who work with government and private health insurance options.

On a national scale, a recent survey of older adults found that most can't correctly identify the health care expenses that Medicare parts A, B, C, and D cover, says Jeff Underwood, vice president of Mercer Island, Wash.-based UnitedHealthcare of Washington Medicare & Retirement.

The survey also found that most baby boomers don't know where to begin when transitioning from employer-sponsored health insurance to Medicare, the federal health insurance program primarily for people 65 and older.

UnitedHealthcare, a nationwide health insurance provider that has about 14,000 Medicare Advantage policy holders in the Spokane area, sponsored the survey.

"We always encourage people to talk to their human-resource representative, Social Security, and relatives," says Underwood, who advises people approaching retirement age.

Most Medicare beneficiaries have original Medicare (parts A and B), which cover hospitalization and doctor visits, and a prescription plan (Part D), says Dr. George Rice, a retired physician and Spokane-based volunteer with Statewide Health Insurance Benefits Advisors. Medicare coverage alone doesn't cover all health-care costs, he says, adding that supplemental insurance can reduce out-of-pocket health care expenses.

"I'm on original Medicare; $105 comes out of my Social Security check to pay for Part B," says Rice, who also has a Part D plan. "So I have a supplemental, or Medigap, plan with a health insurance company that covers almost everything for $175 a month."

About a quarter of Medicare beneficiaries are on Medicare Advantage (Part C) plan, which includes benefits of parts A and B and usually includes prescription-drug and Medigap coverage, according to the Kaiser Family Foundation, a health care research nonprofit.

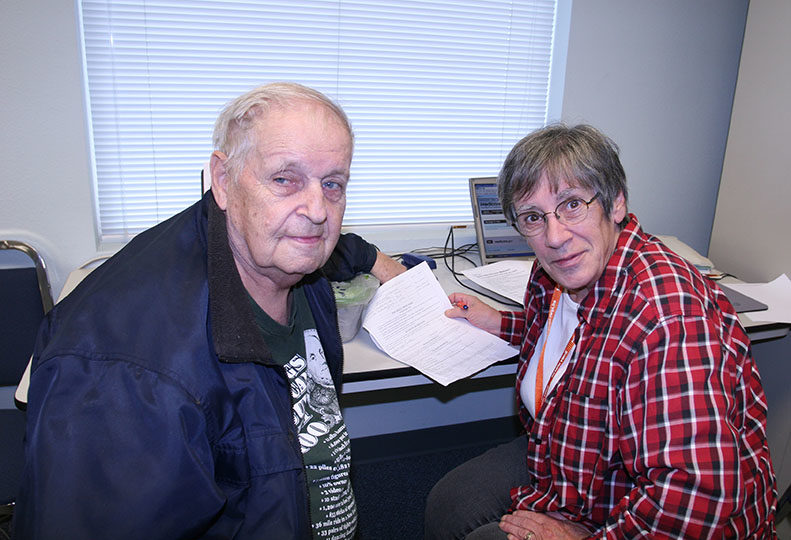

Statewide Health Insurance Benefits Advisors holds regular workshops to help people access Medicare benefits free of charge, says Kathy Dugan, SHIBA coordinator for Spokane and Whitman counties, who's based at the Aging & Long Term Care of Eastern Washington office in Spokane.

Including Rice, the SHIBA chapter here has 46 volunteers who assist thousands of people annually with health insurance inquiries. The majority of its assistance involves people who want to enroll in Medicare or review the plans they have.

During the busy Oct. 15-Dec. 7 annual open-enrollment for certain changes in plans, Washington State University pharmacy students work alongside SHIBA volunteers and clients.

Dugan urges anyone approaching the age of 65 to contact Social Security and enroll in Medicare Part A regardless of when they plan to retire.

"There's no reason not to, because it's free," she says, adding that Part A could be beneficial to people with high deductibles under other insurance, if they end up hospitalized.

In addition to inpatient hospital stays, Medicare Part A covers care in a skilled-nursing facility, hospice care, and some home-health care, the Medicare website says. Many Part A benefits have a deductible, but for eligible beneficiaries, there is no additional cost to receive Part A benefits.

Medicare Part B covers certain provider services, outpatient care, medical supplies and preventive services. For most recipients, Part B benefits are subject to a monthly premium that's withdrawn from Social Security benefits. The current typical Part B premium is $105 a month, the Medicare website says.

Medicare Part D adds prescription drug coverage. Part D plans are provided through private insurance companies and are subject to premiums, deductibles, and copayments. The average monthly premium for Part D is about $30, the website says.

Medicare Part C, also called Medicare Advantage, combines the benefits of Medicare parts A and B. Most Medicare Advantage plans also cover prescription drugs and provide supplemental coverage, the website says. Medicare Advantage plans often require minimal or no deductibles, have simple co-pays for covered services, and limit out-of-pocket expenses.

Rice says, "To be able to understand which policy is best suited for you, you need to be computer literate to navigate the medicare.gov website."

SHIBA helps clients enter electronically their prescriptions, dosages, and how often they take them to help determine which plans cover the drugs they're currently taking.

The Medicare website identifies companies that cover the drugs specific to the client's ZIP code.

"There may be 25 or 30 companies that will cover the drugs," Rice says.

The website sorts the companies by annual expense, including premiums, deductibles, and what the plan will pay for drugs, Rice says. "Many companies will be within a few dollars of each other," he says.

If clients want to make a selection at that time, SHIBA can help them sign up.

"Normally they pick the cheapest plan," Rice says. "There's no need to pay more money for the same benefits."

Medicare Advantage plans can have lower premiums than combined premiums for Medicare parts B, D, and supplemental plan premiums, but Rice says some Medicare Advantage plans have a narrower selection of providers and hospitals to treat the beneficiary, than original and supplemental Medicare plans.

Plans that fall under Part D especially are susceptible to significant changes from year to year, Rice says.

"You need to look at drug programs every year, or you could end up paying a lot more money than you need to," he says.

Rice says he's been on Medicare since 2006 and has changed drug plans nearly every year to maintain specific drug coverage at the lowest rates available.

Maureen McCabe, who has worked in the Medicare arena for a number of years, says she founded Health Insurance Choices, a Spokane insurance agency, this year to focus on Medicare Advantage and supplement options.

"Generally, I'm talking to individuals turning 65 who are ready to go onto Medicare because they don't have any coverage," she says. "There's a lot of confusion when people first go on it. An agent who works with insurance all the time can help them narrow their options and work with their budget."

McCabe, like most insurance agents, works on commission and is paid by the providers of plans that her clients select.

"Original Medicare is a great program," McCabe says, adding, however, that deductibles, copays, and noncovered expenses could still be significant.

She advises clients to look at costs and co-pays for specific services that they might need, such as chiropractic and physical therapy, which are covered more under some supplemental plans than others.

She says she also helps clients navigate the benefits after they buy a plan.

"Insurance-company customer service can be difficult. Often, clients don't understand what they should ask," McCabe says. "I spend a lot of time on three-way calls to work through concerns with insurance companies."

She says she helps clients select options that work correctly for them.

"We need to look at who their primary care provider is, and who their specialists are, because not all doctors participate in all plans," McCabe says.

She says it usually takes two or three meetings with clients before they decide from among their options.

UnitedHealthcare's Underwood says most people approaching age 65 have a seven-month window to enroll in Medicare without penalties—the month of their 65th birthday and the three months before and after the birthday month.

"If someone doesn't have employer-sponsored insurance, they're going to want to pay attention to that window," he says.

People who are age-eligible for Medicare, but are still employed, can defer selecting parts B and D as long as their employer-sponsored insurance is better than or comparable to Medicare options—what Medicare calls "credible" insurance, Underwood says.

Penalties come into play when people who haven't had credible insurance seek late enrollment in Medicare parts B and D. The penalty for late enrollment in Part B is 10 percent of the premium for every noncovered year, Underwood says.

"If you wait five years, you pay a 50 percent penalty for the rest of your life," he says.

Late enrollment in Part D carries similar penalties, Underwood says.

When people retire, they have an eight-month window from their retirement date to elect Part B without a penalty, but they only have a two-month window to select a Part D plan or risk being penalized, he says.

Underwood advises prospective retirees to get some form of Medicare-qualified prescription drug plan regardless of whether they have active prescriptions.

"I get concerned when I hear people say they don't need Part D because they don't take prescriptions," he says.

Adding to the complexity of options, people older than 65 and seeking Medicare Advantage coverage upon retirement have to already be enrolled in Medicare parts A and B, he says.

"It can take a couple of months to process" the move to Medicare Advantage, Underwood says. "That's why we tell people to start early. You don't want to find a lapse in coverage because of the timing of the windows."

Group Health Cooperative is one of a few organizations in Washington state that has earned a five-star rating from Medicare for its Medicare Advantage plan, says Rick Henshaw, Group Health's Seattle-based director of Medicare sales. Henshaw also oversees Group Health's Medicare Advantage program in Spokane.

Providers that receive the five-star rating, which is a measure of quality and coverage that exceeds Medicare's benchmarks, potentially receive a higher rate of federal reimbursement than providers of plans rated with fewer stars.

Group Health has more than 4,800 Medicare Advantage members in Spokane, Henshaw says.

The Medicare Advantage plan has been attracting new members to the cooperative, he says, adding that Group Health's sales team offers people assistance in making Medicare choices.

"It's really a consultation process," Henshaw says. "Medicare has strict guidelines in how we market to beneficiaries. I've were not the right fit for someone, we're not going to sway them to enroll in our plan."

Latest News Special Report Health Care

Related Articles

Related Products