Home » Spokane County's top taxpayer levies swell

Spokane County's top taxpayer levies swell

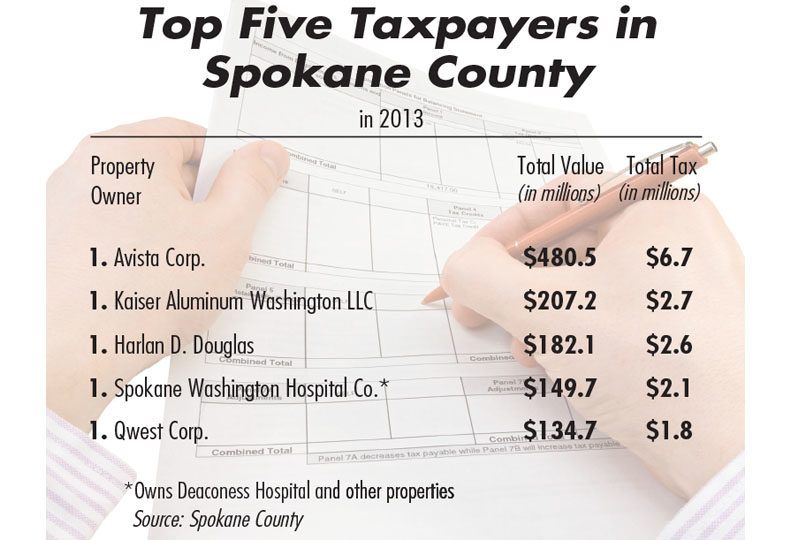

Perennial leader Avista ranks first on list of 50 largest property owners

November 7, 2013

The collective share of the 50 largest property taxpayers in Spokane County, led by perennial top payer Avista Corp., grew by 16 percent this year to reach nearly 9 percent of the total property taxes levied in the county, according records obtained through the Spokane County Treasurer's Office.

In all, the bills levied on the top 50 property taxpayers in Spokane County for 2013 totaled $44.2 million, up from $38.1 million in 2012. The total valuation of properties owned by the top 50 taxpayers was $3.2 billion this year, up 10.5 percent from $2.9 billion in 2012.

The second half of property tax payments were due Oct. 31, says Spokane County Assessor Vicki Horton.

The top 50 taxpayers also are paying a larger share of the total countywide property tax bill this year than last, a comparison with last year's list shows.

This year's total tax levy for the top 50 taxpayers is 8.8 percent of the tax bills totaling $501.8 million for all of Spokane County. Last year's top 50 taxpayers were assessed 7.7 percent of countywide tax bills, which totaled $494.8 million.

Overall property tax assessments increased by 1.4 percent this year, compared with countywide assessments in 2012.

Despite the increase in taxes, the county's total assessed value for the 2013 tax year, at $36.4 billion, was down from the year-earlier countywide valuation of $37.5 billion, marking the third consecutive year of declining overall values.

Horton says the tax bills for 2013 were based on 2012 property values, when residential property values were just beginning to level off after recession-related declines. So far this year, residential valuations are on the rise "pretty much throughout the county," she says. "The trend is about 1 to 2 percent (increase in valuation) overall."

Those increases will be factored into next year's property tax assessments, Horton says.

Commercial values, though, did go up in 2012, and that was reflected on the 2013 tax bills, she says.

Horton, who was elected in 2010, says her office has initiated annual assessments of commercial property values. Previously, those valuations had occurred at intervals of up to six years, she says.

"Commercial properties in 2012 all were assessed," Horton says. "Generally, commercial property owners are our highest taxpayers."

The top six taxpayers remained unchanged from last year's rankings.

Avista Corp. tops the county's list with a record tax bill of $6.7 million, more than twice the amount levied on the second-highest taxpayer, Kaiser Aluminum Washington LLC. Avista's bill, which was assessed on 304 properties valued at $480.5 million, was up 16 percent compared with its 2012 tax assessment of $5.8 million on 300 properties valued at $434.9 million.

"Avista is continuing to grow," says Don Falkner, the Spokane-based energy company's tax director and assistant treasurer. "We're upgrading facilities across the system. That's translating to higher property values and property taxes."

The company is investing capital in all of its service areas, which include parts of four Western states, Falkner says.

Avista pays $27.5 million in property taxes throughout its system, with $10.6 million of that going to taxing entities in Washington state, he says, adding that Spokane County receives the largest share of Avista's property taxes in the state.

Avista's corporate headquarters are here, at 1411 E. Mission. The company also owns numerous service and training centers, hydroelectric facilities, substations, and transmission lines throughout Spokane County.

Kaiser Aluminum Washington, a real estate holding arm of Foothill Ranch, Calif.-based Kaiser Aluminum & Chemical Corp., had a property tax bill of $2.7 million on 10 properties in Spokane County, up from $2.5 million on 11 properties a year earlier.

Harlan Douglass, who owns numerous commercial properties and multifamily housing complexes in Spokane County, is third on the list with a total tax assessment of $2.6 million, up from $2.5 million a year earlier.

Spokane Washington Hospital Co., which operates Deaconess Hospital and other properties under the Rockwood Health System, is the county's fourth largest taxpayer with a 2013 assessment of $2.1 million, up from $1.9 million.

Qwest Corp. and Inland Empire Paper Co. maintain the fifth and sixth rankings, with respective tax assessments of $1.8 million and $1.6 million, both slight increases over 2012 tax assessments.

This year, 12 taxpayers on the list were assessed property tax bills in excess of $1 million, up from seven taxpayers in 2012.

Two taxpayers this year topped the $1 million property tax mark because of consolidations of properties that had been assessed separately, Horton says. One of those was a consolidation of apartment complexes that had a combined tax bill of $1.4 million. Cedar Builders Inc., which is led by longtime Spokane builder Rich Naccarato, developed the complexes.

Philadelphia-based Comcast Corp., with a bill of $1.1 million, also consolidated at least two properties.

Providence Health & Services jumped in taxpayer rankings to the ninth spot with a total tax bill of $1.1 million on 70 properties, up from $747,000 on 31 properties in 2012. Providence Health & Services is the Seattle-based nonprofit parent of Providence Sacred Heart Medical Center & Children's Hospital downtown, Providence Holy Family on the North Side, Providence Medical Park-Spokane Valley, and other properties.

Other taxpayers that jumped over the $1 million mark this year include NorthTown Mall, with a tax bill of $1.2 million; Fort Worth, Texas-based BNSF Railway Co., assessed $1.1 million in taxes on 90 properties; and Benton, Ark-based Wal-Mart Stores Inc., assessed a total of $1.1 million in taxes on 10 properties.

Latest News Government

Related Articles

Related Products

_web.jpg?1729753270)