Home » Bankruptcies in Eastern Washington, North Idaho fall for third straight year

Bankruptcies in Eastern Washington, North Idaho fall for third straight year

Spokane, Cd'A attorneys expect trend to continue

January 16, 2014

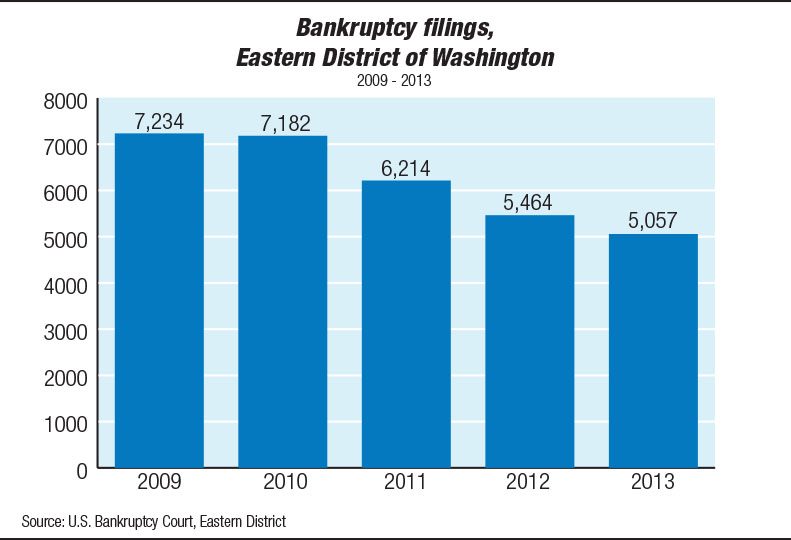

Bankruptcy filings fell again in Eastern Washington and North Idaho last year, marking the third year in a row that they’ve declined.

The U.S. Bankruptcy Court’s Eastern District of Washington reported 5,057 cases filed in 2013, down 7 percent from 5,464 in 2012 and 18 percent from 6,214 in 2011. Last year’s cases included just over 4,000 Chapter 7 filings, seeking liquidation of assets, and 25 Chapter 11 filings, seeking time to reorganize finances.

The Eastern District is made up of 20 counties in Washington east of the Cascade Mountains.

Spokane County filings also fell for the third year, with almost 1,800 filings in 2013, compared with about 2,000 in 2012 and 2,143 in 2011.

Spokane bankruptcy attorney Kevin O’Rourke, of Southwell & O’Rourke PS, says he believes the filings are continuing to decline because the economy is continuing to improve. O’Rourke says he anticipates the downward trend in bankruptcy filings to continue this year.

In the U.S. Bankruptcy Court’s District of Idaho, the Coeur d’Alene court reported 1,026 filings, which is a decrease of 15 percent compared with the 1,212 filings in 2012 and an overall decline of 24 percent from 1,353 filings in 2011. Coeur d’Alene had 934 Chapter 7 filings last year, down from 1,000 in 2012, and five Chapter 11 filings.

Bankruptcies peaked in Eastern Washington in 2005, with just over 11,500 total cases filed, and in North Idaho between November 2004 and December 2005 with 1,769 cases filed.

There was speculation that filings would rise in 2013, O’Rourke says. This is because of the Bankruptcy Abuse and Prevention Consumer Act, which was passed in 2005. The act states that a debtor who files bankruptcy and attains a discharge, or a wiping of the debt, cannot obtain a discharge again within eight years of the first case. Since the act went into effect April 20, 2005, it expired last year, which some thought could cause a rise in filings, O’Rourke says.

Like O’Rourke, Coeur d’Alene bankruptcy attorney Tyler Wirick attributes the decline of bankruptcies in that area to the continued rise of the economy and an increase in jobs, he says.

“I think the economy is getting better,” he says. “The folks who were affected in 2008, 2009, and 2010 are starting to dig themselves out. People are starting to get back to work, especially in construction jobs.”

For 2014, Wirick predicts that bankruptcies in Idaho will continue to fall as jobs rise.

“It’s kind of counterintuitive, considering what I do, but I’m hoping they’ll decrease,” he says.

Latest News Banking & Finance Government North Idaho

Related Articles

Related Products