Home » RiverBank is back to 'playing offense'

RiverBank is back to 'playing offense'

Institution profitable again, expects FDIC to terminate consent order soon

January 30, 2014

RiverBank, an eight-year-old bank here that has sought to differentiate itself in the competitive local financial market by offering concierge services to mostly small-business and commercial clients here, says it returned to profitability last year and is eager to expand on that rebound this year.

The small institution, which suffered net losses totaling more than $7 million over the three prior years, says it expects restrictions placed on it by state and federal reg ulators in August 2011 to be lifted shortly. It also says it plans to launch a mobile banking application within a few weeks.

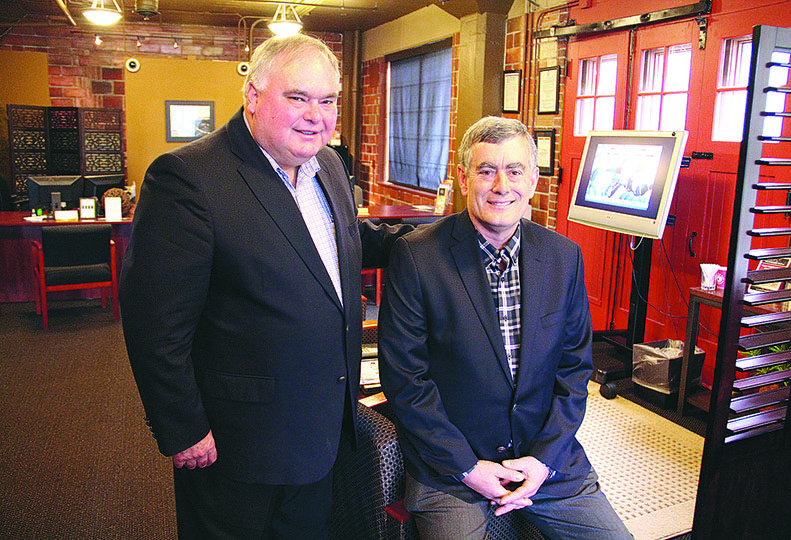

Dan Byrne, the bank’s recently named CEO, says the company reported 2013 net income of about $111,000.

“We’ve been stable, and now we’re looking to grow the business,” he says, adding that it feels good to be “not playing defense, but playing offense.”

The bank ended last year with total deposits of $92.2 million, net loans of $79.2 million, and total assets of $103.5 million, Byrne says.

Its assets were down from $129.2 million at the end of 2012 and from a peak of $153.1 million at the end of 2009. Similarly, its deposits and loans were down from $118.1 million and $98.4 million in 2012, respectively, and from year-end peaks of $139.2 million and $126.6 million, in 2009.

Byrne says part of the reason for those declines has been that bank officials have been working to resolve problem loans from the institution’s portfolio, to improve capital ratios, and to return it to a size where it could stabilize its finances. Now, with it back on more solid financial footing, he says he’d like to see it grow gradually to around $140 million to $150 million in total assets.

“We’re going to be working real hard to expand our relationships,” Byrne says, adding the strategy for doing so will involve RiverBank executives “just getting out knocking on doors.” He adds, “I think for us to be successful, we need to expand our relationships.”

RiverBank currently has about 1,270 deposit accounts and 300 loan accounts, and Byrne says its clients have been steadfast in their support, despite the substantial challenges the bank has endured since the beginning of the Great Recession.

He says it also has received great support from its board. Along with Byrne and President Cajer Neely, both of whom have been with the bank less than a year, the eight-person board includes Chairman Bill Lawson, Casey Colley, Sharon Colley, Tim Welsh, Shelley McDowell, Steve Schmautz, and John Bley. All of them are local residents except for Bley, former director of the state Department of Financial Institutions, who Byrne says brings “an awful lot of talent to the board.”

The bank says in its vision statement that its vision is “to become the community bank of choice for small business and professional relationships throughout Spokane County.”

The bank occupies most of the top two floors of a five-story building at 202 E. Spokane Falls Blvd., plus has a ground floor branch there. Using the slogan “We bring banking to you,” its highly personalized services include concierge courier vehicles, treated and insured as mobile “branches,” that go to customers’ locations to collect deposits or to respond to customers’ other banking needs.

Byrne, former longtime chief financial officer here for Sterling Financial Corp., was named CEO of RiverBank last fall. He took over the position formerly occupied by Clyde B. “Chuck” Brooks Jr., who died in late April after a brief battle with cancer.

Brooks, who was experienced in leading troubled institutions working to regain regulatory compliance, joined RiverBank in May 2011, succeeding Duane Brandenburg, one of the bank’s founders, who retired. In August of that year, RiverBank entered into a consent order with the Federal Deposit Insurance Corp. and the Washington state Department of Financial Institutions that placed it under tighter regulatory scrutiny.

The order required RiverBank to hire and retain qualified managers, notify regulators when it plan to add or replace board members or senior executive officers, and increase the board’s participation in the affairs of the bank. It also required the bank to increase its capital, keep a fully funded allowance for loan or lease losses, reduce troubled assets, and develop a financial plan that set specific goals in a number of areas.

RiverBank reported a net loss of $3.9 million for 2012, compared with a loss of $686,000 for 2011 and a $2.8 million loss the year before. However, Byrne said last July that it had been profitable for two straight quarters and its financial condition was improving.

On Sept. 3, the bank announced that Neely had been appointed president. He has more than 34 years of commercial banking experience locally and most recently worked at Wells Fargo.

Byrne served as CFO of Sterling Financial Corp. from 1983 to 2011. Most recently, he was consulting through Byrne Financial Services LLC, helping clients raise capital and develop business plans.

Latest News Special Report Banking & Finance

Related Articles

Related Products

![Brad head shot[1] web](https://www.spokanejournal.com/ext/resources/2025/03/10/thumb/Brad-Head-Shot[1]_web.jpg?1741642753)