Home » Growth rate slows for Spokane County's biggest tax bills

Growth rate slows for Spokane County's biggest tax bills

Avista retains No. 1 ranking among property owners

November 6, 2014

Tax bills levied on the top 50 property owners in Spokane County for 2014 totaled $46.3 million, up 4.4 percent from the total tax bills for the top 50 property taxpayers in 2013, county records show.

The rate of increase, though, was substantially slower this year than the 16 percent jump in 2013, compared with the prior year’s total tax assessments for top taxpayers in the county.

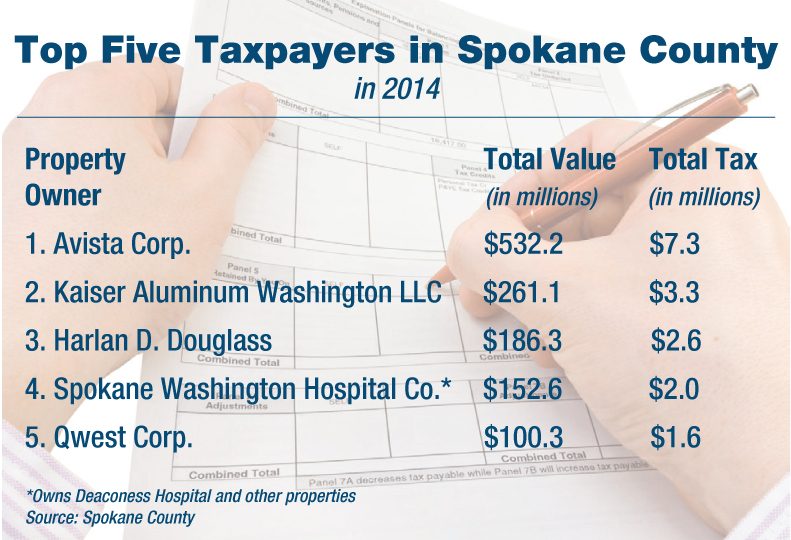

Avista Corp., the perennial leader in tax assessments, tops Spokane County property owners with a total tax assessment of $7.3 million on 309 properties valued at $532.2 million.

The 2014 tax assessment for the Spokane-based energy company is up 9.9 percent compared with its 2013 tax bill of $6.7 million on 304 properties valued at $480.4 million.

Don Falkner, Avista’s tax director and assistant treasurer, says much of Avista’s growth in valuation is due to infrastructure and facility improvements the company is making.

“You can’t get around the fact that we’re in a capital-expenditure mode and will be there for the foreseeable future,” Falkner says.

He says Avista has spent $300 million in capital improvements this year across its four-state service area and plans to spend at least $300 million in each of the next three years.

Falkner says the company pays $35 million in annual property taxes systemwide, with the largest single share going to Spokane County.

Avista’s 2014 tax bill also is more than twice the amount levied on the county’s No. 2 taxpayer Kaiser Aluminum Washington LLC, the real estate holding arm of Foothills Ranch, Calif.-based Kaiser Aluminum & Chemical Corp.

Kaiser Aluminum Washington had a property tax bill of $3.3 million on 10 properties valued at $261.1 million, up from $2.7 million in taxes on properties valued at $207.2 million in 2013.

Spokane real estate magnate Harlan Douglass is third in the Spokane County property taxpayer rankings with a tax levy of $2.6 million on 389 properties valued at $186.3 million. Douglass’ tax levy was up slightly from his 2013 assessment.

Spokane Washington Hospital Co., which operates Deaconess Hospital and other properties under the Rockwood Health System, is the county’s fourth largest taxpayer with a 2014 assessment of $2 million on 27 properties valued at $152.6 million. Spokane Washington Hospital’s bill dropped 6.3 percent this year from its 2013 tax assessment of $2.1 million on properties valued at $149.7 million.

Spokane-based Inland Empire Paper Co. and Qwest Corp., a Denver-based real estate holding company for the communications company CenturyLink Inc., are ranked fifth and sixth, each with tax bills of $1.6 million, although Qwest’s 2014 tax bill is 12.4 percent lower than its 2013 bill.

Cedar Chateau/Creek/Springs Properties, a holding company for three large Spokane-area apartment complexes, held its ranking of seventh in the county with a tax bill of $1.4 million, on properties valued at $108.4 million.

Fort Worth, Texas-based BNSF Railway Co. is eighth in this year’s rankings, with a $1.3 million tax bill.

Providence Health & Services, the Seattle-based nonprofit parent of Providence Sacred Heart Medical Center & Children’s Hospital, Providence Holy Family Hospital, and Providence Medical Park-Spokane Valley, is ninth with a $2.2 million tax bill.

Hollister-Stier Laboratories LLC, the Spokane-based real estate holding company for Jubilant HollisterStier Contract Manufacturing & Services, jumped to 10th in the taxpayer rankings in 2014, with a tax bill of $1.2 million. The sterile allergy product maker, a subsidiary of India-based Jubilant Life Sciences, was ranked 15th among Spokane County property taxpayers in 2013.

Other property owners with tax bills topping seven figures are NorthTown Mall, which is owned by Chicago-based General Growth Properties Inc.; Benton, Ark.-based Wal-Mart Stores Inc.; and Philadelphia-based Comcast Corp., with tax bills of $1.2 million, $1.1 million, and $1 million, respectively.

General Growth Properties also owns Spokane Valley Mall, which is ranked 14th among top Spokane County property taxpayers with a 2014 tax bill of $947,100.

Davenport 2000 LLC, the real estate holding company for Spokane developer Walt Worthy’s hotel properties has climbed to 18th in the rankings, up from its 2013 ranking of 32nd. Davenport 2000’s tax bill for this year, is $796,500, on four properties valued at $56.1 million, up from a 2013 tax bill of $465,200 on property valued at $32.8 million.

Worthy is developing the 716-room Grand Hotel Spokane near the Spokane Convention Center downtown, and earlier this year announced an agreement to franchise the Davenport Collection hotels with Marriott International’s Autograph Collection.

Overall property taxes levied for 2014 totaled $509.7 million, up 1.6 percent from $501.8 million levied in 2013, county records show.

The top 50 property taxpayers in the county were assessed just over 9 percent of the total property taxes levied countywide in 2014, up slightly from 8.8 percent of the total property taxes levied in 2013.

The second-half property tax bill for those who pay in two installments was due Oct. 31.

Property taxes billed in 2014 are based on 2013 assessed values.

The total assessed value for all property in Spokane County in 2013 was $37.2 billion, up 2.3 percent from the year-earlier countywide valuation of $36.4 billion, marking the first countywide increase in property valuation since 2009, Spokane County Assessor’s records show.

Prior to the 2013 uptick the total assessed value for the county had declined from a peak of $38.8 billion in 2009.

Latest News Real Estate & Construction Government

Related Articles

Related Products