Home » Real estate market signs point to consistent growth

Real estate market signs point to consistent growth

-

December 18, 2014

With individual sectors of the real estate market described as improving to “darn good” this year, some market observers are anticipating sustained growth in sales and leases in 2015.

Dave Black, CEO of Spokane-based brokerage NAI Black, has high expectations for most segments of the commercial real estate market.

“Our 24 commercial brokers are the busiest they ever have been, and I expect that will continue through next year,” Black says.

The investment sector of the real estate market is strong, he says, adding that investors are especially looking at apartment complexes.

“The multifamily market is on fire,” Black says. “Cap rates have edged downward due to good demand and low interest rates,” he says. In simplest terms, a lower capitalization rate suggests a less risky investment.

In addition to national infill tenants coming into the retail market, local tenants also are gaining confidence, he says.

The office-lease sector still is in recovery from the Great Recession, he says, although he adds that it’s stronger than it was last year, and he expects continued modest improvement in 2015.

Some Class A office buildings downtown, such as the Paulsen Center, have filled up partly with the help of tenant incentives and landlord concessions, Black says.

“That allows more activity in class B & C properties where the real vacancies have been,” he says.

In the residential resale market sector, Ken Lewis, owner of Spokane Valley-based Prudential Spokane Real Estate, says he expects 2015 will be the best for sales in many years.

Lewis says October and November were stronger for residential real estate sales than normal fall months, and he expects that will be followed by strong sales in the spring.

“2014 was pretty darn good,” he says. “I think 2015 will be even better.”

He says residential sales in the medium price range have been especially strong, while there’s still “a little bit of extra inventory in the real high-priced stuff.”

Rob Higgins, Spokane Association of Realtors executive officer, says he too expects continued improvement.

“All indicators are headed in the right direction,” Higgins says.

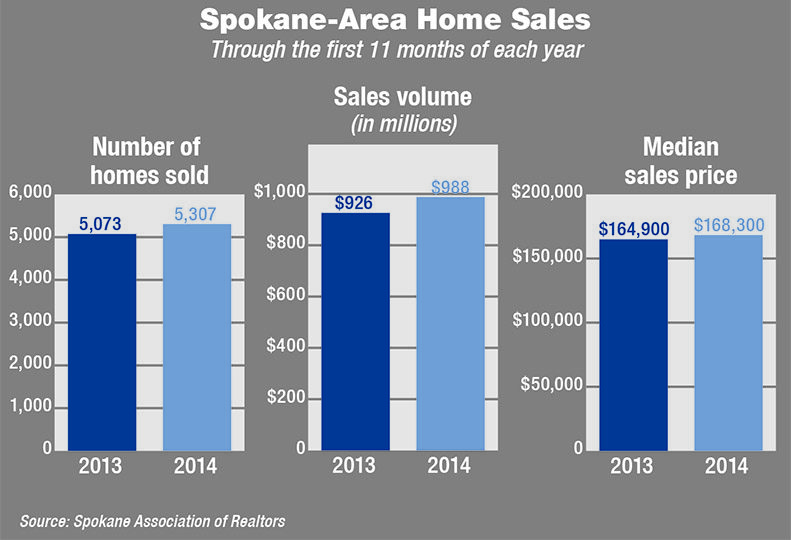

In the first 11 months of 2014, 5,307 homes were sold through the association’s Multiple Listing Service, an increase of 4.6 percent compared with the year-earlier period.

The median home sales price for the first 11 months of this year was $168,300, up 2.1 percent from the year-earlier period.

Higgins says he expects home sales to top 6,000 units by the end of 2016.

“I think that’s sustainable,” he says. “Starting in the mid-1990s, sales were in between 5,500 and 6,000 for a period of time. In the mid-2000s sales went over 8,000 (units), and that’s not sustainable.”

—Mike McLean

Latest News Special Report Real Estate & Construction

Related Articles

Related Products