Spokane Airports stats show steady climb

Total revenue for 2014 surpassed projections

Revenue, passenger count, and total freight rose at Spokane International Airport in 2014 compared with 2013, also exceeding the airport’s projections for last year, according to a preliminary financial report, submitted recently to the Spokane Airport Board.

Looking ahead, the Spokane International Airport is anticipating a modest increase in revenue this year, says airport CEO Larry Krauter.

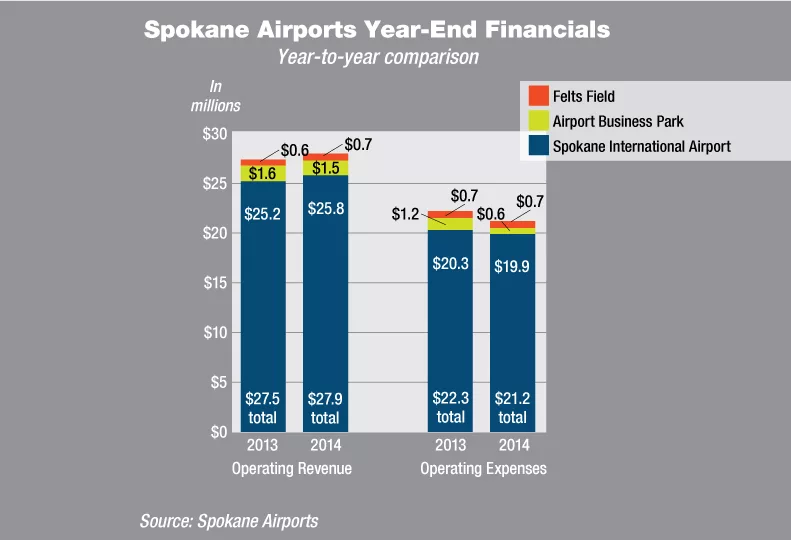

Total combined revenue for Spokane International Airport, the Airport Business Park, and Felts Field in 2014 was $28 million, surpassing projected revenue by more than $1 million, the unaudited report says.

The three airport facilities are owned jointly by the city of Spokane and Spokane County. An audited annual report for 2014 is being prepared for expected release in June, Krauter says.

Operating expenses in 2014 totaled $21.2 million, coming in nearly $2 million lower than projected in the combined 2014 budget, and also below 2013 expenses of $22.3 million, the preliminary report says.

Operating income before deprec-iation totaled $6.7 million, steeply surpassing projections by $2.5 million and exceeding 2013 operating income before depreciation by $1.5 million.

Spokane International Airport’s 2014 revenue was $25.8 million, exceeding projections by 4.3 percent, while operating expenses totaled $19.9 million, 6.8 percent below projections.

The total passenger count, which combines departing and arriving passenger counts, was 3 million, up 2 percent from a year earlier, marking the first uptick in the year-over-year passenger total since 2010. Even so, passenger counts have been on a general downward trend since 2007, when they peaked at 3.5 million.

Alaska Airlines, with 617,800 departing passengers, had the highest lift in passenger traffic with a 5.7 percent increase over the year-earlier count.

Krauter says he anticipates modest growth of between 1 and 2 percent in passenger counts this year.

The total passenger counts likely would be higher if airlines added flights here.

“Enplanements aren’t based on market share, but on profitability,” he says. “When airlines are willing to offer more capacity in our market, we’ve been able to fill them up.”

It’s too early to tell how Denver-based Frontier Airlines’ decision to halt service at Spokane International Airport will affect the total passenger count, Krauter says.

“We still have service to Denver on Southwest and United airlines,” he says. “We never want to lose a service, but the good news is that we didn’t lose a city. There’s plenty of seats, but we lost some fare competition.”

Cargo tonnage coming in and out of Spokane International Airport reached a 14-year high in 2014, at 65,619 tons.

“Our theory is a lot of the increase has to do with the way mail contracts changed a couple of years ago,” Krauter says. “That was attributable to mail contracts with UPS flying for the Postal Service.”

Arriving cargo totaling 39,014 tons exceeded the 2013 tonnage total by 4.6 percent, while departing cargo totaling 26,605 tons dipped below 2013 tonnage by nearly 1 percent.

Cargo carriers aren’t planning any changes in service here this year, he says.

“That’s good news for the business community,” Krauter says. “Businesses can get packages in and out of here on time.”

Spokane International Airport’s revenue and expenses account for more than 90 percent of the total for the three Spokane airport facilities.

The Airport Business Park, which has 32 buildings and 23 tenants on 600 acres of land adjacent to Spokane International Airport, had 2014 operating income before depreciation of $870,000, up from $369,000 in 2013.

Felts Field, the smaller of the Spokane airport facilities, had slightly more expenses than revenues in 2014. Felts Field’s 2014 revenue totaled $680,000, and expenses totaled $703,000 for an operating loss before depreciation of $23,000, still an improvement over a year-earlier loss of $97,000.

Top sources of revenue for Spokane International Airport include parking, airline terminal rent, car rentals, commercial building and land leases, airline landing fees, and concessions.

Krauter says airfield revenue was 10.2 percent higher than budgeted largely due to larger aircraft using the airport. Airfield revenue includes landing fees, which are calculated according to weight of the aircraft.

“Part of the trend we’re seeing is airlines are reducing the frequency of flights, but using larger aircraft,” he says

Also increasing landing weight, Alaska Airlines added flights with larger aircraft and Delta Airlines recently started service to Seattle with five daily flights, Krauter says.

The only major revenue source in which revenue was below projections was the airport’s fueling operations.

Fuel-flow fees generated revenue of $556,200 in 2014, about 17 percent below projections.

The reduction in fuel flow is the result of a strategy by airlines, which realize cost savings by fueling at their hubs rather than at spoke airports.

The 2015 combined budget for the three Spokane airport facilities projects revenue of $29.1 million and expenses of $27.5 million.

“My guess is we won’t be as far off on the budget as we were this year in terms of additional revenue,” he says.

The 2015 budget projects a 27 percent increase in revenue from landing fees and a 12 percent increase in terminal-rent revenue.

Related Articles

Related Products

_c.webp?t=1763626051)

_web.webp?t=1764835652)