SBA lenders encouraged by rebound in volume

Banks hope incentives will embolden more borrowers

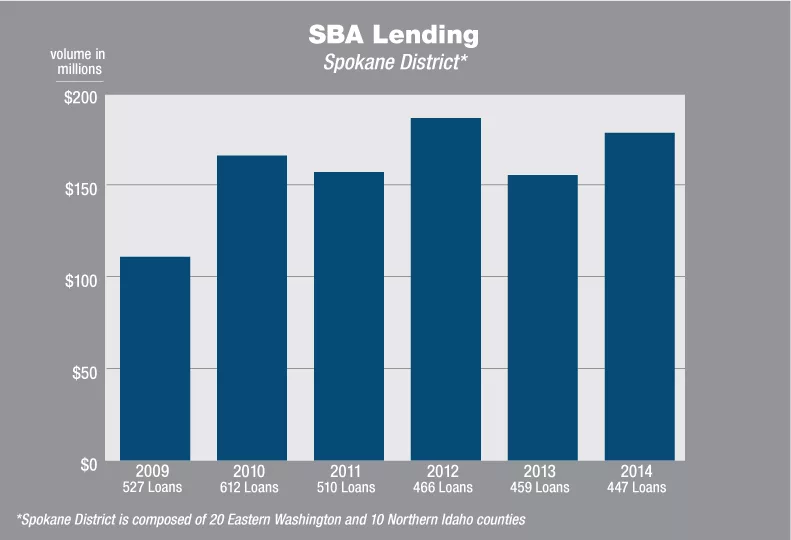

Some providers of U.S. Small Business Administration-backed loans here are anticipating a second consecutive year of loan growth after the dollar volume bounced upward in fiscal 2014 from a year-earlier decline.

Last year, lenders in the SBA’s Spokane branch of its Seattle district issued 447 SBA-backed loans totaling $172.8 million, up from a four-year low of $155.2 million in 2013.

The Spokane branch covers 20 counties in Eastern Washington and 10 counties in North Idaho.

Coeur d’Alene-based Mountain West Bank, one of the perennial leaders in small-business lending here, returned to the top lender spot in the SBA’s Spokane branch in 2014, with a near-record $29.5 million loaned on 95 loans, up from 72 loans totaling $14.6 million in 2013,when it was ranked the third highest lender.

Mountain West’s SBA loans in 2014 ranged from $5,000 to $5 million.

Thomas Pool, senior vice president and SBA department manager at Mountain West, says the bank has nine people dedicated to SBA lending in the federal agency’s Spokane branch area. Four are based in Spokane and five are in Coeur d’Alene.

“We also have an office in the SBA Boise district,” Pool says.

He says Mountain West’s SBA personnel don’t work with any other type of commercial loans. Their experience helps them deliver timely loan services, he says.

“It used to be a tedious process,” Pool says of the application process for SBA-backed loans. “We try to make it seamless. The customer wouldn’t know the difference between applying for an SBA loan and a conventional commercial loan.”

Pool predicts demand for SBA loans will grow here with the improving economy in 2015.

“Borrowers are looking to make longer term investments in buildings and equipment,” he says. “That brings jobs, and that’s really good for our economy.”

Meantime, Spokane-based Washington Trust Bank was second highest in SBA loan dollar volume in 2014 with 47 loans issued totaling $15.5 million, up from 29 loans valued at $9.5 million a year earlier, when the bank was ranked fifth among lenders in SBA’s Spokane branch.

Doug Wolford, Washington Trust’s SBA department manager, says the bank has placed a stronger emphasis on SBA lending over the last three years.

“We created a department that specializes in SBA lending, supporting loan officers throughout the system,” he says.

Washington Trust’s SBA loans in 2014 ranged from $10,000 to $3 million.

Wolford says he expects to see continued SBA loan growth this year due to improving economic conditions, compounded by SBA’s general incentives on smaller loans and veteran incentives on larger loans, reducing borrower costs.

“Our hope is that incentives will generate activity,” Wolford says. “We’ve seen in the past they do increase SBA lending volume.”

Wolford says the bank’s footprint also includes portions of SBA’s Portland and Boise districts.

“Were growing in all three districts,” he says, adding that the bank’s SBA loans generated annually in all three districts has grown to $28 million in 2014 from $13 million in 2012.

While the dollar volume of loans in the SBA’s Spokane branch in 2014 was second only to the record year of 2012, when SBA-backed loans totaled $186.3 million, the number of individual loans has dipped for four consecutive years since the post-recession peak of 612 loans in 2010.

Ted Schinzel, manager of the SBA Spokane branch office, says he anticipates that the number of loans as well as the dollar value will be up this year because incentives remain in place for lenders and borrowers to craft smaller loans.

“Lenders are loosening up a little,” he says. “The economy is getting better, and we don’t charge any fee now on loans of $150,000 or less.”

Without the fee waiver, the borrower typically would pay the SBA a one-time fee of 3 percent of the loan value for a government guarantee to cover 75 percent of the loan should the borrower default.

Additionally, banks normally charge borrowers an annual fee of 0.5 percent of the balance owed for the life of the SBA loan, Schinzel says, adding that fee also is being waived.

“The idea is to incentivize lenders to do smaller, working-capital loans,” he says. “A lot of businesses are expanding and in need of capitalization. A lot of startups can work with $150,000 or less.”

The incentives appear to be working, Schinzel says. In the first quarter of fiscal 2015, which ended Dec. 31, SBA lenders issued 138 loans totaling $40.6 million, up sharply in loan numbers but not in dollar volume from 88 loans totaling $42.5 million in the year-earlier quarter.

“That tells me smaller loans are coming because of the incentives,” he says.

Average loan sizes had been trending upward over the longer term, approaching $400,000 in 2014, because the SBA maximum individual limit climbed to $5 million in 2010 from a previous limit of $2 million.

In addition to the small-loan incentives, veteran-owned businesses are eligible for additional incentives on loans exceeding $150,000, Schinzel says. SBA loan guarantee fees are reduced by 50 percent for veteran loans ranging from $150,000 to $5 million. Such loans can be used for startup or working capital, buying or improving land or buildings, or acquiring long-term equipment.

Related Articles

Related Products

_c.webp?t=1763626051)

_web.webp?t=1764835652)