Home » Met, Summit trusts OK'd for one last extension

Met, Summit trusts OK'd for one last extension

Beneficiaries could reap close to $60 million in all

August 27, 2015

Investors hoping to recoup a larger portion of the money they had tied up in Metropolitan Mortgage & Securities Co. and Summit Securities Inc. before those affiliated companies here shut down 11 years ago have received some encouraging news.

Based on the likelihood of recovering close to an additional $60 million through remaining property sales, a U.S. Bankruptcy Court judge here approved late last month a second—and likely final—five-year extension of separate trusts that were established to liquidate the companies’ assets.

However, Maggie Lyons, plan administrator and trustee for the Metropolitan Creditors’ Trust and Summit Creditors’ Trust, told the Journal she hopes the remaining asset liquidations can be wrapped up and final distributions made by 2018.

“It’s sad. It’s a shame that it’s taking so long to liquidate these assets,” says Lyons, who has noted in several interviews with the Journal that many of the investors with the two companies were elderly and a sizable percentage of them have died.

“The creditor pool is increasing because we have heirs now inheriting ownership positions in the trusts,” she says.

Lyons also points out that the distributions don’t included tens of millions of dollars’ worth of preferred stock that was wiped out when the companies collapsed.

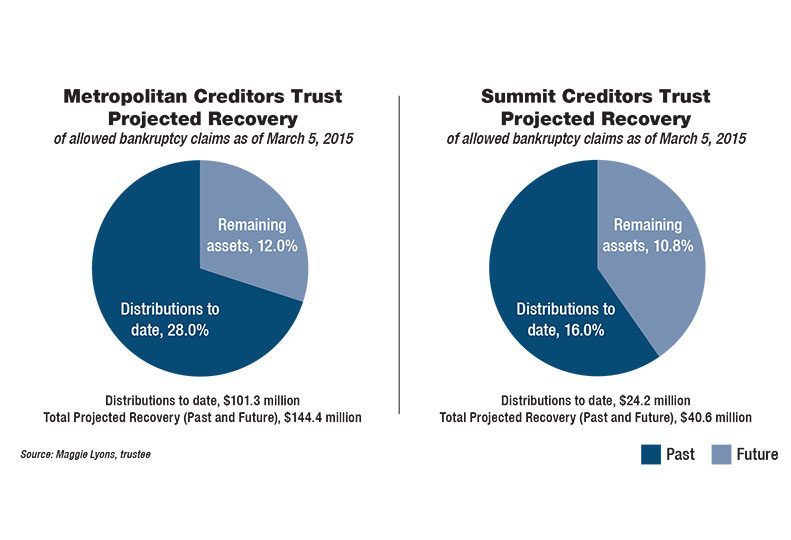

In an update letter sent to eligible creditors five months ago, Lyons said extending the trust-liquidation deadline one more time potentially would enable Metropolitan trust beneficiaries to receive an additional estimated $43.1 million, equal to about 12 percent of allowed Metropolitan bankruptcy claims. That would bring their total projected recovery to 40 percent.

Meanwhile, the extension would enable Summit trust beneficiaries to receive an additional projected $16.4 million, or about 10.8 percent of allowed Summit bankruptcy claims, bringing their total projected recovery to 16.5 percent of allowed Summit bankruptcy claims, she wrote.

The lion’s share of the additional proceeds are expected to come from the sale of a 367-acre residential subdivision property in Brea, Calif., that former Metropolitan affiliate Old Standard Life Insurance Co. had owned and that has an estimated recovery value of more the $40 million.

Lyons said in the update she sent to creditors that the Brea property is located in a highly desirable area of Orange County where demand for new housing exceeds the supply. Unfortunately, though, her letter said, several environmental groups filed a lawsuit in July 2014 that seeks to block development of the project.

“The trusts are actively defending the lawsuit,” she wrote, “and we expect that it will delay, but not prevent, development of the property. We believe it is in the best interests of the trusts to defer a sale of the Brea Property until the litigation is resolved, which may take two to two and a half years.”

With the extension, she said, “Our hope is that the Brea Property can be sold in 2017, with the final distribution to all beneficiaries in 2018 and the filing of final tax returns.”

To date, the Metropolitan Trust has issued six distributions to its beneficiaries—the most recent one occurring last November—totaling $101.3 million, or equating to a 28 percent recovery on $361.7 million in allowed Metropolitan bankruptcy claims. By comparison, the Summit Trust has issued five distributions to all beneficiaries, totaling $24.2 million and representing a 16 percent recovery on $151 million in allowed Summit bankruptcy claims, Lyons’ letter said.

In all, the Metropolitan and Summit creditors’ trust have disbursed money to more than 12,000 creditors.

Many investors had their life savings wiped out and hundreds of employees lost their jobs when the $2 billion-plus Metropolitan conglomerate, widely regarded for many years here as a safe and conservative investment option, collapsed.

Its demise, which included vacating its 178,000-square-foot, 18-story flagship building at 601 W. First that now is named the Wells Fargo Center, was a precursor to the financial industry crisis that swept the country a few years later.

A lot of investors laid the heaviest blame for the corporate failure on former Chairman and CEO C. Paul Sandifur Jr., who spearheaded a sizable expansion of the company that his father founded here in the 1950s.

The numerous scattered real estate holdings of Metropolitan, Summit, and affiliate companies ranged at one time from 23 acres of light-industrial-zoned land in Airway Heights and nearly 100 acres of commercial land in Everett, Wash., to a ranch in Montana, a castle in Phoenix, prime development property in Hawaii, and 10 acres of freeway frontage in Granbury, Texas, near Fort Worth.

It also formerly owned and hoped to develop the 78-acre Kendall Yards property northeast of downtown Spokane—then referred to as the Summit site—that Coeur d’Alene developer Marshall Chesrown bought through a U.S. Bankruptcy Court auction for $12.8 million in December 2004.

Greenstone Corp., of Liberty Lake, in turn acquired the Kendall Yards property in November 2009 from a company Chesrown headed and since then has been pursuing an aggressive development strategy to create a $500 million pedestrian-friendly, mixed-use urban community there.

The Metropolitan and Summit trusts were established following a bankruptcy reorganization plan confirmation in early 2006. The trusts originally were scheduled to be terminated in February 2011, but that was based on the assumption that all significant assets would be liquidated by then.

The liquidation process has been slowed by a number of factors, including the sheer number and complexity of the companies’ real estate holdings and related contracts, as well as the sharp decline in real estate values and demand caused by the Great Recession. For those reasons, the U.S. Bankruptcy Court approved a requested five-year extension under which the trusts were scheduled—until late last month—to terminate in February 2016.

The extensions have been bittersweet for Lyons. She has sought aggressively to maximize the amount of money recovered by investors, including by waiting for the real estate market to improve before selling assets, but has told the Journal on several occasions that she regrets not being able to complete the recoveries sooner. She’s noted that many of the investors affected by the bankruptcies were elderly and that a sizable number of them have died while waiting for trust fund disbursements to wrap up.

Extending the liquidation deadline the first time, she said in the letter to creditors earlier this year, has “allowed us to take advantage of the improving real estate market over the last two years.”

As an example, she said, the Metropolitan trust owns three real estate assets that are under sales contracts and are expected to generate $6 million in proceeds before the end of the year.

“We believe that these three assets would have generated less than $500,000 in total proceeds if we had been forced to liquidate by February 2011,” she wrote.

Another significant Metropolitan trust asset—the previously mentioned property in Everett, Wash.—sold last year to the city of Mukilteo for $5.4 million, she said.

“Without the extra time provided by the liquidation extension, the city of Mukilteo would not have been able to secure the funding needed to purchase the property. The proceeds from that sale alone allowed the Metropolitan Trust to issue a distribution in 2014,” she wrote.

Extending the plan deadline also provided Old Standard Life to complete land-use entitlements on the big, previously mention Brea property in Orange County, California, she said. After six years of environmental and planning review, the city of Brea formally approved in June of last year a 162-lot residential development proposed for that site.

That project “entitlement” more than quadrupled the property’s market value, making it the single most important asset of both trusts, she said, adding that the Brea property’s estimated current market value represents 60 percent of the total projected value for Old Standard Life’s assets.

Old Standard Life was still in liquidation proceedings as of two years ago, but the Idaho Department of Insurance decided to terminate its receivership in June of last year. To avoid a forced auction and to allow time for the trusts to reap the value of the Brea property, Old Standard’s assets and liabilities were transferred last November to a newly formed company, OSLIC Holdings LLC, which is jointly owned by the trusts.

Lyons said in her letter to creditors earlier this year that neither trust has sufficient cash to make a distribution for now, but that the Metropolitan trust could before the end of the year if several assets sell as expected.

The Summit trust likely won’t be able to make another distribution until all of the OSLIC assets are sold.

Latest News Real Estate & Construction Banking & Finance

Related Articles

Related Products

![Brad head shot[1] web](https://www.spokanejournal.com/ext/resources/2025/03/10/thumb/Brad-Head-Shot[1]_web.jpg?1741642753)