Home » Tax planners await action by Congress on extenders

Tax planners await action by Congress on extenders

Uncertainty said to delay spending, giving decisions

October 22, 2015

Some tax preparers here say they expect another late-season rush as they await congressional action on dozens of tax deductions, credits, and benefits collectively grouped together as extenders.

The extenders are up for potential renewal, but 10 months into the calendar year, Congress hasn’t acted on them.

Uncertainty over the extensions compresses the tax preparation period, especially for Form 1040 filers, says Jason Munn, tax partner at the Spokane office of Seattle-based accounting firm Moss Adams LLP.

Andrew McDirmid, partner at the Spokane office of Fargo, N.D.-based Eide Bailly LLC, says, “We’re in the exact same place as last year with 50 or more provisions expired and waiting for Congress to give us guidance.”

David Green, principal at David Green CPA PLLC, of Spokane, says Congress seems to be holding off on making certain perennial extenders permanent because of an overarching desire to reform the tax code. However, he also questions whether Congress has the collective fortitude to accomplish meaningful reform anytime soon.

“It’s a nonelection year for the House and Senate, but presidential politics has already reared its ugly head,” he says. “I don’t know if there’s political will to push something through Congress that would be major tax reform.”

Munn says some businesses might be holding off on equipment purchases and improvements because of uncertainty over the future of certain tax incentives.

The bonus depreciation provision, for example, is one of the expired tax provisions up for extension.

The provision, which had been renewed every year since the recession, had enabled businesses to write off up to 50 percent of the cost for new equipment and improvements for the year it was bought.

“Businesses don’t know if they want to spend $100,000 or more on fixed assets now or later,” Munn says.

Also, under Section 179 incentives, the current maximum deduction for newly acquired assets has returned to $25,000, down from a maximum write-off in recent years of $500,000 for equipment and real estate purchases.

“As it is, the Section 179 benefit is significantly lower,” Munn says.

A credit that enables companies to write off certain research-and-development expenses also has expired.

“It’s never been made permanent, and it’s always rolled over year to year,” Munn says. “For a lot of companies locally, it’s a really big credit for them annually.”

Other companies should look into the R&D credit if Congress extends it again, he advises.

“A lot of folks don’t capture actual time that goes into R&D,” Munn says. “It can be a big deal.”

In some cases, an alternative of sorts for the Section 179 incentive can be applied using provisions of tangible property and repair regulations, Munn says. TPR regulations include safe-harbor provisions for certain supplies, repairs, and depreciable property, which can be expensed immediately rather than capitalized and depreciated over a number of operating cycles, he says.

In the safe-harbor provision for routine maintenance, for instance, costs for regular maintenance that keeps big-ticket equipment in working order can be expensed immediately Munn says.

Also as an alternative to bonus depreciation and Section 179 provisions, businesses might be able to expense large equipment orders if they can break them down into smaller units, he says. For instance, if a company were to buy $50,000 worth of computers valued at $2,500 each, it likely could invoice the computers at their individual values and expense all of them, he says.

Green says the state sales tax exemption also has expired, although it’s among exemptions that have been extended annually in recent years.

“It makes it hard for people who can itemize and are thinking about big-ticket purchases,” he says.

Some clients have made decisions earlier this year to buy big-ticket items such as a new car, Green says, adding, “I can’t tell them whether sales tax will be deductible or not.”

Tax breaks would come at some cost to the government, he says.

“Under normal budgeting rules, Congress has to figure out how to pay for extenders,” Green says.

Because federal tax law has a permanent option to deduct state income tax, he says, “From a fairness perspective, states that don’t have state income tax would argue sales tax should be deductible.”

Green says charities are hoping Congress extends the charitable rollover provision for older Americans who own individual retirement accounts.

The IRA charitable rollover would allow IRA owners aged 70 ½ years old and older to contribute directly to charities from their IRA accounts without having to report the distribution as income.

The IRA rollover would be especially useful for people who are required to make distributions from their IRAs at a certain age even if they have other sources of income, Green says.

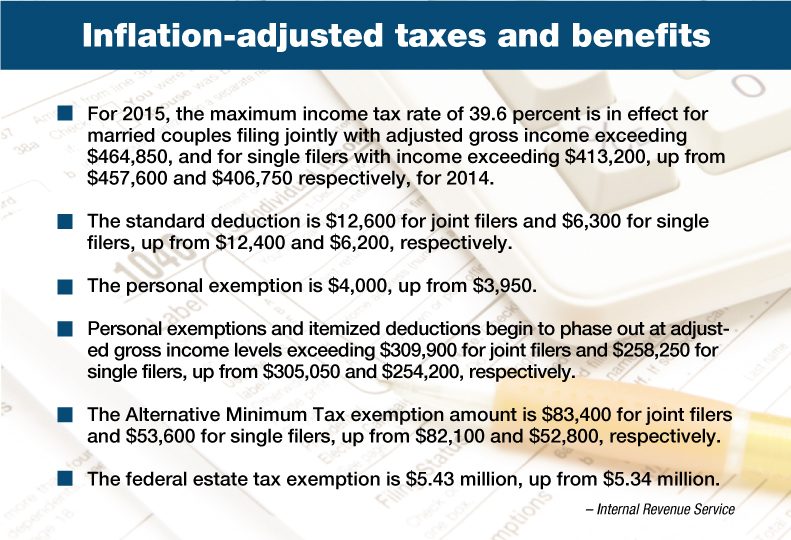

“Now that personal-exemption and itemized-deduction phaseouts are back, it’s a bigger deal,” he says of the IRA rollover. The phaseouts for tax year 2015 are triggered when adjusted gross income exceeds $258,240 for individuals, and $309,900 for joint filers.

McDirmid says the rollover wouldn’t just benefit rich donors. Older Americans with smaller IRAs could use the rollover provision to distribute some component to charity to reduce above-the-line income, he says.

“Every time we run the numbers, whether large or small, having dollars directed out of required distributions to charity pencils out,” McDirmid says.

Affordable Care Act

Green says some provisions of the Affordable Care Act are still being rolled out.

For the 2015 tax year, certain ACA benefit recipients have to reconcile health care-premium tax credits and actual income levels.

“People not covered by employer plans and who might have availed themselves to the health care marketplace might have some surprises in store,” Green says.

Those who don’t file 2015 tax returns won’t be eligible for advance health-care premium credits for 2016.

McDirmid adds that for the current tax year, large employers have annual reporting responsibilities regarding health insurance they offer their full-time employees.

“The mandate applies to entities with more than 100 full-time employees,” McDirmid says. “In 2016, the mandate goes from 100 employees to 50. That change is going to grab a lot of entities.”

McDirmid says his firm has been meeting with employer clients to evaluate whether they’re complying with reporting requirements.

“Most have plans in place,” he says. “It’s the folks right on the line who are most nervous about it.”

McDirmid says employers need to talk to their tax advisers to make sure everyone is up to date with ACA regulations.

“Even in the profession, I’ve seen confusion over what needs to be done with the Affordable Care Act,” he says. “People need to reach out for help because it’s fluid and there’s some confusion over what needs to be done.”

Estate taxes

McDirmid says Washington state residents are much more likely to exceed the state estate tax threshold than the federal threshold.

The Washington estate tax exclusion is approaching $2.1 million for 2015. The estate tax ranges from 10 percent to 20 percent for values above the threshold.

The federal estate tax exclusion, which includes gifts bestowed during an individual’s lifetime, is $5.4 million per individual with a 40 percent tax rate on estate values above that.

Washington state has no gift tax, meaning some high-asset Washington residents could avoid the Washington estate tax by gifting highly appreciating assets before they die to keep their estates below the tax threshold.

“Someone who’s worth $3 million and who doesn’t want the estate to pay state taxes can give $1 million to beneficiaries and get below $2 million,” he says.

At the federal level, most people can get to zero estate tax liability, although that may require giving up control of assets and giving to charities, he says.

Latest News Up Close Banking & Finance

Related Articles

Related Products