Home » Health enrollment plans said likely to increase

Health enrollment plans said likely to increase

Officials cite improvements to plans, payment process

December 3, 2015

Washington Healthplanfinder, the online health insurance marketplace operated by the Washington Health Benefit Exchange, recently launched its third open enrollment period, which runs from Nov. 1 through Jan. 31, and some observers say they expect the number of enrollees to rise.

They attribute that belief to changes in both the payment system and coverage plans that they say have made the enrollment process easier.

The Washington Health Benefit Exchange created Healthplanfinder in response to the federal Affordable Care Act, which gave states authority to set up their own health care exchanges or give residents the option to participate in a federal exchange.

Healthplanfinder enables state residents to compare different health plans, searching for the one that’s best suited to them. Individuals and small businesses can search based on income, family size, and health care needs.

For the current enrollment period, the Washington Health Benefit Exchange has listed 11 providers offering 138 qualified health plans, an increase from last year’s total of 10 providers with 82 plans.

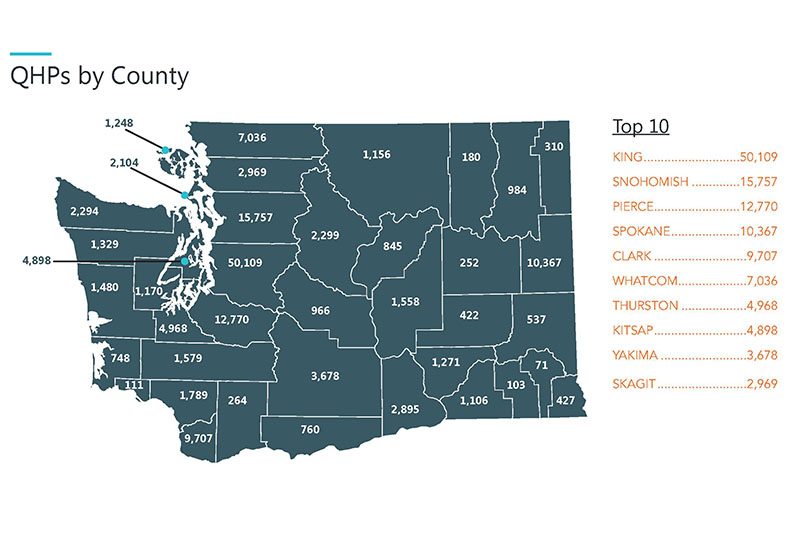

Prior to this enrollment period, Washington Health Benefit Exchange reported 10,367 people enrolled in qualified health plans in Spokane County, and 123,215 enrolled in Medicaid. In both categories, Spokane County is listed as fourth in the state among counties with highest number of people enrolled.

Better Health Together is one of several area navigator networks designed to assist individuals in enrolling in the marketplace and helping them to connect with other resources. Curt Fackler, program manager for Better Health Together, says the organization serves seven Eastern Washington counties, including Spokane, and has a system of 100 navigators ready to help people enroll.

“This time around there are more carriers and more plans to choose from, so I encourage people to check online, as there might be a new plan that better suits their needs,” says Fackler.

Fackler says this year, Better Health Together is targeting established customers who need to renew their coverage, and those who are 55 and older.

“Many people we get calls from are planning to retire at the end of the year, but may not yet be 65, but still need health insurance. The word has gotten around that the exchange is a good place to do that,” says Fackler.

“We won’t have the numbers of how many have enrolled until we’ve completed our monthly report, but we do expect an increase from last year,” he says. “Enrollment definitely appears to be easier, with fewer errors.”

The biggest change that seems to be easing the enrollment process, has been the ability of existing customers to begin making premium payments directly to their insurance companies.

In September, Washington Healthplanfinder was modified to transfer invoicing, payment processing, and collection to health and dental insurance companies. Customers now receive monthly invoices directly from their insurance company, along with other important information on payment deadlines, collection policies, and grace periods.

Michael Marchand, director of communications and outreach for the Washington Health Benefit Exchange, says of the changes, “We have seen that when the system gets better, the insurance products get better, the personal help and available information gets better, and the consumer gets smarter and more informed. It is a recipe for success.”

Every plan offered through the exchange must cover 10 essential benefits, including outpatient care, treatment and inpatient care, emergency room visits, prescription drugs, mental health services, pre and postnatal care, lab work, preventive tests, pediatric services, and various therapies to treat injuries or chronic conditions.

Customers have a choice between four levels of health insurance plans—bronze, silver, gold, and platinum. According to Healthcare.gov, a website managed by the U.S. Centers for Medicare & Medicaid Services, plans in the bronze category have the lowest premiums, but the highest deductibles and other out-of-pocket costs. Platinum plans generally have the highest premiums, but the lowest deductibles and other out-of-pocket costs.

Federal poverty levels are used to help determine Medicaid and Children’s Health Insurance Program (CHIP) eligibility, as well as eligibility for a number of other non-health-care-related assistance programs.

Fackler explains that if a person makes between 100 and 250 percent of the federal poverty level, they might qualify for out-of-pocket cost assistance on silver plans sold through Healthplanfinder. The closer their income is to 100 percent, the more it caps their out-of-pocket costs.

“For those making less than 250 percent of the federal poverty level, a silver plan may be a better option,” says Fackler. “This is because it maximizes savings, out-of-pocket costs are lower as they are based on income, and individuals don’t have to pay back cost-sharing subsidies if their income increases.”

Additionally, he says that this year the cost of a silver plan has dropped, allowing for lower tax credits. If an individual makes between 100 and 400 percent of the federal poverty level, they might qualify for premium tax credits through the marketplace.

“Many people who choose a bronze plan make less than 250 percent of poverty, but if they’re willing to pay $10 or $20 more for a silver plan, that changes their deductible,” says Fackler. “We target people who may have bought a bronze plan, so that they can better understand their options.”

Molina Healthcare is one of the 11 companies offering qualified health plans through the Washington Health Benefit Exchange again this year.

A spokeswoman for the company says Molina’s bronze plan is this year’s lowest-priced plan for Spokane County, and its Medicaid plan ranks as the largest in Washington. Molina serves nine counties, including Spokane, Chelan, Douglas, Grant, King, Mason, Okanogan, Pierce, and Thurston.

Peter Adler, president of Molina Healthcare, says that company is particularly proud of its bronze plan being the lowest priced, as its main goal is to serve low-income residents.

“Many people with low incomes fall in and out of eligibility,” Adler says. “For Molina, we want to focus on helping those people to have a continuity in their care. Therefore, we strived to design our bronze plan so that it is as affordable and easy to understand as possible for those individuals.”

Molina provides several health insurance products to those eligible for Medicaid; those who are dual eligible, qualifying for both Medicaid and Medicare; and those who are eligible for exchange plans.

Adler says Molina expects to see continued growth in both new and renewed enrollment to its plans this year, due in part to its marketing to low-income individuals.

“We’re thrilled with the progress level of awareness and education of this population looking to the exchange for their coverage. The changes in payments and information being provided have resulted in fewer questions, and the questions still being asked are differently focused and easier to answer,” says Adler.

Also new this year are changes in enrollment periods and deadlines, as well as stricter penalties for not having insurance. Some individuals might qualify for special enrollment periods if they have been affected by life events such as marriage, having a baby, or losing other coverage. Individuals can apply for Medicaid or Children’s Health Insurance Program enrollment at any time of the year.

Residents must select their health plan by Dec. 23 for coverage that begins on Jan. 1, 2016. If an individual doesn’t have coverage next year, they’ll be asked to pay the higher of two amounts, either 2.5 percent of their yearly household income, or $695 per person ($347.50 per child under 18). However, some residents might qualify for an exemption from the penalty if they meet certain income-based criteria, along with some other factors.

Brokers, as designated representatives within the Washington Health Benefit Exchange’s customer support network, are allowed to recommend specific plans to those considering enrollment or renewal. Whether or not customers choose to select a plan on their own, through a navigator, or a broker, they can still find information and resources at wahealthplanfinder.org and wahbexchange.org.

One final change many were expecting during this enrollment period that didn’t end up taking effect was the expansion of small business coverage to include businesses with up to 100 employees.

SHOP, the Small Employer Health Options Program, is the small-business version of the Washington Health Benefit Exchange, also known as Washington Healthplanfinder Business. SHOP had previously announced this change, however that was before the PACE Act of 2015 was signed into law, repealing the ACA provision expanding coverage definitions to include these businesses. States are now free to define small group coverage size, and Washington has chosen to go along with the PACE Act and continue to define small group plans as those with up to 50 employees.

Latest News Health Care

Related Articles

Related Products