Federal budget quietly cuts Social Security provision

File-and-suspend strategy to be eliminated in phases

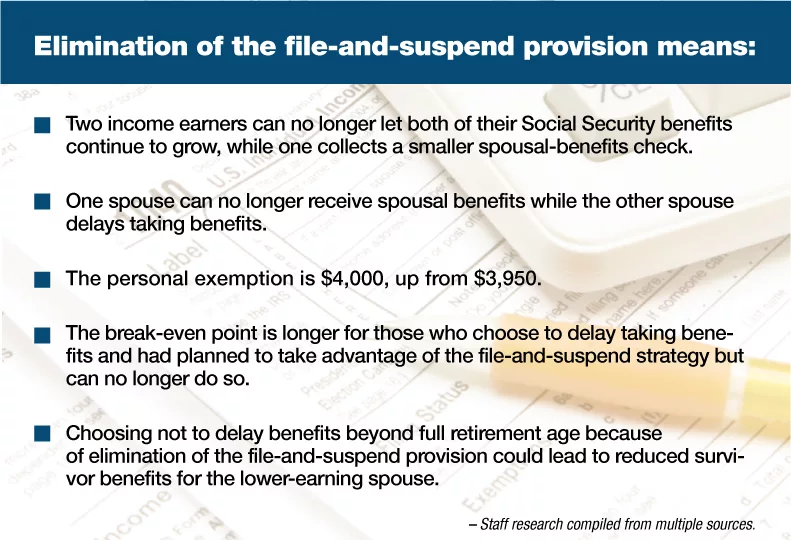

The new federal budget contains a cut to Social Security benefits that could limit options for baby boomers close to retirement—and everybody who follows them.

Hidden in the budget bill is a change to Social Security that eliminates file-and-suspend rules, says John Bjorkman, a principal at the Spokane office of Minneapolis-based financial planning firm CliftonLarsonAllen LLP.

The change affects people up to 65 years old, including most boomers.

For couples who had planned to take advantage of the file-and-suspend strategy, the difference could mean tens of thousands or even hundreds of thousands of dollars in their total retirement cash flow, Bjorkman says.

Under the file-and-suspend provision, one married wage earner could file for Social Security benefits upon reaching normal retirement age, but then suspend the benefit. Meantime, that spouse could retire and claim spousal benefits, which equal half of the suspended benefits of the still-working spouse.

Benefits for both spouses then would grow at about 8 percent until the age of 70.

When the working spouse chooses to retire, the other could then take the higher of spousal benefits or individual benefits.

Bjorkman, who is 62, says he and his wife had done the analytics and were considering the file-and-suspend option.

“It would have been beneficial for me at 66 to file and suspend and have my wife start drawing my half of Social Security while I wait until 70, when I would start drawing. Then she would start drawing her (individual) benefit,” he says. “If we both live into our 80s, it would have added several hundred thousand dollars in net cash flow.”

The elimination of the file-and-suspend provision likely will force some people close to full retirement age to revise their plans regarding when to collect Social Security benefits, he says.

“For a lot of folks who’ve spent time looking at this, it adds a whole new wrinkle and real complexity,” Bjorkman says.

Taking options away makes such an important financial decision regarding when to take Social Security benefits harder, he says.

“It didn’t really simplify anything,” Bjorkman says. “It just changed the rules.”

He recommends anyone who will be 66 or older by April 30 and who isn’t planning on collecting benefits immediately to consider the file-and-suspend option while they still can.

“I think there will be a huge flurry of people looking to file and suspend in the next few months,” Bjorkman says. “Whether they decide to use it or not, at least they have the option to use it.”

Full retirement age is 66 for people born from 1943 to 1954, then increases to age 67 for people born in 1960 or later.

After full retirement age, each month a person waits up to 70 years of age results in higher benefits equal to annual increases of about 8 percent.

Anyone who already has filed to take advantage of the file-and-suspend strategy or who does so before April 30 won’t be subject to the change.

Unaffected by the file-and-suspend changes, people can still start collecting reduced Social Security benefits at age 62, although benefits would be slashed at that age by 25 to 30 percent, compared with benefits at full retirement age, Bjorkman says.

Ryan Franklin, a Yakima-based senior financial adviser with Seattle-based Moss Adams Wealth Advisors LLC, says the file-and-suspend strategy will be eliminated in two phases.

The primary file-and-suspend option will be eliminated April 30 for anyone who isn’t 66 by then.

A secondary option, called restricted application, will be banned for anyone who isn’t 62 by the end of this year.

Under a restricted application, both spouses collect benefits at full retirement age, but one spouse collects spousal benefits while individual benefits continue to grow until age 70, at which time the spouse collecting spousal benefits has the option to collect the higher of spousal or individual benefits.

After the phase-in, one spouse—including a qualified divorced spouse—won’t be able to claim spousal benefits while the other spouse is working.

Franklin says the file-and-suspend elimination changes the break-even point for some people looking to retire later to enable their Social Security Income benefit to grow.

“If the choice is to wait and give up four years’ worth of collecting (smaller) benefits, you might have to collect 10 or 11 years to break even,” he says. “It may be a little longer now, because you don’t have the spousal benefit as well.”

Franklin says the change blindsided financial planners and their clients.

“What surprises people is the speed with which it passed with virtually no publicity about it,” he says. “It appears to have gone through with no debate or dissent.”

Congress originally enacted the file-and-suspend provision as a part of a 2000 law that was intended to encourage retirement-aged people to return to work without losing their benefits through taxes and penalties.

Contrary to some criticism of the strategy, Don Moulton, a certified financial planner and co-founder of Retirement & Tax Planning Specialists Inc., says the file-and-suspend strategy didn’t just benefit wealthy people.

“The only reason they say it was more of a strategy for wealthy people is that whoever uses it has to be able to afford not to take Social Security right away,” he says. “File and suspend certainly worked with one-income couples. It was a bit like a longevity insurance policy.”

The government didn’t create the file-and-suspend provision for such a strategy, Moulton says, “It was more a loophole.”

Curbing the provision under the guise of closing unintended loopholes, however, might have its own unintended consequences, Moulton says.

In the example of single-income couples, one spouse won’t be able to claim spousal benefits at full retirement age if the other spouse continues to work. Under that scenario, the working spouse might decide to retire earlier, rather than give up a few years of benefits for the nonworking spouse by waiting to retire.

If people start retiring earlier than they had planned when file and suspend was available to them, such cases might not result in a savings to the system, Moulton says.

“It all depends on how long they live,” he says. “They’ve got to live a long time for (delaying benefits) to make sense.”

Moulton says no one really knows how much the elimination of the file-and-suspend rules will save the government.

“The bulk of Americans take Social Security benefits as early as they can retire,” he says. “That’s why we don’t have a handle on how much it’s going to save.”

He says the change likely wasn’t driven by how many people have actually used the strategy, “But Congress saw a huge bunch of baby boomers coming and heard a lot of talk about this strategy.”

Donald Morgan, founder of and financial adviser at Spokane Valley-based Independent Wealth Connections LLC, says the file-and-suspend strategy was talked about much more than it was executed among his clients.

“It was a marketing tool our industry used to talk to folks of that age,” he says. “I don’t know if it was becoming fiscally noticeable or if marketing programs made it noticeable. One way or another, Congress noticed and took action,” he says.

People approaching retirement age still need to scrutinize when to take benefits, Morgan says.

“Many people take their benefits early, often to their detriment,” he says.

Morgan tells clients to look into their own family genes.

“If both of your parents are alive when you’re 60 and you’re in good health, it makes good sense to wait,” he says. “Not many investments pay 7 to 8 percent interest a year.”

Taking retirement early results in reduced annual Social Security income “that lasts the rest of your life,” Morgan says.

He says to expect more changes to Social Security.

“I don’t think there is any question that actuarial data say changes need to be made,” he says. “Social Security isn’t sustainable over the long haul the way it’s written today.”

Related Articles

Related Products

_c.webp?t=1763626051)

_web.webp?t=1764835652)