Home » SBA small-business loan incentives help more borrowers

SBA small-business loan incentives help more borrowers

Programs boost cash flow for business starts, growth

February 25, 2016

U.S. Small Business Administration loan incentives are helping a growing number of businesses start up or expand, some lenders here say.

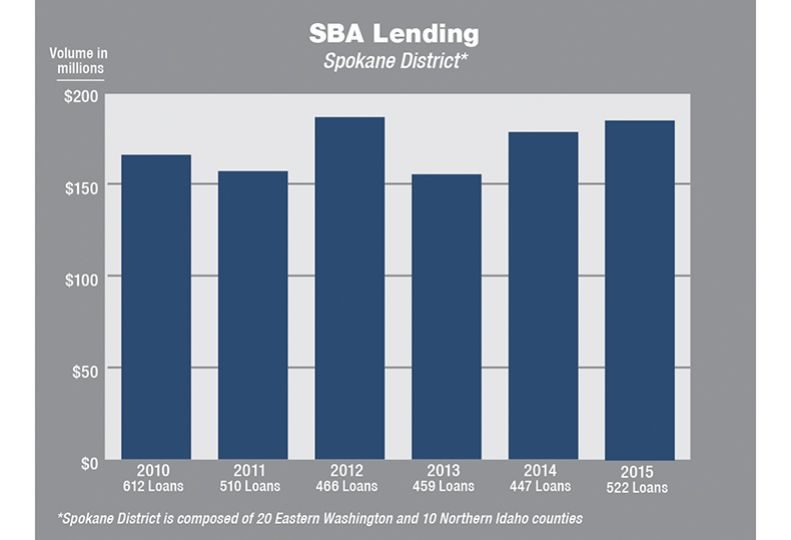

In 2015, lenders in the Spokane branch of SBA’s Seattle district issued 522 SBA-backed loans totaling $183 million, up from 447 loans valued at $173 million in 2014, says Ted Schinzel, SBA Spokane branch manager.

The 2015 totals ended a four-year decline in the total number of loans and provided a second consecutive annual increase in dollar volume.

Nationwide, SBA backed 18,000 more loans in 2015 than it did in 2014, Schinzel says. The administration briefly maxed out its funding authority in July before Congress expanded it, he says.

Schinzel says SBA loan growth in Eastern Washington is comparable to the nationwide rate of increase. Western Washington, however, is growing at one of the fastest rates in the country.

“Spokane, for the second year in a row, is looking pretty darn good,” Schinzel says. “Spokane isn’t growing as fast (as Western Washington), but it’s improving a lot.”

The Spokane branch’s area includes 20 counties in Eastern Washington and 10 counties in northern Idaho.

“One of the big changes last year was that on loans less than $150,000, there were no fees to the borrower and no fees to the lender,” Schinzel says.

Without the waiver, borrowers would have to pay up to 3 percent of the guaranteed portion of the loan as a fee, and lenders would pay nearly 0.5 percent of the balance of the loan every year, he says.

More than half of SBA loans are between $100,000 and $150,000, and two-thirds are below $250,000, he says.

SBA backs two main types of loans, both of which have a $5 million limit. One is a 7(a) loan, which can be used to start a new business or expand an existing business. The other is a 504 loan, which comes with a job-creation requirement and, Schinzel says, is used primarily to buy buildings, big fixed assets, and large equipment.

SBA guarantees 85 percent of 7(a) loans up to $150,000, and 75 percent of loans greater than $150,000.

“It’s like an insurance policy,” Schinzel says, “So banks are willing to take a little more risk.”

Nonprofit certified development corporations arrange 504 loan packages in which the borrower puts at least 10 percent into the project, a conventional private-sector lender puts in 50 percent, and the SBA guarantees 40 percent of the loan through a debenture brokered by the certified development corporation.

Fees for 504 loans total about 3 percent of the debenture and can be financed with the loan.

Active certified development corporations here include Spokane Valley-based Northwest Business Development Association and Seattle-based Evergreen Business Capital.

Under a new SBA policy, business owners can refinance buildings using the 504 program, if they qualify as job-retention projects, Schinzel says.

Doug Wolford, SBA department manager at Spokane-based Washington Trust Bank, says additional SBA incentives are aimed at veteran-owned businesses.

Veteran Advantage loans reduce fees for 7(a) loans greater than $150,000 by 50 percent.

SBA Express loans waive fees for 7(a) lines of credit of up to $350,000 for certain veteran-owned businesses.

Last year, Washington Trust Bank had the steepest trajectory of loan volume increases in the Spokane branch’s area, and it was the top SBA lender in the Inland Northwest in terms of dollar volume. The bank issued 59 SBA loans valued at a total of $26.2 million, up from 37 loans valued $15.5 million in 2014.

The bank’s individual loans ranged from $20,000 to $4 million last year.

While Washington Trust has handled some SBA loans toward the upper limit allowed, Wolford says, the bank also is pursuing smaller loans, which are encouraged under the SBA’s streamlined process.

“We have enjoyed more success on small-dollar transactions,” he says. “We have a special unit for doing that now.”

The general economic environment will play a role in SBA loan demand as new businesses start up and growing businesses make commitments to acquire equipment and real estate, Wolford says.

“The SBA is adept at accelerating that process,” he says.

He also expects to see growth in SBA activity as retiring baby boomers sell their businesses to the next generation of small business owners.

Coeur d’Alene-based Mountain West Bank, a perennial Inland Northwest SBA loan leader, had issued the second highest loan total in dollar volume in the SBA’s Spokane branch in 2015 at $23.9 million, down from $29.5 million in 2014, when it was the largest SBA lender in the Spokane branch.

Mountain West, however, issued 101 individual SBA loans in 2015, which was the highest number of loans issued by any lender in the district, and up from 95 SBA loans issued in 2014.

“SBA loan numbers are up for Mountain West, but the total dollar amount is down a bit,” says Thomas Pool, senior vice president, SBA department manager, at Mountain West Bank.

“It’s more a function of the type of deals than economic trends,” he says of the upswing in smaller loans.

Pool says SBA incentives are helping businesses start up and expand by providing small businesses access to working capital.

“It puts capital in the hands of entrepreneurs in the country who put it to good use creating jobs,” he says.

Demand for SBA-backed loans will remain strong this year, Pool asserts.

“We think the business community has reached a comfort level with borrowing and is looking to expand plants, equipment, and sales,” he says. “We expect 2016 to be a good year in North Idaho and in Eastern Washington, where we have offices.”

Mountain West has nine employees dedicated to SBA lending in the federal agency’s Spokane branch territory.

Three of them work in the Spokane area, and six are based in North Idaho, he says.

At least for this year, certain SBA products will continue to have advantages over conventional loans.

“If you need a loan of $150,000 or less and can get it without a fee, you can’t beat that conventionally,” Pool says, adding that banks would charge up to 1 percent fee for a conventional loan.

The SBA’s loan-guarantee programs are largely self-funded through fees charged on loans.

The agency has been able to waive fees on smaller loans because of low default rates, Pool says.

SBA’s Schinzel says he anticipates that SBA will consider extending fee waivers on smaller 7(a) loans and renewing incentives for the Veteran Advantage loan program on a year-by-year basis. “My guess is that as long as the default rates continue to be low, (fee waivers) will continue to be the trend.”

Latest News Up Close Banking & Finance

Related Articles

Related Products