Spokane County assessments hit record

Valuations top $40 billion; tax revenue rises 3 percent

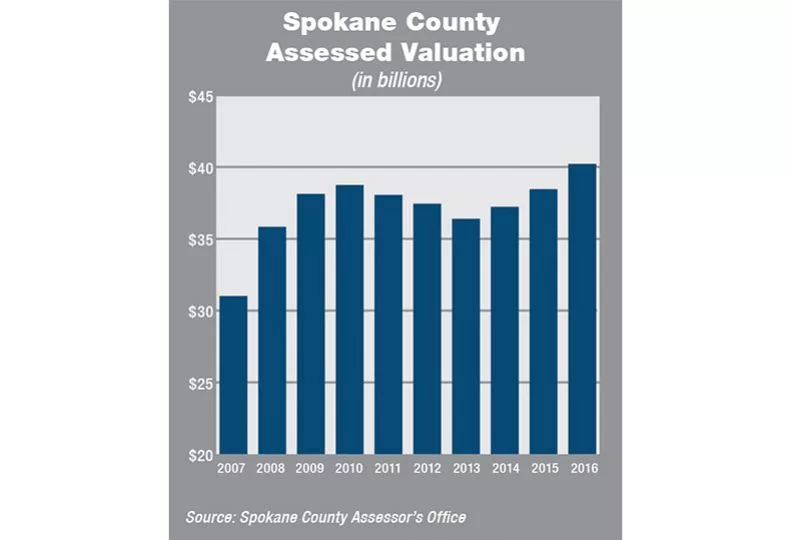

The overall property value for Spokane County reached a record level in 2015, finally breaching the earlier crest of 2009, says Byron Hodgson, the county’s deputy assessor.

Spokane County’s total assessed value for 2015 was $40.2 billion, up from $38.6 billion in 2014.

The 2015 total marks the third consecutive annual increase since the county’s assessed value dipped to $36.4 billion during a three-year slide from the 2009 record valuation of $38.8 billion.

“It’s been a long time coming,” Hodgson says regarding the slow climb from the Great Recession-related drop in overall property values.

The new valuation also resulted in a record property tax levy of $544.7 million, up 3 percent, or $15.6 million, compared with the 2014 valuation year.

Taxes levied in 2016 are based on 2015 valuations.

The average property tax rate for this year is $13.60 per $1,000 of valuation, down 22 cents compared with the 2015 average tax rate. The 2016 tax rate also is slightly lower than average rates in 2014 and 2013.

Under the average rate, property taxes for a home with an assessed value of $165,000 would be $2,245, down $37 from the tax bill for a home of the same value a year earlier.

First-half property tax payments are due April 30, and second-half payments are due Oct. 31.

The county government’s share amounts to 11 percent of the total tax assessments.

The county has 55 taxing districts, which include schools districts, cities, fire districts, county roads, and libraries. Some taxing districts overlap, creating 112 unique tax-code areas.

Most of the total property tax assessment, 55 percent, goes to schools, while 16 percent is shared among Spokane, Spokane Valley, and 11 other incorporated cities in the county.

The county assessed 230,763 tax parcels in 2015, up from 226,658 parcels a year earlier.

Hodgson says much of the increase in parcels is due to a more sophisticated method in which the Washington state Department of Revenue has started appraising property that crosses county lines, such as pipelines, electricity transmission lines, and railroad cars.

“They’re typically spread throughout the counties, so we get a portion,” Hodgson says. “I can’t say if it’s a real increase. It’s more of an administrative increase. They got more precise in how state utility parcels are assessed.”

New construction accounted for $490 million in value added to the tax roll in 2015, down 2.8 percent compared with new construction value a year earlier, although still the second highest total since 2010.

Factoring in the average levy rate, new construction alone added roughly $6.7 million to property taxes due this year.

New construction valuation includes new projects that were substantially completed by July 31.

Hodgson says he’s expecting an increase in assessed value for new construction in 2016 for the 2017 tax roll.

Not all construction projects result in new taxes, Hodgson says, adding that public works projects, including school construction, aren’t included in new-construction assessments.

“If it’s purely government property, it’s exempt,” he says.

State law mandates that county assessors appraise all property at market value, Hodgson says.

The Spokane County Assessor’s Office revalues real estate annually and physically inspects each property at least once every six years.

The Assessor’s Office staff is made up of 43 employees. Of those, 25 are appraisers, up one from a year earlier, Hodgson says.

“We converted a position to an appraiser position,” Hodgson says.

After a few years of declining numbers of tax assessment appeals, Hodgson says there was an increase in tax appeals by commercial property owners this year.

Hodgson says the county has prevailed in the lion’s share of those appeals.

“We’ve won nearly all cases brought to the Board of Equalization,” he says. “Then the process can continue to the state Board of Tax Appeals.”

Related Articles

Related Products

_c.webp?t=1763626051)

_web.webp?t=1764835652)