Home » Keeping Spokane-area homebuyers in the game

Keeping Spokane-area homebuyers in the game

Median-priced residences stay within reach despite sellers' market

February 2, 2017

While the median home sale price for Spokane County climbed to a record level in 2016, ownership of a median price home here is still attainable for most families with good credit, some residential lenders and market observers say.

Traditional lending scenarios often are calculated based on borrowers making 20 percent down payments, but most borrowers here are securing home loans with less money up front.

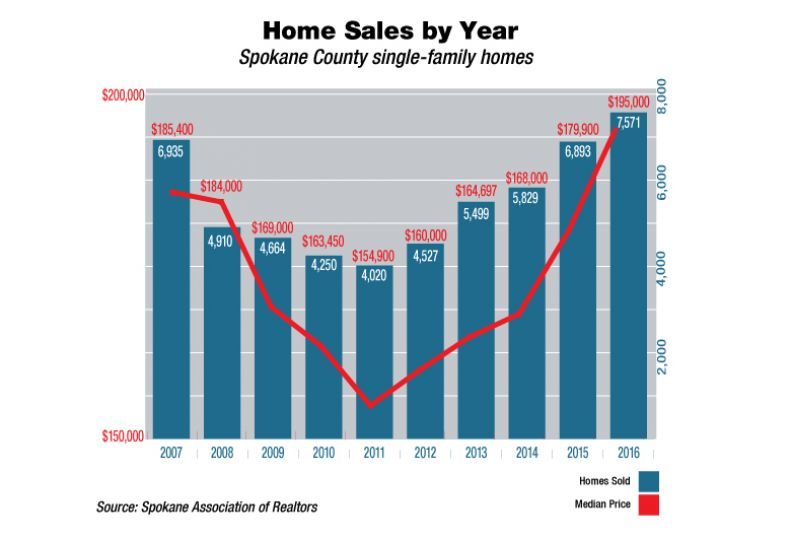

The median sales price for homes sold in Spokane County in 2016 through the Spokane Association of Realtors Multiple Listing Service was $195,000, an increase of 8.4 percent compared with the 2015 median sales price of $179,900.

The 2016 median sales price also eclipsed the prerecession peak median sales price of $185,400 in 2007, says Rob Higgins, executive vice president of the Spokane Association of Realtors.

In 2016, 7,571 single-family homes were sold through the Spokane MLS, an increase of nearly 10 percent compared with the year-earlier total of 6,892 homes sold.

Higgins says 2016 marked the third-highest total in unit sales through the Spokane MLS, surpassed only by the 2005 and 2004 totals of 8,373 homes and 7,758 home sold, respectively.

Meantime, the inventory of homes for sale dropped 24 percent in December compared with the year-earlier month, meaning it’s a strong sellers’ market, Higgins says.

That said, the housing affordability index rating for Spokane County was one of the best in the state at 173 in the third quarter of 2016, while the statewide index rating for the same period was 127, according to the most recent data available through Eastern Washington University’s Spokane Community Indicators website.

An index rating over 100 indicates a family with a median household income can purchase a median-priced home.

The National Association of Realtors reports Spokane’s housing-affordability rating is slightly higher than the overall U.S. rating of 163.

The index assumes the homebuyer would qualify for a typical 30-year, fixed-rate mortgage with a 20 percent down payment and mortgage payments within 25 percent of household income.

Most homebuyers, however, don’t actually have to put up 20 percent, which would be roughly $40,000 for a median-priced home, says Troy Clute, vice president of the Home Loan Center at Spokane Valley-based Numerica Credit Union.

Clute says borrowers typically strive to put down 5 to 10 percent for a 30-year, fixed-rate home loan, which also is known as a conventional mortgage. Some conventional mortgages are structured to enable qualified borrowers to put down just 3 percent, he says.

A few government-backed low-down or zero-down programs are offered through the Veterans Administration, the U.S. Department of Agriculture, Federal Housing Administration, and Washington State Housing Finance Commission bonds, he says.

“Some first-time homebuyers, veterans, or those who qualify for the USDA program might not be required to put down any money at all,” he says.

Clute says one rule of thumb to help first-time homebuyers determine the home price they can afford is to multiply their rent payments by 200.

Another general budgeting rule is to plan on spending no more than 30 percent of monthly household income on mortgage payments, he says.

According to the most recent household income data available on the Spokane Community Indicators website, the median annual household income in Spokane County was $48,525 in 2015, having been stagnant for about five years.

Using the 30-percent-of-income rule, the maximum monthly house payment, including property taxes and mortgage insurance, would work out to around $1,200 for a median-income family.

Clute says typical mortgages for a $200,000 home would fall under that threshold.

While individual situations vary, monthly mortgage payments for a borrower with excellent credit on a $200,000 home might range from $800 for a conventional, 30-year loan with 20 percent down payment to $940 a month for a VA loan with no money down, as of earlier this month, he says.

Private mortgage insurance typically is applied to conventional mortgages for homebuyers who put less than 20 percent down.

A homebuyer who puts 10 percent down on a conventional loan for a $200,000 home can expect to pay an additional PMI fee of about $81 a month tacked onto their house payments, according to Bankrate.com, the online brand of New York-based consumer financial services company Bankrate Inc.

Other government loans have different fee and insurance components that sometimes can be paid up front or built into the loan, Clute says.

Mortgage rates also are affected by credit scores, and not all borrowers are eligible for every loan type, he adds.

Jered Helton, regional manager of home lending at Portland-based Umpqua Bank, says homebuyers in the Spokane market who can foot 20 percent down payments generally are move-up buyers who have built up more assets than homebuyers entering the market.

“Not a lot of first-time homebuyers have $40,000,” Helton says. “Plenty of people are putting down less.”

In the fourth quarter of 2016, Umpqua-originated home loans in the Spokane market averaged just shy of $200,000 with down payments averaging 5 percent, says Helton, whose office is in Oregon.

In the same quarter, two-thirds of Spokane home loans originated by Umpqua were conventional loans, and loans backed through government programs, which include FHA, VA, and USDA loans, accounted for just over a quarter of mortgages.

In light of projected continued increases in home prices and interest rates, Helton also asserts it might not be prudent for some people who qualify for home loans to wait until they can save up for a large down payment.

“Buying now versus waiting until you have 20 percent down might make sense,” he says.

As of last week, annual percentage rates started at 4.41 percent for Umpqua’s 30-year fixed-rate loans.

“Interest is on the uptick, but it’s still low based off historical rates,” Helton says.

He recommends that prospective homebuyers seek preapproval for a loan through one or more lenders before shopping for homes.

“It’s important they put the financial part first to determine what they qualify for and what fits within their budget,” he says.

Ken Lewis, owner and broker at Berkshire Hathaway Home Services First Look Real Estate, in Spokane Valley, says he expects rising home prices and upticks in interest will motivate some homebuyers to act sooner rather than later.

“Some buyers aren’t totally in the market because they see interest rates and prices as stable, but when one or both start to move, it will actually stimulate the market,” he asserts.

He says Spokane is still a good market for median-income households to own homes.

“This area is relatively conservative,” he says. “People here for the most part aren’t trying to buy a house beyond their means.”

Regarding affordability, Higgins, of the Spokane Association of Realtors, says, “We’re still in pretty good shape. Homeownership is still a critical element to families generating wealth over the long run.”

Looking ahead, Higgins says, “I anticipate a healthy market with 4 to 6 percent price increases and unit sales up 3 to 5 percent.”

The current tight inventory of homes listed for sale will continue to be a contributing factor to the upward trend in home prices, he asserts.

“When a house comes on market, a whole bunch of eyes are looking at it,” Higgins says. “If it’s priced right, it will move.”

Anticipated interest rate hikes might slow the sales growth rate, he says.

“We might see (rate) increases throughout the year,” he says.

Latest News Special Report Real Estate & Construction Banking & Finance

Related Articles

Related Products