Inland Northwest executive pay rebounds

Average compensation increases 3.8 percent

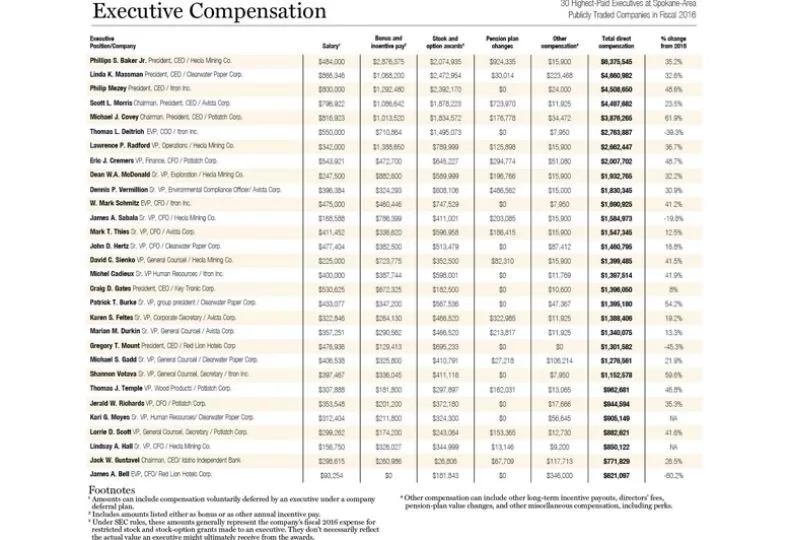

Total compensation rebounded last year for executives at Inland Northwest-based publicly traded companies, according to the annual analysis conducted by the Journal of Business.

Average annual total compensation in 2016 for 41 executives from the eight public companies here was $1.56 million, up 3.8 percent from the total compensation for the same group of executives in 2015.

The increase comes after a 2 percent decline in executive pay last year that snapped a five-year streak of pay hikes. At a 3.8 percent increase, compensation grew at a faster rate than it did in 2013—when executive pay rose a negligible 0.2 percent—but slower than the 9 percent jump in 2014.

The analysis is conducted using information those companies must disclose to the U.S. Securities & Exchange Commission in annual proxy statements. Total pay includes stock options and grants, pension-plan changes, and other compensation in addition to salaries and bonuses and incentive pay, so the total amounts are far more than executives actually took home for the year.

That said, most executives appeared to take home substantially more in 2016 than they did the previous year. Average salary and bonus, when coupled, increased a dramatic 25 percent, to about $839,000 last year from $672,000 the previous year.

In 2015, the salary-bonus average dropped 14 percent, from $769,000 the previous year.

Increases in compensation often are tied to a company’s performance.

Four of the five named executive officers at Itron Inc., the Liberty Lake-based maker of meter reading technology, received strong increases in compensation last year because the company met goals for profitability and other financial milestones, the company’s proxy states.

Itron executives also are credited in the proxy with restructuring operations and rebalancing the company’s product portfolios and investments.

“These initiatives demonstrate our executive leadership’s balanced approach to driving long-term growth in addition to near-term financial improvements,” the proxy said.

The total compensation for four Itron executives increased by between 41 percent and 59 percent each. The one executive whose pay fell, Chief Operating Officer Thomas L. Deitrich, had received a special, one-time equity-award grant in 2015, which pushed his total compensation number higher than usual that year.

At Avista Corp., the five named executive officers had total compensation increases ranging from 13 percent to 32 percent last year compared with the previous year. The company said in its proxy that its earnings-per-share performance exceeded its target, as did its relative total shareholder return, which—when coupled with exceeded milestones—led to higher executive compensation.

Red Lion Hotels Corp., however, appears to be running counter cyclical to the other public companies in the Inland Northwest, but that trend doesn’t appear to be tied to performance.

In 2015, its executives had triple-digit increases in compensation. Last year, however, its executives’ pay fell at rates ranging from 45 percent to 69 percent.

Annual salaries increased for four of the five Red Lion executives in 2016, and the changes in compensation involved stock awards and options granted in 2015.

Among individuals on the list, Phillips S. Baker, president and CEO of Coeur d’Alene-based Hecla Mining Co., finished on top for the second year in a row. At total compensation of $6.4 million, Baker’s pay increased 35 percent in 2016 compared with the previous year.

Linda Massman, president and CEO of Clearwater Paper Corp., came in second with $4.7 million in total compensation. Massman’s pay increased 33 percent, and she moved up two spots on the list.

While Massman ranked second in total compensation last year, she had the highest annual salary, at $866,346.

Rounding out the top five are Itron President and CEO Philip Mezey, at third at about $4.5 million; Avista Chairman, President, and CEO Scott L. Morris, fourth at $4.5 million; and Michael J. Covey, fifth at $3.9 million.

The rest of the top 10 included Itron’s Deitrich, sixth at $2.8 million; Hecla Vice President of Operations Lawrence P. Radford, seventh at $2.7 million; Potlatch CFO Eric J. Cremers, eighth at $2 million; Hecla Senior Vice President Dean W.A. McDonald, ninth at $1.9 million; and Avista Senior Vice President and Environmental Compliance Officer Dennis P. Vermillion, 10th at $1.8 million.

In all, 23 of the 41 named executive officers had total compensation that exceeded $1 million last year.

That’s down from 27 in 2015 and the same as in 2014. In 2013, 15 executives had total compensation of more than $1 million.

As alluded to earlier, though, those amounts include stock awards and accounting factors that don’t involve current cash value of that stock. Amounts listed for grants of restricted stock and stock options, for example, use formulas to determine what the stock could be worth in the future. Consequently, an executive receiving that stock might not be able to reap the rewards of that asset for years.

The Journal doesn’t include in the analysis gains that executives earn in a single year from having past restricted stock vest or for exercising past stock options.

By adhering to more stringent disclosure rules put in place in the mid-2000s, companies now include the current-year cost of such gains in their filing. Because of that, adding them could be duplicative.

One constant in the analysis of the 2016 data is the number of companies and executives involved. Last year’s analysis of 2015 also included eight companies and 41 executives.

In previous years, the analysis included more companies and, of course, more executives.

Three public companies fell off the 2015 list after Ambassadors Group Inc. discontinued operations, Mines Management was acquired, and Northwest Bancorp. began trading its stock on an over-the-counter bulletin board.

Other companies that have fallen off the list in recent years include Coeur Mining Inc., which moved its headquarters to Chicago from Coeur d’Alene; Sandpoint-based Coldwater Creek Inc., which shut down its operations after filing for Chapter 11 bankruptcy protection; and Sterling Financial Corp. and Revett Minerals Inc., which both were subjects of acquisitions.

Related Articles

Related Products

_c.webp?t=1763626051)

_web.webp?t=1764835652)