Home » Reform buzz builds uncertainty among Spokane-area tax pros

Reform buzz builds uncertainty among Spokane-area tax pros

Some deductions, credits go away prior to changes

October 26, 2017

Some Spokane-area tax preparers say President Trump’s recently announced plan for tax reform has shifted their focus toward possible major changes coming in 2018, rather than the comparatively few changes in the tax code for this year.

“In my opinion, there are not many tax law changes from 2016 to 2017 when compared to a normal year,” says Andrew McDirmid, partner with the Spokane office of Fargo, N.D.-based Eide Bailly LLC. “I think most people in our industry expected tax reform in 2017, and we’re almost afraid to speculate about whether or not it will happen at this point.”

Late last month, several media outlets published a nine-page document called The Unified Tax Reform Framework, in which both White House and Congressional Republican negotiators laid out plans for a bill that would overhaul the federal tax code.

And while any changes would likely only affect 2018 taxes, McDirmid says the big question right now is whether tax reform could be made retroactive to 2017.

“I would say it is unlikely major tax reform would be made retroactive to January 1, 2017, in part due to the process of preparing new tax forms before filing season begins,” he says.

Don Moulton, CFP, co-founder of Moulton Wealth Management Inc., of Spokane Valley, agrees talk of tax reform has made this fall a period of uncertainty for tax preparers and their clients.

“If President Trump has his way, a new tax plan would be pushed through by December, but the big question is whether it would be retroactive,” he says. “It makes planning difficult because we don’t know what the final plan will be, who it will impact, or how one should respond in relation.”

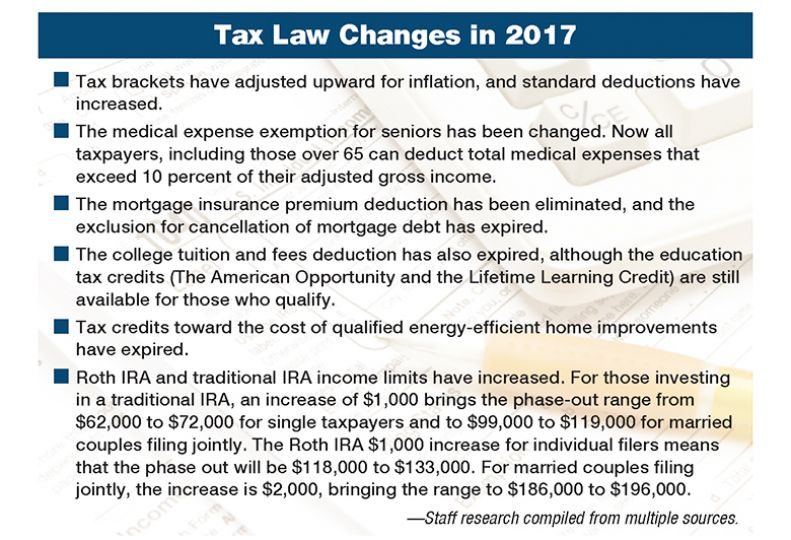

Apart from speculations about the effects of upcoming tax reform, changes in tax law for 2017 include: tax brackets having adjusted upward for inflation, increases in standard deductions; changes to the medical expense exemption for seniors, elimination of the mortgage insurance premium deduction, expiration of the exclusion for cancelation of mortgage debt, expiration of the college tuition and fees deduction, expiration of energy-efficient tax credits, and the increase of Roth IRA and traditional IRA phase-outs.

Moulton says one change that affects his client base—most of whom are retired or soon to be retired—is the change to the medical expense exemption for seniors.

“Prior to Obamacare, it used to be that deductions had to exceed 7.5 percent of adjusted gross income. Obamacare raised that to 10 percent but not for people over 65,” he says. “So through 2016, those over 65 could still claim deductions based on the 7.5 percent of their AGI. This year, that 10 percent applies to everyone.”

Moulton says clients who are homeowners should also pay attention to the elimination of the mortgage insurance premium deduction, and the expiration of the exclusion for canceled mortgage debt.

As Moulton explains, homeowners who paid a smaller down payment when purchasing their home are likely paying for private mortgage insurance. Prior to 2017, the premiums for PMI were 100 percent tax deductible for households with an adjusted gross income of $100,000 or less.

“Now that that tax break has been eliminated, homeowners could miss out on a large deduction depending on the size of their mortgage and PMI amount,” he says. “It’s an extra expense that they used to be able to deduct.”

Meanwhile, he says, the Mortgage Forgiveness Debt Relief Act, which allowed taxpayers to avoid income taxes on unpaid mortgage debt, also has expired, meaning homeowners may end up with higher tax bills if a sizable portion of their mortgages were forgiven.

Also this year Moulton says taxpayers should note that the college tuition and fees deduction, which allows you to deduct up to $4,000 from your income for qualifying tuition expenses paid for you, your spouse, or your dependents, has been eliminated.

“Many people choose to skip the education credits and claim the tuition and fees deduction instead,” he says. “The American Opportunity Credit and the Lifetime Learning Credit are harder to qualify for, but they are both still available this year, so parents and students should definitely be aware of that change.”

While any upcoming tax reform will depend on transition rules and the effective dates of the various changes, McDirmid says the anticipation of reform is guiding his advice to clients in 2017.

“Anytime we are in an environment in which it is possible tax rates will be reduced in 2018, the goal is to defer income in 2017 to 2018 and accelerate deductions into 2017 at the individual or entity level,” he says.

To start, McDirmid advises those participating in a 401(k), 403(b), SIMPLE (Savings Incentive Match Plan for Employees), or other retirement accounts to try to maximize their deferral before year’s end.

“For a 401(k), one can generally fund up to 100 percent of their compensation for a maximum deferral of $18,000 and if you’re 50 or over the maximum deferral is $24,000,” he says. “The deferral limits on a SIMPLE are $12,500 with a $3,000 catch-up contribution if you are 50 or over.”

McDirmid says individuals also should work with an investment adviser to review whether they have realized capital gains or losses, and evaluate whether it makes financial sense to sell certain investments that have an unrealized loss.

“Good tax planning strategies involve working with your CPA or tax attorney to legally have income taxed as long-term capital gains, or qualifying dividend income which is taxed at a much lower rate than ordinary income or interest income,” he says.

McDirmid also advises individuals to keep an eye on Individual Retirement Accounts and required minimum distributions, as taxpayers over age 70 ½ are required to take distributions from their IRAs before Dec. 31 in order to avoid a penalty.

He says taxpayers are allowed to contribute up to $100,000 from their required minimum distributions (RMD) to charity in what’s called a qualified charitable distribution.

“The IRA distributions must go directly to the qualifying charity, versus going to the IRA owner and then the charity,” he says. “The benefit of making charitable donations from a RMD is the deduction is an above-the-line deduction, which is more valuable than an itemized deduction.”

For business entities, McDirmid says top factors to keep in mind include considering setting up retirement accounts for employees, prepaying reasonable business deductions before Dec. 31, and looking into purchasing any needed equipment also before year’s end.

“If your business has taxable income, it can expense (under Iternal Revenue Code Section 179) up to $510,000 of qualifying fixed assets, assuming total fixed asset purchases for the year do not exceed $2.03 million,” he says. “In addition to the section 179 deduction, your business can claim a first-year bonus depreciation equal to 50 percent of the cost of qualifying new equipment, including software placed in service before December 31, 2017.”

McDirmid also advises entities to determine whether they have obsolete or damaged inventory as, there may be a write off which can be taken.

David Green, owner of Spokane-based David Green CPA PLLC, says although it’s unlikely Congress will pass tax reform this year, it helps to plan ahead.

“A lot of tax planning is about taking advantage of timing, whether that’s timing income or timing deductions. That’s the game we’re all playing now,” he says.

“We may see more details in the next two months, but so far, Trump’s tax reform plan leaves most of the details up to Congress, which makes planning difficult.”

For 2017, Green says he would advise upper-income clients to take a close look at their charitable contributions, and consider planning for possible elimination of the AMT (alternative minimum tax) under Trump’s reform plan.

“We don’t yet know what tax reform will do, but for those in the higher income bracket, it makes sense to look at those two areas,” he says.

Green says if tax rates end up being lower in 2018 than 2017, clients should look to prefund charitable contributions this year through a donor-advised fund, in order to get a current year tax deduction but make charitable distributions next year, when the taxpayer expects to take the standard deduction.

As Trump’s proposal also plans to do away with the alternative minimum tax (AMT), Green says taxpayers in the AMT may want to think about whether to defer deductions or accelerate income.

The AMT is intended to ensure high-income filers don’t escape paying taxes through otherwise allowable credits, deductions, and loopholes.

If a client knows they’ll be subject to the AMT in 2017 but not in 2018, Green says, it might be beneficial to accelerate income (such as a year-end bonus) into 2017 so it will be taxed at the lower AMT rate.

“The big thing is to know whether or not you’re in the AMT for the year,” he says. “Normally, you’d want to pay taxes later, but if you accelerate income in the year you’re paying AMT tax, you’ll be paying less.”

Green advises clients to time the payment of expenses that are deductible for regular tax purposes but not AMT purposes, for the years in which they don’t anticipate AMT liability. Otherwise, they’ll gain no tax benefit from those deductions.

“For clients who know they’ll fall under the AMT for 2017, I would advise them to make those payments in January 2018 as opposed to this year, because they may get a deduction in 2018 if the AMT is repealed,” he says.

“If the client isn’t paying AMT tax in 2017, then those payments would be deductible in 2017, if made before the end of the year,” he says.

Although Trump’s reform plan still lacks key details, many industry experts speculate it will benefit wealthy Americans the most, due to its proposed decrease in the tax rate, and the elimination of the Alternative Minimum Tax (AMT), as well as the estate tax.

“There seem to be many industry experts out there, and many have different opinions,” says McDirmid. “We try to understand the details of proposed new tax law changes, and be proactive with our clients about tax planning.”

For individuals, the tax plan proposes to consolidate the current seven tax brackets into three; increase the standard deduction; eliminate most itemized deductions; increase income levels at which the child tax credit phases out; and repeal both the alternative minimum tax (AMT) and the estate tax.

For businesses, the framework proposes to reduce the top corporate tax rate—to 20 percent from 35 percent—provide a new top tax rate of 25 percent on business income generated by sole proprietorships and pass-through entities. It also introduces possible changes in the taxation of foreign earnings.

“At the individual level, the elimination of the state income/state sales tax deduction should cause taxpayers to pre-pay state income taxes or purchase items they can deduct the sales tax on before Dec. 31, 2017,” McDirmid says.

He adds, “At the entity level, the concept of a top 25 percent rate on business income, which would apply to pass-through entities like partnerships, S-corps, and sole proprietors, causes us to want to defer income to 2018 and accelerate deductions in 2017,” he says.

Because most businesses operate as S-corps, limited liability companies, partnerships, or sole proprietorships, McDirmid says, industry experts question how a new law would break out the “business income” taxed at 25 percent versus the “reasonable compensation,” which would be taxed as ordinary income, which is generally taxed at higher rates.

“If C-corp tax rates are reduced to 20 percent, we would likely see more entities choosing to be taxed as C-corps, which is different than today’s environment in which S-corps, although administratively cumbersome, provide significant tax savings,” he says.

McDirmid says changes in the foreign earnings taxation are exciting.

“Yes, these changes would benefit the huge entities likes Google, Apple, etc. However, there are many privately held businesses with foreign operations,” he says. “The suggested changes would motivate entities with foreign operations to bring their net earnings back into the United States.”

Latest News Up Close Banking & Finance

Related Articles

Related Products

![Brad head shot[1] web](https://www.spokanejournal.com/ext/resources/2025/03/10/thumb/Brad-Head-Shot[1]_web.jpg?1741642753)