Home » INW advisers: Watch out for red flags when investing nest eggs

INW advisers: Watch out for red flags when investing nest eggs

Investment professionals offer guidance in light of recent indictment in Spokane

September 22, 2022

In light of recent charges against the local financial adviser accused of stealing millions from his clients, Spokane-area financial professionals and the legal examiner involved in the case say there are red flags investors should watch for and ways to protect retirement nest eggs.

In that case, Ronald W. Hannes is charged in U.S. District Court for Eastern Washington, in Spokane, with wire, mail, and investor fraud and is accused by the Washington state Department of Financial Institution of taking a total of $2.9 million from at least 19 clients from 2003 to late 2019, when he was fired from Woodbury Financial Services Inc.

DFI alleges that Hannes instructed clients to write checks to him individually or his Spokane practice, Hannes Financial Services, Inc., rather than Woodbury Financial.

Hannes has pleaded not guilty, and a pretrial hearing is scheduled for January, says his attorney, Phillip Wetzel, of Spokane-based Phillip Wetzel Attorney at Law.

Michael Jackson, senior vice president and branch manager at the Spokane office of D.A. Davidson & Co., says that there are several red flags prospective investors should look out for when searching for and starting a relationship with a financial adviser.

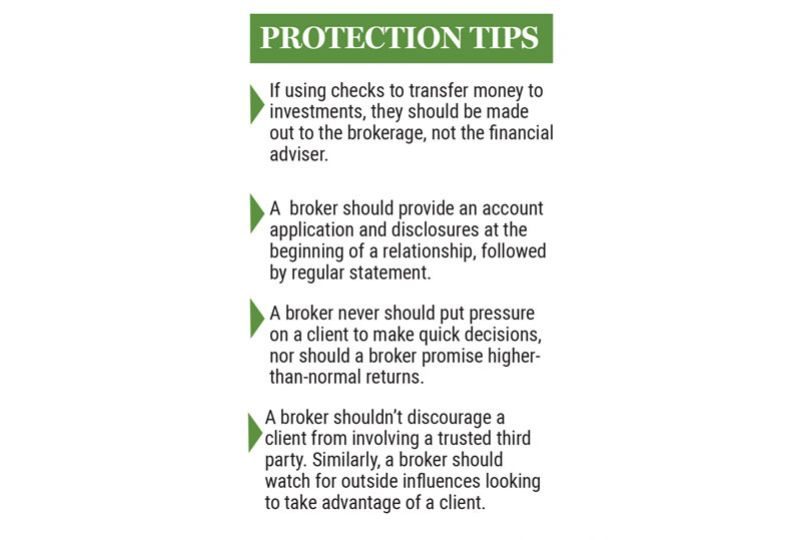

Although checks are becoming rarer, Jackson says his firm still receives them. On these occasions, checks should never be made out to an individual, but rather should be made out to the financial planning firm and “for the benefit of” the client to limit who can deposit the check and who can benefit from it.

In the Hannes case, Woodbury Financial wasn’t aware of investments made by clients because Hannes was keeping them outside the view of the firm, according to DFI.

Jackson adds that automatic clearing house payments, known as ACH payments, are a safer form of transferring funds for the purpose of investing.

ACH payments offer protections that checks lack, he says, adding, “We never take cash.”

Adam Yeaton, a financial legal examiner with DFI’s Securities Division involved with the Hannes case, says via email correspondence that the checks written directly to Hannes by his clients were major warning signs he noticed when reviewing the case.

“While this does not automatically make the investment fraudulent, it is another red flag, because it can be an indicator that the financial professional is depositing the funds into a personal account to keep them concealed from their firm,” Yeaton explains.

Yeaton says that the investments at issue in this case were “off the books,” and not shown on the regular account statements that Hannes’ clients received from Woodbury Financial. More generally, investors rarely, if ever, received reports about the status of the off-the-books investments, he says.

“If your financial professional has sold you any investments that are not shown on your regular account statements, it’s a good idea to verify that their firm is aware of these investments,” Yeaton says.

One of the first things investors should do is to check that their financial professional is properly licensed, such as through the Financial Industry Regulatory Authority’s brokercheck website.

Jackson also advises prospective investors to vet financial professionals.

“On brokercheck, you can check a financial adviser’s experience, proper licensing, and regulatory history,” he says.

Sarah Carlson, founder and private wealth adviser at Fulcrum Financial Group LLC, of Spokane, says, in addition to checking through brokercheck, she advises clients to meet with multiple financial advisers before selecting one.

“It’s always reasonable to get a second opinion,” Carlson says. “If something sounds too good to be true, talk to another investment professional.”

If a financial adviser is unwilling to offer a free introduction meeting, that also should be viewed as a red flag, she says.

Jackson says that investors also should ask financial professionals if they are fiduciaries—meaning they have a legal requirement to act in the best interest of the client. Not all financial professionals are fiduciaries, he adds.

When a client chooses to begin working with a financial professional or broker-dealer, the financial professional should provide an account application and disclosures to the client, including a definition of the team structure, the professional’s capabilities and resources, compensation expectations, and how strategies will be developed for the client, Jackson says.

“It is a major red flag if disclosures are not delivered,” he says.

He listed off a few other warning signs, including:

•Pressure on the client to make quick decisions.

•Promises of higher-than-normal returns.

•Discouraging a client to involve a trusted third party in decisions.

Carlson says clients can choose to receive monthly statements. She adds several applications are available for clients investing in publicly traded companies to check on their investments at any time.

“If you can’t get data on the account, that’s a problem,” she says. “If you are told you will only get statements once a year, that’s a problem.”

Jackson also says clients should get account statements quarterly or monthly. In addition, when creating an online account with an investment firm, a financial adviser is only allowed to walk the client through the process but shouldn’t be privy to clients’ account passwords and usernames.

In order to better safeguard against fraud, personal record keeping from a client’s side is also advised.

Yeaton says that the legally required retention period for many types of bank records is seven years, and many banks regularly delete records older than that.

He advises investors to keep records of transfers, including wire transfer receipts and front-and-back copies of any investment-related checks. Investors also should retain copies of information related to investments, such as promotional materials, disclosure materials, contracts, and account statements.

Yeaton adds investors should keep records of communications with people selling investments, and clients should be wary of a financial professional who doesn’t communicate in writing about the investments.

While Jackson says clients should always do their due diligence when starting a relationship with a financial professional, most warning signs he sees of potentially fraudulent financial activity originate from third parties on the clients’ side.

“We really press for financial professionals to see red flags on the other side of the phone,” he says. “Especially when you start talking about older investors and the potential for those individuals to be taken advantage of.”

Jackson says financial advisers are continuously trained in catching red flags coming from a client’s side such as noticing forgetfulness, changes in spending and investing, large gifts and donations out of the norm, and the introduction of a new third party in the client’s life who answers questions for the client, sometimes to the point of interrupting the client.

Jackson says advisers are trained to document those red flags and report them to their managers.

“We tend to catch the majority, if not all,” he says. “You always hope there is none.”

Latest News Special Report Banking & Finance

Related Articles

Related Products