Home » Gesa Credit Union set to open fourth Spokane-area office

Gesa Credit Union set to open fourth Spokane-area office

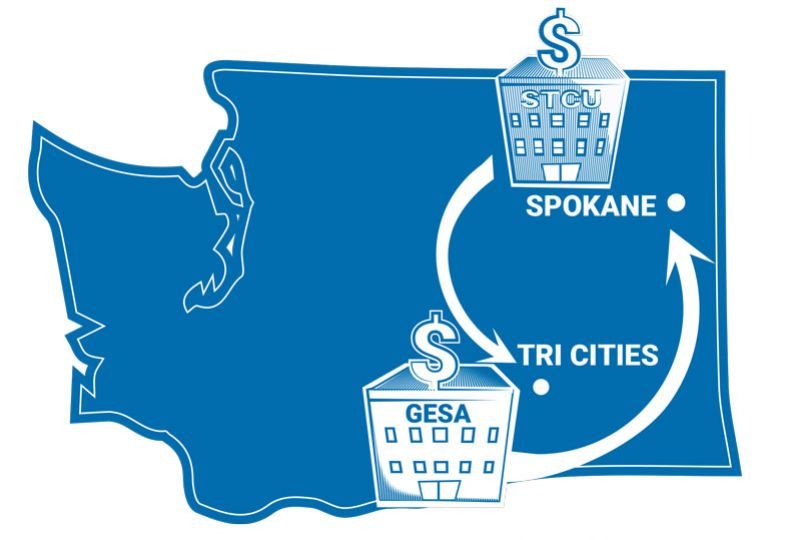

Tri-Cities-born credit union looks to expand further here

April 12, 2018

In response to a growing customer base in Spokane, Gesa Credit Union will open its fourth Spokane-area office next month.

The Richland, Wash.-based credit union, celebrating its 65th anniversary this year, has enjoyed steady growth in the Lilac City since it entered the market through a merger with Northland Credit Union, of Spokane, in the summer of 2015, says Brian Griffith, Gesa’s assistant vice president for marketing.

“We’re becoming more of an Eastern Washington-focused credit union,” Griffith says.

The new branch will be located in a 2,300-square-foot space in the Northtown Office Building, at 4407 N. Division, on Spokane's North Side. Gesa plans to employ six people there, bringing to 25 the number of Gesa employees in the Spokane market.

Gesa's other branches here are located at the former Northland Credit Union branch on the North Side, at 9625 N. Newport Highway, and in Spokane Valley, where it opened a branch last year at 409 N. Sullivan Road.

Aside from its Spokane-area branches, which Gesa calls member service centers, the credit union also operates a home and commercial loan office in the former Bank of Whitman Building, at 618 W. Riverside downtown.

When the Northtown branch opens, the credit union will have 17 offices in Eastern Washington—reaching as far west as Wenatchee and Yakima—offering services available to any Washington resident, including checking, auto loans, savings accounts, and investment consulting.

While doors aren't yet open to its new branch, Gesa is already looking to future expansion in the Spokane area, Griffith says.

“We’re excited by the prospect of continued growth in Spokane and foresee an additional location or two soon—I think we’re talking in the next year or so,” he says. “It always depends on the market conditions and what our members tell us.”

Gesa has experienced solid recent fiscal growth, Griffith says. The credit union's loans totaled $1.57 billion as of Sept. 30, up from $1.49 billion a year earlier, according to the latest available financial statement Gesa filed with the National Credit Union Administration. Deposits totaled $1.61 billion as of Sept. 30, up from $1.54 billion a year earlier.

As the fifth-largest credit union based in Washington state, in terms of total assets, Gesa has more than 150,000 members with $1.9 billion in assets as of Sept. 30, an increase of more than $100 million, compared with total assets a year earlier.

Griffith declines to disclose the number of members in Spokane County, saying the credit union doesn't break down membership by county.

While the credit union experienced modest growth in its first four decades since its founding in 1953 in Richland, Wash., by members of the General Electric Supervisors Association, Gesa's growth accelerated starting in 1996, when it opened membership to all residents of Washington state, Griffith says.

“Across the board, we’ve grown because we’re able to extend the value proposition of lower rates and personalized customer service that is part of our organization structure,” he asserts.

“One of the things you see most often with credit unions—especially with mortgages—is the decisions are made locally versus in some office somewhere else in the country,” he adds. “We don’t have Wallstreet shareholders who we need to appease. So, as a result, we’re able to return value to our members in the form of lower rates on loans, higher rates on savings, and reduced fees.”

Beyond its focus on traditional financial services, Gesa is an active community participant in dozens of nonprofit causes, Griffith says.

“As part of each community we serve, one of the areas we’re most excited about is charitable giving,” he says. “Gesa has a long history of giving back. Our members really appreciate knowing that their financial institution is investing in the community where they live and work.”

In 2016, for example, Gesa supported more than 90 organizations and events across Central and Eastern Washington, focusing in the areas of food insufficiency, housing insufficiency, and education, Griffith says.

In Spokane, Gesa has supported other nonprofits, such as Children’s Miracle Network at Providence Sacred Heart Medical Center & Children's Hospital, Second Harvest Food Bank of the Inland Northwest, and Wishing Star Foundation. It also has been involved in Greater Spokane Incorporated.

In the areas of education, housing, health, and hunger relief, Gesa provided $808,202 in support in 2016, according to the company’s annual community report. Those philanthropic figures will continue to grow as Gesa grows, Griffith asserts.

“Our nonprofit structure allows us to participate actively in community events and programs,” Griffith says. “Giving back to our communities is just one way we follow our motto of ‘People helping people.’”

Latest News Banking & Finance

Related Articles

Related Products

![Brad head shot[1] web](https://www.spokanejournal.com/ext/resources/2025/03/10/thumb/Brad-Head-Shot[1]_web.jpg?1741642753)