Home » Program aims to reduce unbanked populations in North Idaho

Program aims to reduce unbanked populations in North Idaho

Access, education called keys to financial health

April 12, 2018

(UPDATED AT 2:50 P.M. Pacific 4/13/18 to reflect correct spelling of Keri Stark's name.)

In an effort to build better basic financial education, Coeur d'Alene-based United Way of North Idaho has partnered with nearly two-dozen regional community and financial partners to institute a program for unbanked and underbanked residents of North Idaho.

Bank On North Idaho will seek to provide families and individuals with mainstream financial services such as affordable checking products and free, community-based financial education opportunities beginning June 8.

Bank On looks to help new customers reduce debt, increase credit scores, build emergency savings that will cover three months of expenses, achieve financial goals, build assets, and increase net worth, says Keri Stark, director of community impact for United Way of North Idaho.

"We want to help people set up starter or second-chance accounts," Stark says. "They may have past, charged-off bank accounts that are leaving a black mark. The Bank On program is there to help provide a framework to overcome past transgressions."

Stark emphasizes that the program isn't geared exclusively to low-income individuals or families.

"The key to the program is access and education. Income is largely irrelevant," she says.

Financial challenges can be complex, and can range from monthly expenses that meet or exceed earned income to overconsumption, she adds.

Someone considered to be unbanked lacks a basic checking or savings account, Stark says, while those regarded as underbanked may or may not have a basic checking or savings account, but are highly reliant on the use of pawnshops and often high-interest payday loan institutions.

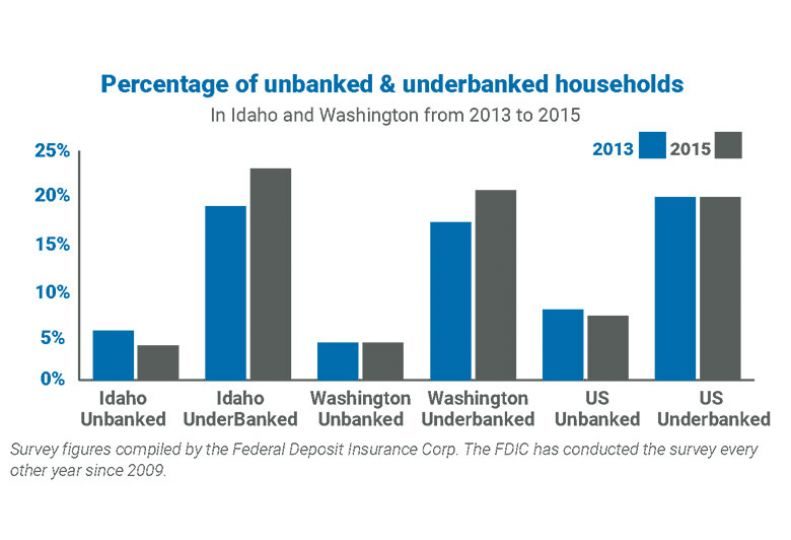

In its most recently compiled survey, conducted in 2015, the FDIC's survey of unbanked and underbanked households showed close to 4 percent of all households in Idaho are unbanked, down from more than 5 percent in 2013.

The percentage of households that were underbanked, however, increased to 23 percent in 2015 from 19 percent in 2013, FDIC figures show.

Stark says Kootenai County's figures for unbanked and underbanked residents are comparable to the rest of Idaho with close to 5 percent of all households without a checking or savings account, and close to 20 percent of households that are underbanked.

Washington state's numbers are similar to Idaho's, as 4 percent of all households statewide are unbanked and 21 percent are underbanked. Nationally, 7 percent of all households are unbanked while 20 percent are unbanked, the FDIC survey says.

The United Way of North Idaho is coordinating the Bank On program here, and its financial partners include Idaho Independent Bank, Inland Northwest Bank, Mountain West Bank, Northwest Bank, Potlatch First Federal Credit Union, U.S. Bank, Washington Trust Bank, and Wells Fargo Bank, Stark says.

"We didn't have challenges getting financial institutions on board," she says.

The participating banks have agreed to offer a free or minimal-cost starter account, will participate in the Bank On program for at least a year, will incorporate Bank On information and training to staff members, and will designate employee volunteers to provide financial education workshops for Bank On customers, she says.

Meanwhile, United Way of North Idaho solicited as community partners the Coeur d'Alene School District, Coeur d'Alene Public Library, Hayden-based Habitat for Humanity of North Idaho, the Coeur d'Alene office of the Idaho Department of Health and Welfare, North Idaho College, and Post Falls Food Bank.

Alliance Data, Community Action Partnership, and Resolve Financial Group, also are community partners Stark says.

"We'll collaborate with the community-based organizations to connect these resources to individuals who are unbanked or underbanked, and make up a large portion of the poverty and working-poor populations in North Idaho," Stark says.

Several Spokane-area banks employ the use of Bank On programs, and Sterk says both the United Way of North Idaho and financial institutions in the Panhandle have used their Spokane counterparts to help prepare for their June launch.

Marcia Dorwin, a senior credit analyst and community reinvestment officer at Inland Northwest Bank in downtown Spokane says INB is a founding financial partner of Bank On Spokane established in about 2012.

As is the case in North Idaho, the United Way of Spokane helped play an integral part of setting up Bank On at several banks here.

"We've helped open the accounts of hundreds of people who previously didn't have access to the financial system," Dorwin says.

As of the end of third quarter 2017, INB had a total of 285 open Bank On checking accounts with an average balance of $425 and 133 open savings accounts with an average balance of $232, Dorwin says.

"Bank On is important because it's free, or at low-cost, and it plays a vital part of meeting the needs of the community," she says.

Latest News Banking & Finance North Idaho

Related Articles

Related Products

_web.jpg?1729753270)