Home » Spokane-area foreclosures decline further

Spokane-area foreclosures decline further

Observers here call uptick in April nothing but noise

June 6, 2019

Recent data released by Irvine, California-based real estate research company Attom Data Solutions show foreclosure rates for Spokane County, already at a historic low, continued their downward trend for the first quarter of 2019, a trend Spokane market observers attribute to a booming economy and strong job growth.

Attom reported a total of 152 foreclosures through April of 2019, a 17% decrease over the first quarter of 2018, which recorded a total of 184 foreclosures.

Spokane County’s economy has been on a 120-month expansion, Grant Forsyth, chief economist for Avista Corp. says. The last time its economy enjoyed this long of an expansion was in the 1990s until it ended in 2001 with the burst of the tech bubble.

“If we can make it to July, we’ll have the longest expansion since they’ve been able to keep records, going back to the 1850s,” Forsyth says.

The Washington state Employment Security Department reported the unemployment rate was 4.7% statewide for April, while Spokane County’s unemployment rate was 5.6% for April. Unemployment has been on a steady decline in Washington since 2010, when it hit 10.1%.

Forsyth says the economic expansion and the low unemployment rates are helping to push the foreclosure numbers down.

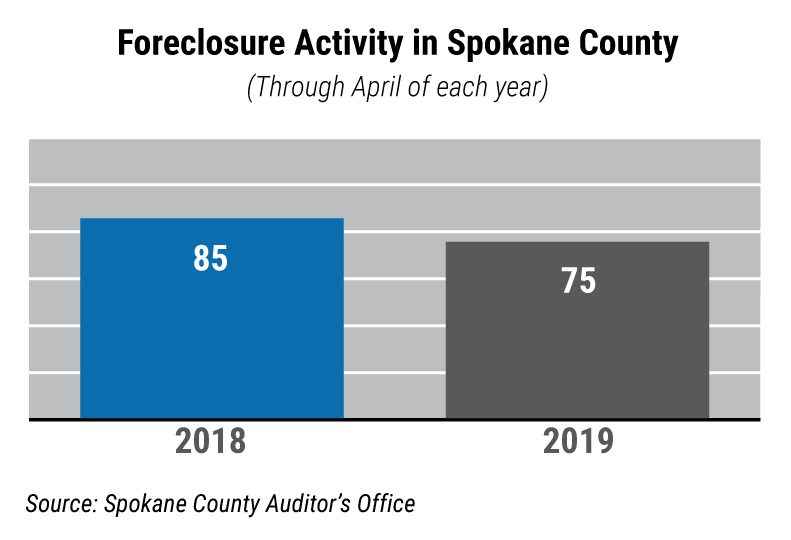

The Spokane County Auditor’s office reported a 12% decrease in foreclosures on deeds of trust through April year-over-year, clocking 75 total foreclosures through April 2019 and 85 through April 2018.

With a deed of trust, three parties are involved, the borrower, the lender, and a third-party trustee that holds the deed until the debt is repaid.

In all, the auditor’s office recorded 460 foreclosures on deeds of trust in 2017, and 226 in 2018. As of May 2019, there have been 88 foreclosures on deeds of trusts recorded by the office.

“If you compare it to the last expansion — the pre-Great Recession expansion — foreclosures are even lower than they were then,” says Forsyth. “So, (what we have now) are incredibly low levels by historical standards.”

Rob Higgins, executive vice president of the Spokane Association of Realtors, agrees that foreclosure numbers are at a record low, stating only 1.7% of all sales through April recorded in the association’s Multiple Listing Service were in the “real estate-owned sales” category, which are foreclosed homes held by lenders.

This translates to 31 out of the 1,795 homes sold through April 2019. At the same time last year, the association reported 2,087 home sales, says Higgins, 73 of which were reported as real estate owned sales.

“To give you a comparison, it was 2.1% in 2018, and in 2011, it was 22%, so you can see where we’ve come from,” Higgins says.

“It’s a different world today,” Higgins says. “During the recession a lot of people went sideways, but we’ve come out of that.”

Home sales have been on the decline this year, sliding 14% in April 2019 year-over-year, according to the association’s market snapshot. Higgins attributes this decline primarily to a lack of inventory of homes for sale, which, as of April, was 1,083, or a 1.9-month supply, down 7% year-over-year.

Attom reported a slight spike in foreclosure numbers in Spokane County for the month of April, showing a 6.7% increase in lender completed foreclosures and a 21.2% increase in foreclosure starts for Spokane County year-over-year.

“In percentage terms, that’s large, but in absolute terms, I would consider that noise,” says Forsyth. “Those are very low numbers of foreclosures … small changes will look large in percentage terms, but based on absolute numbers and historical average, those are pretty low.”

Spokane County had a total of 50 foreclosure starts and completions in April of 2018, compared to April 2019 with a total of 56 foreclosure starts and closures, which translates to a 12% increase in total foreclosures, according to Attom data.

Forsyth contends that the April numbers don’t reflect the current economic state of Spokane County, or even the state of Washington, saying, “There could be several factors at work here, but in this case, I don’t think it reflects what’s happening in the economy, because the economy is still relatively strong both statewide and regionally.”

Nationwide, foreclosure activity decreased 13% in April compared with foreclosure activity in the year-earlier month, according to the Attom report.

Washington state ran counter to the national trend, with annual increases in both foreclosures starts and completions, reporting an increase of 38% and 53%, respectively — the highest rate of increase in the U.S. in terms of percentages, the report says.

“I don’t know what would bring about an increase in the state of Washington,” says Higgins. “I know the market on the West Side, in Seattle, has slowed some, but it’s still a very strong market.”

The spike in the state’s numbers can be illustrated by what appear to be drastic foreclosure increases in Whatcom County (up 1,400%), Kittitas County (up 400%), and Franklin County (up 300%).

However, when looking at the unit numbers, Whatcom County reported 15 foreclosures in April 2019, up from one foreclosure in April 2018. Kittitas County went to five, up from one a year earlier, and Franklin County went to four from one, all of which are relatively small increases in units that translate to large-percentage increases.

Only five out of the 39 counties in Washington reported a decrease in foreclosures year-over-year, while 12 reported no change year-over-year, according to Attom’s April report.

Latest News Real Estate & Construction Banking & Finance

Related Articles

Related Products