Home » Bankruptcy filings decrease for ninth straight year

Bankruptcy filings decrease for ninth straight year

Eastern Washington activity runs counter to U.S., N. Idaho trend

January 30, 2020

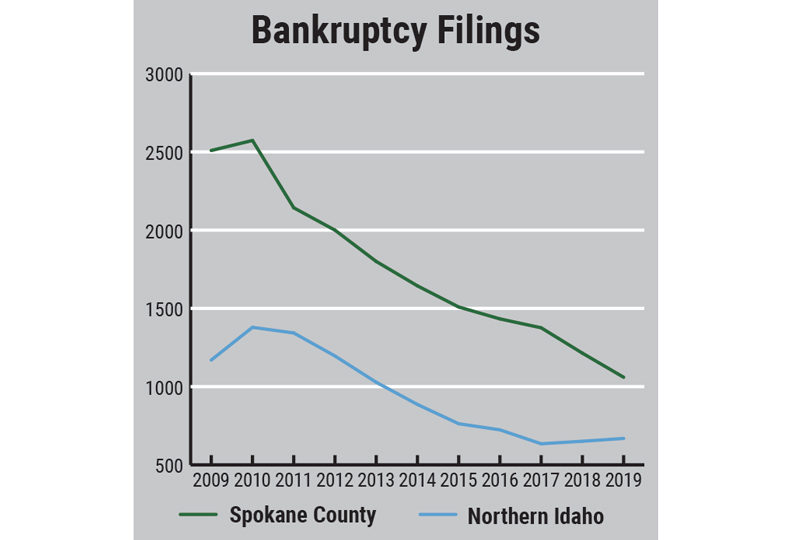

The number of bankruptcy filings in Eastern Washington decreased for the ninth straight year in 2019, U.S. Bankruptcy Court figures show.

At the same time, however, Northern Idaho saw a slight uptick in filings for the second year in a row. Nationwide bankruptcy filings also saw a slight increase in 2019.

The U.S. Bankruptcy Court’s Eastern District of Washington reported a total of 3,259 filings through 2019, down from 3,549 filings in 2018, a decrease of 8.2%.

The court’s Eastern District consists of 20 counties in Washington that are located east of the Cascade Mountains.

The year’s bankruptcy filings in the Eastern District included 2,490 Chapter 7 cases, which is the most common form of bankruptcy in which filers seek to liquidate their assets. Chapter 13 filings for the year totaled 739. Chapter 13 allows a person or company to present a plan of financial reorganization that sets up a court-approved repayment plan.

In Spokane County, the decrease was more pronounced. Bankruptcy data showed a total of 1,060 cases filed in 2019, a 12.7% decline compared with the 2018 total of 1,214.

Spokane attorney Lisa McBride, of McBride Law, says despite recent annual decreases, she expects bankruptcy filings will increase this year.

“Last year, the filings were down by about 10%, and that was larger than the year before,” she contends. “But business picked up, and we saw filings pick up later in the year.”

She adds that more people are coming in with medical bills and credit card debt.

Overall, she adds, she saw a recent uptick in Chapter 13 filings.

McBride says she handled roughly 200 bankruptcy cases in 2019, a slight increase over the previous year.

The Eastern District ran counter to the national trend, with roughly 757,500 bankruptcy filings in the U.S. in 2019, a 0.3% increase over 2018 with roughly 755,300 filings. Nationwide bankruptcy filings had been declining steadily for at least a decade, according to data from the Alexandria, Virginia-based American Bankruptcy Institute.

The U.S. Bankruptcy Court District of Idaho’s Northern Division, which is based in Coeur d’Alene and covers Kootenai, Benewah, Bonner, Boundary, and Shoshone counties, reported a total of 669 bankruptcy cases through 2019, up 3% from the 651 reported in 2018.

The Northern Division had 572 Chapter 7 filings in 2019, up 2.1% from 560 in 2018, and 99 Chapter 13 filings, a 10% year-over-year rise.

Northern Idaho had an eight-year run of decreases in bankruptcy filings between 2009 and 2017, but the trend broke in 2018.

Cameron Phillips, attorney with Coeur d’Alene-based Cameron Phillips PA, says despite overall filings through his office being down for the year, the small firm still has as much bankruptcy work as it can handle.

Phillips says, “Like a lot of areas, Idaho seems to be behind the rest of the country, and I think a lot of people could be filing bankruptcy who aren’t.”

He attributes this to a continuing stigma around filing for bankruptcy and misconceptions as to what it means to file for bankruptcy.

“It’s a legitimate legal remedy that people have to get rid of debts,” he asserts. “People aren’t aware that it’s in the Constitution.”

Phillips, like McBride, saw a recent uptick in Chapter 13 filings this year.

Medical bills remain one of the biggest drivers leading to bankruptcy, he also contends, with roughly half of all clients coming in with medical bills that have been sent to collections.

“I don’t think a person needs to be choosing between homogenized milk and medication -- those aren’t the only choices -- and bankruptcy is a remedy that is in the Constitution,” says Phillips.

As far as future trend predictions, Phillips says it will depend largely on what happens with the economy.

“I think most people up here are not really affected by the economy in a direct way as active participants in the marketplace, buying and selling stocks,” he contends. “I think when it comes to the number of filings, we are always optimistic.”

Latest News Banking & Finance

Related Articles

Related Products