Catching up with Silver Valley's Sunshine Mine

Owner aims to restart production at the site within about five years

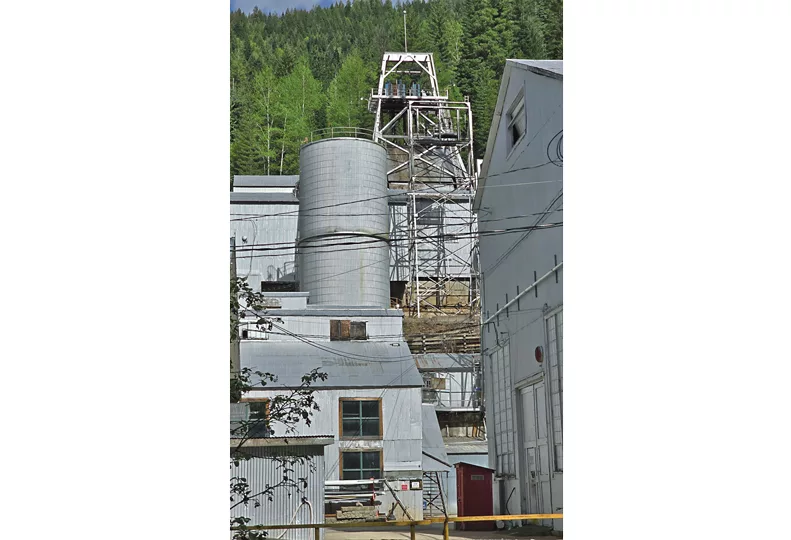

Much of facilities and equipment at the long-closed Sunshine Mine complex remains intact.

| Sunshine Silver Mining & Refining Co.The current owner of the Sunshine Mine complex, about five miles southeast of Kellogg, Idaho, is slowly working toward reopening the mine, 140 years after the first metals were extracted from the ground there.

Under the company’s current business plan, the mine may reopen around 2030 and eventually employ 250 miners.

The Journal last reported on Sunshine Mine in 2011, when Denver-based Silver Opportunity Partners LLC acquired Sunshine’s assets from Coeur d’Alene-based Sterling Mining Co.

The company has invested in excess of $100 million in the property, says Tom Henderson, Kellogg-based general manager of the mine.

Silver Opportunity Partners, which also does business as Sunshine Silver Mining & Refining Co., is a subsidiary of Electrum Group LLC, a New York-based investment advisory company.

The Sunshine Mine complex still holds one of the most massive silver deposits in the world, making the company the largest mineral rights holder in the Silver Valley, Henderson says.

“In the current mineral inventory, we have in excess of 200 million ounces of silver waiting to be mined, providing a 25-year-mine life,” Henderson says.

—Sunshine Silver Mining & Refining Co.

Sunshine Mine manager Tom Henderson says a plan to reopen the historic mine is under way.

Further exploration is underway at the mine, which he says reaches 5,600 feet underground and has about 100 miles of tunnels in multiple levels.

“With a little additional drilling, we’ll add to (the resource),” Henderson says.

The restart of production, however, is a number of years away.

“The principals want a good startup plan so its productive, profitable, and exceeds environmental standards,” he says.

The company will continue its current development and drilling program into 2027, when it's expected to complete a feasibility study and reach a construction decision, he says.

Once the construction decision is reached, “It probably takes three years to build a silver mine and put it back into production,” he says.

As part of the feasibility study, the company also is investigating the potential to resume production of antimony, which is a strategic metal used in communications equipment, weapons, and military technologies.

Antimony may become an essential element in the next generation of energy storage technology, Henderson says.

“Antimony is a hot topic in the U.S.,” Henderson says, as China, the largest global producer, has placed export restrictions on the metal.

Sunshine had refined antimony for 65 years and was once the largest producer of the metal in the U.S., especially during World War II, Henderson says.

In its latter decades, the mine also was one of the largest producers of copper in the Silver Valley, he says.

Historically, Sunshine Mine has generated 92% of its revenue through silver production.

Sunshine Silver Mining & Refining Co. currently has 20 employees, all of whom are based in Kellogg except for CEO Heather White, who is based in Ontario, Canada.

The current workforce includes a milling team, an environmental team, mechanics, engineers, a geologist, and administration.

When in full operation, the company likely will have up to 250 miners, Henderson says.

Operations began at the Sunshine site in 1884, when brothers True and Dennis Blake filed the Yankee Lode claim, according to the Sunshine Silver Mining & Refining Co. website.

While it was one of the most prolific silver mines in the world, it also was the site of one of the deadliest mining disasters in the U.S. when an underground fire broke out in 1972, and 91 trapped miners died from carbon monoxide poisoning.

After having produced over 360 million ounces of silver, the mine closed in 2001, when silver prices hovered at or below $5 an ounce.

It was purchased by Sterling Mining Co. in 2003, and limited operations resumed in 2007 but were suspended the following year.

Last year, Sunshine Silver Mining & Refining Co. issued a memorial coin commemorating the mine’s 140th anniversary. It was made from scraps and residues cleaned out of the company’s legacy refinery equipment at the complex.

Silver for the 1-ounce coin was recovered from the scrap materials by Liberty Refinery, in Hayden, and the coins were minted at Sunshine Mint Inc., in Coeur d’Alene.

"It was all done in Idaho," Henderson says.

As of Friday, Feb. 7, silver was priced at over $32 an ounce, according to New York-based metals futures and options market Commodity Exchange.

_c.webp?t=1763626051)

_web.webp?t=1764835652)