Lunch Money: Student-run credit union program expands

Gesa initiative promotes financial literacy education at high schools

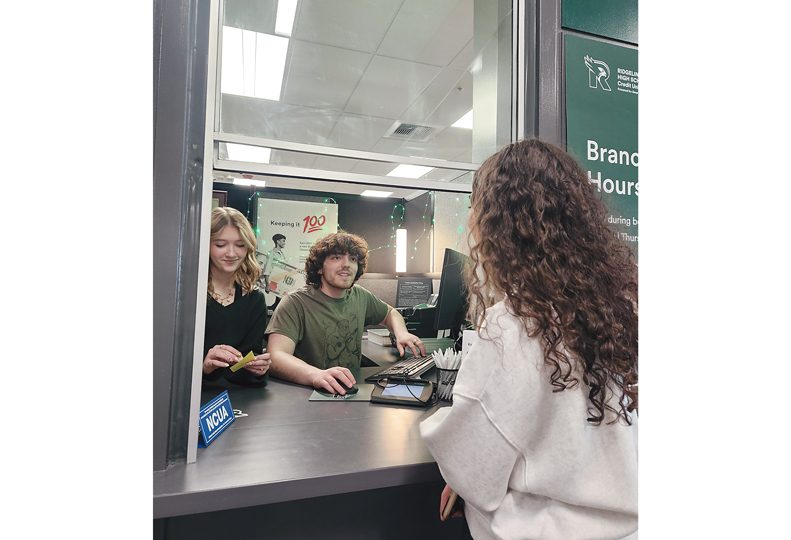

Scarlett Lambert and Rylan Rivera, both students at Ridgeline High School, are paid interns at Gesa Credit Union and manage the Ridgeline branch.

| Ridgeline High SchoolA student-run Gesa Credit Union branch opened earlier this month at Ridgeline High School, in Liberty Lake.

The new branch is the 16th of its kind—and second in the Spokane area—to open through Gesa’s High School Credit Union Program, which launched in 2000.

“We wanted to provide real-world work experience for the students who are working in the campus branches,” says Brandon Allison, assistant vice president of education and community outreach at the Richland, Washington-based credit union.

The campus branches are essentially scaled-back versions of traditional Gesa branches, Allison explains.

“They really only perform basic functionality,” he says. “But that’s all the students really need.”

Ridgeline students can open checking accounts at the campus branch, make deposits and withdrawals, and cash checks.

The branch is open during lunch hours and can be used by all Ridgeline students.

The checking accounts, which have no monthly fees or minimum-balance requirements, come with Ridgeline-branded Visa debit cards, which can be used anywhere Visa is accepted, just like a traditional debit card.

The Ridgeline High School Credit Union, as it’s called, currently is run by a pair of paid interns and a team of 11 volunteer tellers, all of whom are Ridgeline students. Kelli Demarest, a teacher at Ridgeline, oversees the program.

“We afford the opportunity for at least one student per school to have a paid internship,” Allison says. “They are Gesa employees who act as campus branch managers.”

The two interns also work as tellers at traditional Gesa branches on some Saturdays and after school.

“We onboard these interns during summer, and we train them all summer long so they have the skill set to be able to support their credit union when the school year starts again,” Allison explains.

The Ridgeline branch isn’t the first to open at a Central Valley School District school. A branch opened at Spokane Valley Tech & STEM Academy in 2019, but the district is still in the process of revamping that branch, according to John Parker, Central Valley School District superintendent.

The Spokane Valley Tech branch is currently operational, but doesn't have a built-out storefront and teller environment like the Ridgeline branch.

Parker says the district plans to open branches at its other three high schools—Central Valley, University, and Mica Peak.

“Any way that we can give a real-life experience to students, whether it’s through opportunities in career and technical education or anything else, we’re going to jump at that opportunity,” Parker says.

The program is another way to increase financial education for students, a desire that parents and community members expressed in a district survey a few years ago, he says.

“It impacts, on a real functional level, all of our kids and the decisions they make,” says Parker.

Students who work at the campus branch are required to be involved in the school’s Future Business Leaders of America program.

While the program doesn’t require students to have co-signers when opening an account, there are protections in place.

“The student checking accounts are age appropriate,” Allison says.

For example, the accounts don’t allow students to overdraft.

“We do not want students to incur any type of overdraft charges or associated fees with these accounts from simple mistakes,” Allison explains. “We prefer to treat them as learning opportunities.”

Additionally, the student accounts don't include check-writing capabilities.

Students who open accounts will have access to online banking, mobile banking, and an attached savings account.

“It provides a special interest rate designed just for students, up to a certain dollar amount,” Allison says. “We want to actually reward them for savings as well, and we do that through the higher-interest accounts we have for them.”

The program offers additional benefits.

Ridgeline students who join Gesa as new members can also receive a $100 deposit into their savings account by performing five in-person transactions of any amount at the school branch on five separate visits and enrolling in online or mobile banking.

Students who work at the branch—both the interns and the volunteers—are able to list the experience on their resumes, Allison adds.

“They can say that they are a teller at the Ridgeline High School Credit Union,” Allison says. “Our intent really is to be able to provide them with professional development experience that gives them the leg up over their peers.”

Since the program’s inception, over 20 participants went on to work for Gesa after they graduated.

“Some of them still work for the credit union today,” Allison says.

The High School Credit Program is funded by Gesa.

“We budget for this particular program annually through our financial education department, and we pay for all the supplies, all the campaign, all the marketing dollars,” Allison says.

In addition to the high school branches, Gesa has about 30 traditional branches, including two in Spokane, two in Spokane Valley, and one in Post Falls, according to the credit union's website. An additional branch is expected to open on Spokane's South Hill this year, the Journal previously reported.

![Brad head shot[1] web](https://www.spokanejournal.com/ext/resources/2025/03/10/thumb/Brad-Head-Shot[1]_web.jpg?1741642753)