Home » Northwest Farm Credit, California co-op complete merger

Northwest Farm Credit, California co-op complete merger

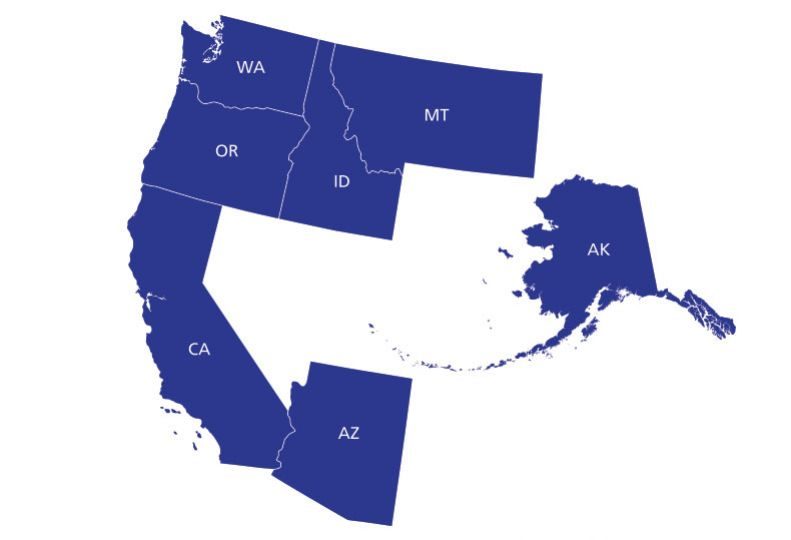

AgWest to be based here, serve seven-state region

January 19, 2023

Spokane-based Northwest Farm Credit Services and Rocklin, California-based Farm Credit West have completed their mergers and created a new financial cooperative association, AgWest Farm Credit.

The merger, finalized Jan. 1, completes a year-long rigorous approval process, says Linda Hendricksen, chief engagement officer for AgWest.

AgWest will serve 22,000 customers through 59 locations in seven Western states: Washington, Idaho, Montana, Oregon, California, Arizona, and Alaska, she says. No changes to the branch locations are anticipated with the merger.

AgWest will be headquartered in the Northwest Farm Credit Services building at 2001 Flint Road and will be led by former Farm Credit West President and CEO Mark Littlefield, with a management team from both legacy organizations, Hendricksen says. Littlefield has residences in both Spokane and Rocklin and will be traveling extensively throughout the West, says Hendricksen.

The boards of the two entities have been combined to form AgWest’s board.

Littlefield says in a press release, “Merging allows us to bring the best of both associations together.”

Hendricksen says AgWest employs 1,058 workers, 315 of whom are based in the Spokane headquarters.

As of January 1, 2023, the combined organization had $30 billion in assets, says Hendricksen. The financial cooperative provides financing and related services to farmers, ranchers, agribusinesses, commercial fishermen, timber producers, rural homeowners, and crop insurance customers.

Prior to the merger, Northwest Farm Credit Services had 44 branches in five states and $14.6 billion in assets, according to a Journal report last March.

Latest News Banking & Finance

Related Articles

Related Products