Home » COVID's legacy includes elevated labor costs, reshaped market

Economic Forecast

COVID's legacy includes elevated labor costs, reshaped market

Labor shortages unlikely to ease to pre-pandemic levels, and more likely will worsen

November 7, 2024

The lingering effects of the Covid-19 pandemic are still shaping the global economy, particularly in the labor market. Despite the worst of the health crisis having passed, one of its enduring legacies is the sharp rise in labor costs.

Businesses across various sectors are grappling with elevated wage demands, a tight labor supply, and the increasing cost of retaining talent. These pressures, some of which began during the pandemic due to widespread disruptions and shifts in work patterns, have continued to affect bottom lines, reshaping the future of workforce management and business operations. As companies navigate this new reality, understanding the long-term impact of the pandemic on labor costs is crucial.

The pandemic fundamentally altered the dynamics of the labor market, forcing businesses to adapt to a changing workforce and an unpredictable economy quickly. From supply chain disruptions to the rise of remote work and heightened safety requirements, Covid-19 reshaped the employment landscape in ways still unfolding today. As economies recover, the cost of labor remains stubbornly high, driven by ongoing shortages, evolving employee expectations, and inflationary pressures. For many industries, the challenge is no longer just about getting back to pre-pandemic levels of productivity—it's about managing the lasting financial implications of a transformed labor market.

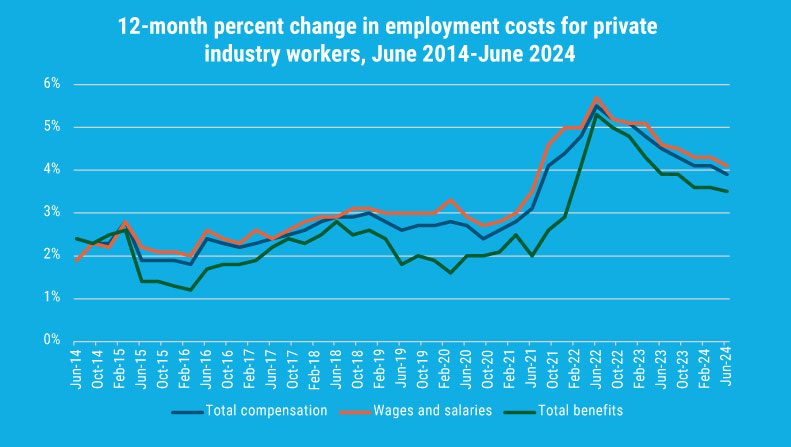

According to data from the U.S. Bureau of Labor Statistics (BLS), compensation costs for private industry workers, including professional and business services, leisure and hospitality, education and health services, manufacturing, trade, transportation, and utilities among others, continue to increase and remain elevated well above pre-pandemic levels. The graph with this article illustrates that compensation costs for private industry workers in the U.S. increased 3.9% percent from June 2023 to June 2024.

To put this in perspective, the annual inflation rate in the U.S., as measured by the Consumer Price Index (CPI), stood at 2.4% according to the BLS in September 2024. This highlights a clear disparity, as the growth rate of labor costs significantly exceeds the inflation rate. Several key factors contribute to this trend, underscoring the urgent need for businesses and policymakers to address labor shortages and mitigate their broader economic impacts.

A recent study by the McKinsey Global Institute found that labor markets in advanced economies such as the United States have been among the tightest in the past two decades. While the pandemic intensified this labor shortage, it stems from a long-term trend likely to persist as the workforce ages. The shortage is particularly pronounced in sectors hardest hit by the pandemic, especially those requiring physical and manual skills, such as food preparation, retail, hospitality, building maintenance, installation, cleaning, repair, and healthcare support. Job vacancies in these sectors surged during the pandemic and remain the highest in the post-pandemic period.

The costs stemming from a tight labor market, along with expenses related to recruiting and retaining workers and inflation-driven pressures, have significantly impacted businesses like restaurants. In 2024, the nation has seen a large wave of restaurant closures. A June 2024 article in Forbes reported that major chains, including Applebee's, TGI Fridays, and Denny's, have been forced to shut down many locations due to underperformance tied to strategic misalignments and financial strains from inflation.

Given that labor costs have largely been driven by labor shortages, it’s important to recognize that these shortages are unlikely to return to pre-pandemic levels and are expected to worsen in the future. This is primarily due to slow population growth, an aging workforce, and declining labor force participation among women and workers aged 65 and older.

Employers and policymakers must urgently address the challenges posed by labor shortages. When companies are unable to secure the workers they need, they struggle to produce goods and services, directly affecting their revenue models. Reduced revenue combined with rising costs undermines business viability, potentially leading to closures or bankruptcies.

Lower production also contributes to unemployment and drives up prices due to supply shortages. If a substantial number of businesses fail, the overall economy may suffer, with lower GDP reflecting the broader impact. A report by the McKinsey Global Institute emphasizes that labor market tightness leads to lost economic output, estimating that GDP in advanced economies could have been 0.5% to 1.5% higher in 2023 if employers had been able to fill labor gaps.

To foster ongoing economic growth and business success, companies and policymakers should explore innovative strategies to nurture and develop the existing labor force. This includes providing greater internal mobility, promoting work-life balance, and implementing policies that attract more women and older workers into the workforce.

By integrating approaches that prioritize employee well-being, development, and engagement with the incorporation of AI into production processes, employers can create a more appealing work environment. This combined strategy not only improves employee retention but also equips organizations to succeed in an increasingly automated and competitive marketplace.

Dr. Vange Hochheimer is a professor of economics and finance at Whitworth University and CEO of Grand Fir Analytics.

Related Articles