Home » Foreclosures rise in INW, following national trend

Foreclosures rise in INW, following national trend

Increase in defaults said not alarming yet

May 11, 2023

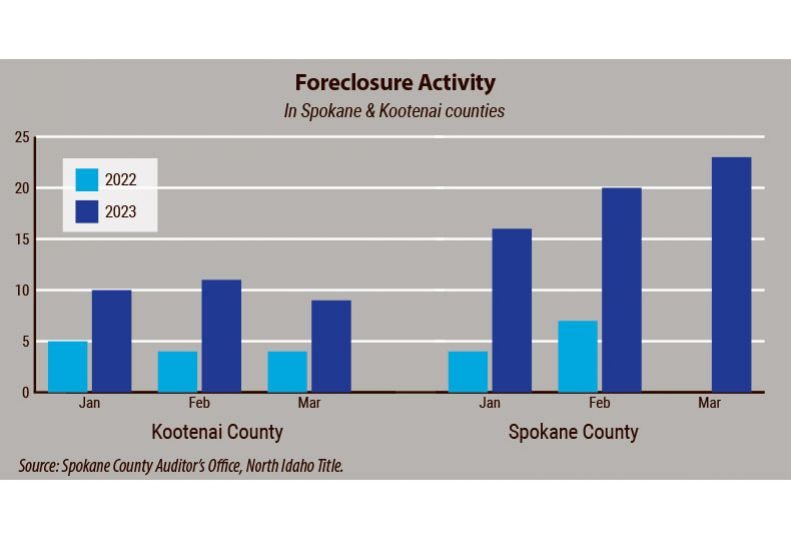

Recent foreclosure activity in Spokane and Kootenai counties shows a significant increase during the first three months of 2023 compared to the year-earlier period, following a year-over-year increase in 2022.

Foreclosures on deeds of trust in Spokane County in the first three months of 2023 have increased 436%, to 59, compared with the year earlier period, according to data from the Spokane County Assessor’s Office.

The percentage seems extreme, but the pace of foreclosures during the first quarter is similar to the pace reported in the first three months of 2019—before the onset of the pandemic and the related federal foreclosure moratorium impacted foreclosure activity, the Assessor’s data show.

In 2019, there were 54 foreclosures reported from January to March and 199 reported for the entire year.

The Assessor’s data shows that foreclosure activity is nearing pre-pandemic levels two years after the federal foreclosure moratorium that began March 28, 2020, and ended on July 31, 2021.

Year-end foreclosure totals in Spokane County for all of 2022 rose to 92, a 228% increase, compared with 28 foreclosures reported in 2021, but a decrease of 54% compared with 2019.

Despite the jump, the dramatic rise isn’t concerning yet, due to a strong labor market, says Avista Corp. chief economist Grant Forsyth. The labor market here has slowed recently, but increased job openings and low unemployment indicate that labor remains strong, he says.

Forsyth says the rise to pre-pandemic levels of foreclosures would be concerning if unemployment also increased.

“In the national economy, the data is pointing to slower growth, but the labor market remains strong both nationally and regionally,” he says.

Across the border in North Idaho, there were 30 reported foreclosure notices of default and trustees deeds filed in Kootenai County from January through March this year, according to data from North Idaho Title. That’s a 131% increase from the year-earlier period, when 13 notices of default and trustees deeds were recorded.

Default notices in Kootenai County increased to 88 in 2022, a year-over-year increase of 252% from 2021.

Year-end foreclosure totals, however, are 57.9% lower in Kootenai County, than in 2019, according to the data reported in the Spokane-Kootenai Real Estate Research Committee’s Fall 2022 Real Estate Report.

Kootenai County information includes initial notices, not all of which result in actual foreclosures, so Kootenai County activity isn’t directly comparable to Spokane County, according to the Real Estate Report.

J.T. Jacobsen, president and general manager of Kootenai County Title Co., says he’s noticed that default notices have increased slightly in the county, but most people cure the loan, often by selling or refinancing the property to avoid foreclosure.

Market data in the Real Estate Report generally shows a declining trend of the number of foreclosures in Spokane County since 2013, excluding a slight increase in 2016. Foreclosures reported in 2021 reached a low of 28, a level not reported since 1979.

In Kootenai County, notices of default generally have declined since 2010, with a new low of 25 reported in 2021.

Forsyth says homeowners with adjustable-rate mortgages may experience higher foreclosure activity going forward.

“The one thing that could cause foreclosures to increase, is that it depends a little on the type of mortgage you’ve got,” says Forsyth. “In order to get into relatively inexpensive housing, (people) accepted adjustable-rate mortgages … where things have maybe gotten a little more painful on top of the inflation that’s already built into a lot of the prices we pay for food, energy, and other commodities people have to buy.”

Forsyth explains that some homebuyers could struggle to make adjustable-rate mortgage payments, because the Federal Reserve’s interest rates that indirectly impact mortgage rates have been rising since March 2022.

Spokane and Kootenai county activity is comparable to U.S. foreclosure activity according to a report by Attom Data Solutions, an Irvine, California-based real estate data company.

Attom’s Year-End 2022 U.S. Foreclosure Market Report shows a 115% increase in U.S. foreclosure filings in 2022, from 2021, although filings were down 34% from 2019.

Rick Sharga, executive vice president of market intelligence at Attom, says in the report, “Foreclosure activity remains significantly lower than it was prior to the COVID-19 pandemic. It seems clear that government and mortgage industry efforts during the pandemic, coupled with a strong economy, have helped prevent millions of unnecessary foreclosures.”

Spokane County investment officer Arthur Whitten says 13 properties went to auction for delinquent taxes in 2021, six of which were residential properties.

Whitten says, “In 2022, we took 12 parcels to auction, of which three were residential in some form, and those final numbers are pretty typical.”

He says future foreclosure activity this year is unclear until the first half of property tax collections have been sorted through.

“We don’t know who necessarily will still be eligible for foreclosure at this point because we’re still processing payments from that first half collection,” Whitten says.

That information likely will be available at the end of June, he says.

Whitten says property tax collection has stayed steady at a 98% to 99% collection rate paid on time.

“Coming out of a lot of those pandemic-related restrictions, we’re still seeing priority tax collection rates are very strong. In a stable, strong economy, you can count on a 99%-plus property tax collection rate.”

Latest News Real Estate & Construction Banking & Finance North Idaho

Related Articles

Related Products