Long-term care insurance market stabilizes as WA Cares gears up

Private insurers faced volatility last year as state rolled out new program

Payroll deductions for the Long-Term Services and Supports Trust Act, also known as the WA Cares Fund, began July 1, but the private long-term care insurance market has been largely unaffected, some in the industry here say.

The WA Cares Fund limited benefit isn’t large enough to offset the long-term care planning needs for most clients, they say.

“I don’t think there’s any impact,” says David Wolf, president and owner of Spokane-based long-term care insurance agency Wolf & Associates Inc. “There’s this idea that somehow the WA Cares program is going to fundamentally change the private insurance world, and I don’t think that’s the case at all.”

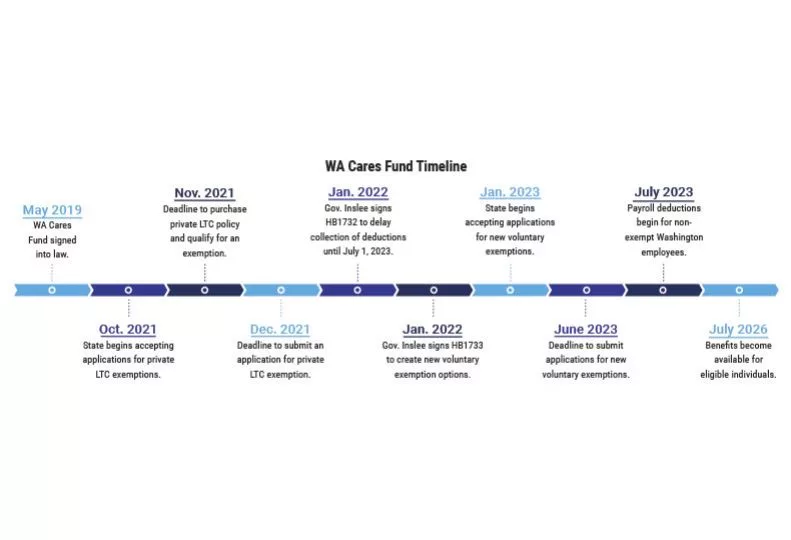

Signed into law by Gov. Jay Inslee in 2019, the mandatory, public, and state-run program requires Washington employers to withhold a 0.58% payroll tax from nonexempt employees and forward the contributions to the Washington state Employment Security Department.

Beginning July 1, 2026, participants of the program with long-term care needs can start using the benefits, with a maximum lifetime benefit of $36,500, which will be adjusted annually for inflation.

As the Journal previously reported in July 2021, private long-term care insurance companies were overwhelmed by people looking to buy policies for tax avoidance purposes after the state announced that workers who purchased private long-term care before Nov. 1, 2021, could opt out of the WA Cares program. Some carriers stopped accepting applications during that time due to increased underwriting workloads and concerns over profitability, but they didn’t exit the Washington market completely, Wolf says.

“I think there’s a large misunderstanding that somehow carriers pulled out of Washington. They did not,” he says.

Since then, however, the impact has been minimal on private long-term care insurance companies, aside from a greater abundance of questions about the law and about long-term care, Wolf says.

“It’s had almost no impact on my business whatsoever, other than questions that need to be answered for people who are paying the tax,” Wolf says.

Joel Ferris, owner of Spokane-based Ferris Long Term Care Insurance, says he has seen a slight increase in policies sold, but he attributes that to the attention garnered by the new law.

“I think the awareness because of the marketing campaign that’s been put into the state plan has gotten more information out about long-term care planning,” he says. “I’m getting more people looking for … larger policies because they are aware.”

Overall, though, Ferris says he hasn’t noticed a major change in the private market.

“It’s not significantly impacting what I do,” Ferris says.

Melissa Owens, an insurance agent at Mutual of Omaha’s Spokane Valley office, says she’s also received more calls about long-term care insurance and has seen a small uptick in people purchasing policies.

“More people are asking questions, and some of the ages of the people calling about it are a little younger than we would typically see,” she says.

Owens says her office typically fields calls from near-retirement age groups—people in their 50s or 60s—but lately there have been more people in their 30s and 40s calling about long-term care insurance.

“People are becoming more aware of long-term care,” she says.

Despite there being many more Washington residents who will have access to long-term care funds starting in July 2026, both Wolf and Ferris agree that private policies are needed on top of the state benefits for most people.

“This program, well-meaning as it is, isn’t going to fully fund much long-term care at all,” Ferris says.

According to the AARP long-term care cost calculator, the average cost per month to stay at an assisted-living facility in Spokane is about $4,000, while the average cost per month for care at a private nursing home in Spokane is over $10,000.

Based on these averages, the $36,500 lifetime benefit provided by WA Cares would cover seven months in an assisted-living facility, or three months in a private nursing home.

“The WA Cares program is a bit of a Band-Aid,” Wolf says. “It doesn’t take care of the planning needs of most of our clients.”

For in-home care services, the AARP calculator shows the average cost for a home-health aide in Spokane is about $35 per hour.

Wolf notes that if looked at through an individual lens, the WA Cares Fund is beneficial to some people, depending on income level and insurability.

“For those who had modest incomes or couldn’t get private long-term care insurance, it was a win for them,” he says.

According to the WA Care Fund website, 70% of Washingtonians will need long-term care at some point in their lives. Most of it isn’t covered by Medicare, and Medicaid only covers it after a person’s assets have been spent down to $2,000 or less.

The WA Cares fund is intended to “provide breathing room during life’s most challenging care stages,” the WA Cares website says.

Wolf and Ferris both say they believe the program is an attempt by the state to offload some of what it would have to pay to Medicaid.

“I think the whole idea with the state plan was to reduce the burden on the Medicaid program,” Ferris says. “The state has to pay part of that money when people go on Medicaid.”

Despite the relatively small impact the WA Cares benefit will have on many individuals’ long-term care planning, Wolf says the attention that has been drawn to long-term care is a good thing.

“I think the increased attention on long-term care planning at a national level as additional states roll this out has a positive impact,” Wolf says.

Ferris contends more people should consider getting private long-term care policies, regardless of whether they’re paying into the state program.

“We need to get more people on board, just for their own sake, so that they don’t devastate their retirement funds, whatever they may be,” he says.

Related Articles

Related Products

_c.webp?t=1763626051)

_web.webp?t=1764835652)