Hecla Mining reaps benefits of surging silver market

In big boom, company fights for regulatory nod on two Montana properties

Hecla Mining Co., the largest silver producer in the U.S., finds itself in a strong position and an ironic one at the same time.

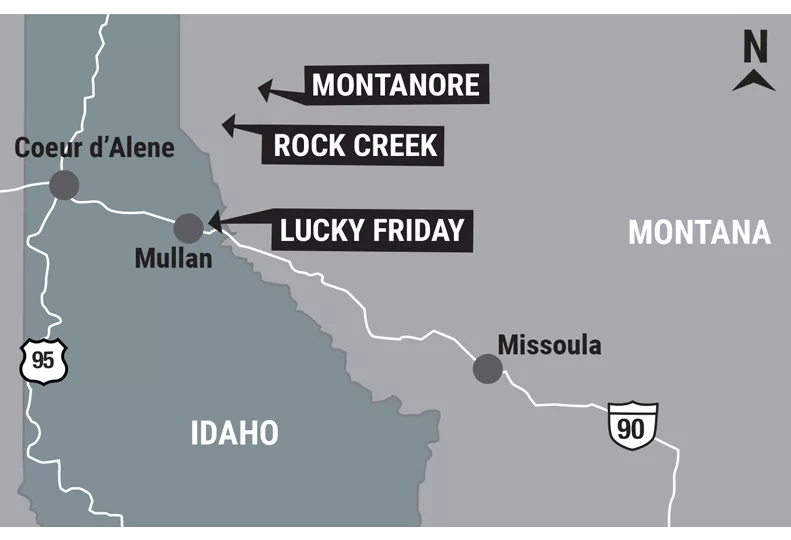

On one hand, the 130-year-old Coeur d’Alene-based company is benefitting from a strong precious-metals market that some say is without precedence, buoyed by demand for silver to be used in environmentally friendly products, such as electric vehicles.

But on the other, the company’s ability to increase production of those metals to its fullest potential remains stymied for the moment by legal roadblocks brought on by groups worried the company will disrupt the environment surrounding a pair of Hecla-owned Montana properties.

Hecla Mining Co. president and CEO Phillips S. Baker Jr. says the company remains focused on bringing its northwestern Montana properties online despite a judge’s decision last month to block Hecla’s initial exploration of one of the mines located in the Cabinet Mountains.

Baker says Hecla still has intentions to mine what are believed to be rich deposits of silver and copper in the Treasure State.

Though previously granted approvals on permits from the U.S. Forest Service and U.S. Fish and Wildlife, U.S. District Judge Donald Molloy last month ruled in favor of a coalition of tribal groups calling itself Ksanka Kupaqa Xa’lcin and six environmental organizations that asserted the federal government didn’t consider the full environmental impact of Hecla’s desire to develop the Rock Creek Mine.

The legal efforts by Hecla and their opponents are taking place against the backdrop of an explosion in global demand for silver due in large part to a shifting toward green technologies. From electric cars to solar panel production, silver is durable and has high electrical conductivity that’s needed in most major appliances.

“Electric vehicles today I think consume about 50 million ounces of silver,” Baker says. “Can you imagine, when electric vehicles get fully ramped up over the course of the next decade or two, what that demand is?”

At the Journal’s press time, the price of silver stood at $27.52 an ounce, a 74% rise from a year ago when it was valued at just under $16 an ounce. In comparison, the price of gold has risen 6.4% over the last year.

Says Mark Compton, executive director of the Spokane-based American Exploration & Mining Association, “Across the mining sector, demand for silver is higher than it’s ever been. The global economy is reopening from the pandemic, and mineral demand is high.”

Hecla has its sights set on mining beneath a federal wilderness area in order to reach substantial amounts of copper and particularly silver. The company estimates there could be more than 300 million ounces of silver to mine at Rock Creek and Montanore, its other holding in the Cabinet Range.

For now, Hecla is waiting to see whether the U.S. Forest Service and U.S. Fish and Wildlife will appeal the federal court’s decision, as those agencies are the defendants in the challenge launched by the tribal and environmental groups. The judge expressed concern in his findings about future mining impacts on bull trout, grizzly bears, and other environmental resources.

“We’re disappointed in the decision of the judge,” Baker says.

Earlier this year, the Montana Supreme Court approved Hecla’s state water permit for the Rock Creek Mine after invalidating a similar permit for its Montanore project. Silver industry experts regard Montanore to be one of the largest undeveloped silver and copper deposits in North America.

Baker says he fully expects the company to one day have operational mines at both sites.

“If you think about the size of these projects, the timing isn’t as important as getting it done and getting it done right,” he says.

He thinks Hecla still is on a timetable to have Montanore and Rock Creek up and running by the end of the decade or the beginning of the next decade.

“I’m quite confident with the energy transformation, green revolution, whatever you want to call it, that there is a need for these projects in the United States,” Baker says.

He adds, “We’ve learned from the pandemic that we’re better off having more in the U.S. Here are two great assets that sort of check those boxes.”

In the 2021 Mineral Commodity Summary compiled by the U.S. Geological Survey, the USGS notes the country is 80% import reliant on silver, with most silver coming from Canada, Mexico, Peru, and Holland.

But Bozeman, Montana-based attorney Katherine O’Brien, of the national nonprofit law firm Earthjustice, says the shift in national energy policy and market forces due to it aren’t legally relevant.

“When it comes down to it, the benefit of doubt goes to the species that will be harmed by Hecla’s efforts,” O’Brien says. “That’s just the law.”

She says the collaborative legal effort from her clients against Hecla stems from their argument that the company remains unable to craft a plan to show its mining efforts won’t be disruptive.

“It’s difficult to see what the path forward is,” she says.

Hecla acquired the former Spokane Valley-based Revett Minerals Inc., which owned Rock Creek, in 2015. A year later, Hecla bought the former Spokane-based Mines Management Inc., which owned Montanore.

O’Brien notes that for 30 years, the previous owners of the two properties failed to convince courts that mining could be done absent environmental disruption.

Nonprofit Earthjustice, is headquartered in San Francisco and has 14 regional offices across the U.S. Established in 1971, Earthjustice employs 160 attorneys currently handling more than 600 environmental cases across the U.S., according to the organization’s website.

Hecla also has silver mines in Idaho, Alaska, and Mexico, as well as gold mines in Nevada and Quebec. In its 2020 environmental report, the company notes that it achieved a 36% reduction in greenhouse gas emissions at all mines from the prior year and drew 76% of its line power from hydropower, among other highlights.

“The impact we have environmentally is remarkably small,” Baker says. “Because our mines are underground, our surface disturbance is very small.”

Lucky Friday

Baker says the company’s Lucky Friday mine in Idaho’s Silver Valley, its largest mine producer, generated 2.5 million ounces of silver in 2020 and expects to top 3.4 million ounces this year. Baker says the company expects the mine to produce 5 million ounces in 2022.

“As we go deeper, the grade of Lucky Friday increases,” Baker says. “That increased grade allows the mine to increase its production of the metal.”

The company issued its first-quarter 2021 earnings report on May 6, in which Baker presented rosy expectations for the short- and long-term future.

“Typically, our first quarter is one of our smallest cash-flow quarters,” he says referencing the strength of the company’s $16.5 million first-quarter cash flow.

Baker says a review of the last three decades of earnings reports revealed the first quarter has netted the lowest amounts of quarterly cash flow for the company in 20 of the past 30 years.

“As good as the first quarter (2021) was, we think the rest of the year will be stronger,” he says.

Hecla posted quarterly sales of $210.9 million, up 54% over the previous year’s quarter, he says.

“We had the second-highest revenues in our 130-year history, and all of this was driven primarily by the strong production results and cost performance at all of our operations,” he says.

Hecla reported net income of $18.8 million in the first quarter, which is up from company’s net loss of $17.2 million in the same quarter last year.

Most of Baker’s sentiments, however, centered on the strength of the current silver market. He expects the company’s U.S. operations will increase silver production to 15 million ounces in two years, a level more than double the amount produced in 2018.

“This time is really like no other for silver,” Baker told investors. “Industrial demand for silver has been growing at about a 2% growth rate for the last decade, and it’s only continuing to grow.”

He says silver presents market characteristics that copper and gold lack. Like copper, silver is needed in the use of day-to-day products, but it has a higher investment value than copper. Only 10% of gold that’s mined is for industrial use, he says.

Baker told investors he doesn’t think it’s fanciful to think silver prices could reach and exceed $50 per ounce over the next decade.

Silver recorded its record high of $49.45 per ounce on Jan. 18, 1980.

Hecla, the largest producer of silver in the U.S., produces a third of all silver in the country, Baker says.

In response to an inquiry on the investors call, Baker noted the following about the Montana properties and the goal to mine them.

“We’re trying to go as rapidly as possible to get underground so that we can do the drilling to prove that we will not have a negative environmental impact,” he says.

Related Articles

Related Products

_c.webp?t=1763626051)

_web.webp?t=1764835652)