Home » Health plan hikes show little letup

Health plan hikes show little letup

Best many employers here can hope for is rate increase in single digits

December 4, 2008

Spokane-area employers can't expect that the nation's economic strife will translate into slower-rising health-plan costs next year. To the contrary, one of the big questions is to what extent the recession will cause those costs to soar even more.

Although the rate at which premiums rise will soften or hold steady in some cases, a large number of employers here still will see percentage increases in the double digits, say industry consultants here and representatives for several of the Inland Northwest's largest health plans.

"We're seeing kind of a tough cycle right now," says Mark Newbold, an employee benefits adviser with Moloney+O'Neill Benefits, which brokers plans for hundreds of employer-employee groups here.

"What we've been telling our clients is to expect increases of 15 to 20 percent," Newbold says. He adds, though, that he's seeing some very low increases, from Group Health Cooperative in particular, but also cites one insured group that was informed its rates would rise 60 percent.

"The thing that's troubling is this is the worst possible time for groups to sustain those increases because the economy isn't what it was a year ago or two years ago," Newbold says.

Rather than dropping their health plans altogether, though, financially strapped employers appear instead to be restructuring their health plans to include higher deductibles, with the intent of giving all or part of any premium savings back to employees for use in tax-free health reimbursement arrangements, he says.

"We're going to see a lot of major plan-design changes" that shift more of the cost burden onto employees, he says.

The median individual deductible required by employers offering preferred-provider organization (PPO) health plans jumped to $1,000 this year, double the $500 of last year, according to the recently released Mercer's National Survey of Employer-Sponsored Health Plans.

In 2000, only about half of employers imposed a health-insurance deductible for PPO coverage, compared with about four-fifths of employers now, Mercer said. PPOs are by far the most popular type of health plan.

What makes that finding more startling, Mercer says, is that it refers to traditional PPOs—not the high-deductible plans in which a deductible of at least $1,100 is required for the insured party to deposit tax-free money in a health savings account, or HSA. Those plans, though, are spreading rapidly as well.

"The introduction of the HSA may have changed employers' thinking on just how high a deductible can go without causing employees to revolt," says Mercer executive Blaine Bos. "Raising the deductible has become the fallback for employers faced with cost increases they can't handle. It's the easiest way to reduce cost without taking more out of every employee's paycheck."

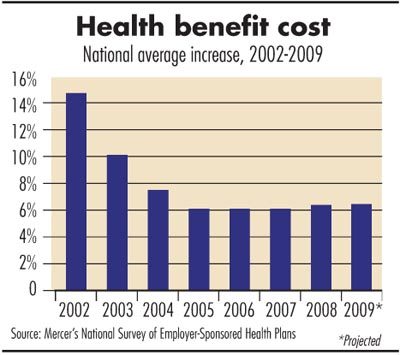

The Mercer study, which included data from about 2,900 private and public employers with 10 or more employees, found that the average cost of health-care coverage per worker rose 6.3 percent this year, and those surveyed expect it to rise at a similar rate—6.4 percent—next year.

That projection reflects changes employers plan to make in the level of benefits they offer, changes in the type of plan they offer, and changes in their plan vendor.

Employers predicted that if they made no changes, the cost would rise by about 8 percent. Based on the employers surveyed, though, the projected rate of increase in the Mercer study typically is lower than what Spokane-area employee benefit advisers say is anticipated here.

Mercer says one of the questions is whether its survey participants' cost projections, gathered in late summer, will hold up in the face of the economic downturn, which has worsened considerably over the last two months. Utilization, meaning the degree to which employees use health-care services, tends to increase during a recession. When job security is in jeopardy and insurance is tied to employment, consumers rush to get care they otherwise might delay.

The mental stress caused by job uncertainty "has a tremendous impact" on health-care utilization and costs, says David Smith, an underwriting consultant at Moloney+O'Neill. He adds, "Hopefully it's temporary."

He expects most small businesses here to see health-plan rate hikes of 8 percent to 15 percent, and large employers to see more wide-ranging increases—both below and well above that range—based on their individual claims experience, Smith says.

Health-plan providers' estimates

Premera Blue Cross, which has about 240,000 members in Eastern Washington, says it expects its health-plan rates to rise mostly in the mid- to upper-teen percentages next year for employers with fewer than 200 workers, which is on par with last year's increase.

Premera says it has been implementing lean principles into its administrative functions to try to hold down costs. It also has engaged in publicized contract tiffs with some health-care providers, including the big Providence Health & Services hospital network, which operates Sacred Heart Medical Center and Holy Family Hospital, as part of that effort.

Group Health Cooperative, which has about 126,000 members in Eastern Washington, offered the most encouraging outlook, saying its health-plan rate hikes should be mostly smaller next year. Small employers typically will see single-digit increases, while mid-large groups, meaning those with 50 to 100 employers, probably will be in the single digits to low double digits, says Deborah Huntington, Group Health's Seattle-based vice president of sales.

"We have a lot of initiatives going on" aimed at giving employers and members more choices, and that has had a stabilizing effect on rates, Huntington says. Also, she says, "We have reduced administrative expenses. The bottom line is we're trying to moderate."

Asuris Northwest Health, which has about 56,000 members in Eastern Washington, says it expects its health-plan rate increases next year to be mostly in the low to mid teens for small and mid-sized to large groups, which is slightly higher than this year.

"The company's premiums are a direct reflection of health-care costs," says Mike Tatko, a company spokesman.

To help mitigate rising premiums, Asuris has launched a suite of products, named Embark, Vantage, and Motivate, that include wellness components such as health coaches, health-risk assessments, and rewards programs to promote desirable lifestyle choices, Tatko says.

"People are visiting their doctors more and more these days, and that usage adds up to higher costs for all involved," he says, noting that new technologies, duplication of tests and services, the aging population, and prescription drugs also remain key cost drivers.

Though some people are visiting doctors more frequently than in the past, Newbold says he's alarmed by data showing that about half of the workers in insured groups that Moloney+O'Neill represents don't even take advantage of the once-a-year preventive exams they're offered at little charge.

"There's a disconnect there," he says, with many people failing to recognize or acknowledge for some reason that good preventive care can help them avoid trips to hospital emergency rooms and serious health problems that run up big medical bills. "That's very concerning to me."

The Mercer study found that consumer-directed health plans (plans coupled with either an HSA or a health reimbursement arrangement) now are offered by 20 percent of large employers, up sharply from 14 percent last year. Just 9 percent of employers with fewer than 500 workers currently offer such plans, but that number is expected to jump to 14 percent next year, the data showed.

With both HSAs and HRAs, employees use spending accounts to buy routine health-care services. Nonroutine expenses are covered by traditional insurance after members meet a high deductible. With an HSA, employees may contribute pre-tax dollars into the account. An employer contribution is optional, but employees have full control over the money in the account. With an HRA, only employers can fund the account, and they decide whether money left in such accounts at the end of the year can roll over.

Latest News

Related Articles