Real estate agent ranksdwindle here

Trend in people leaving realty business follows big slump in home sales

Following a steep decline in home sales here, the ranks of real estate agents also are thinning out.

Rob Higgins, executive officer of the Spokane Association of Realtors, estimates that membership in the association has fallen to 1,950 today, a 13 percent drop from about 2,250 at the end of 2007, which was the peak year for membership.

Higgins says he expects that number to continue to drop at least through April, when annual membership fees come due.

"The first quarter will have telling numbers," he says. "That's when we usually have the most quits for the year."

The association has budgeted for around 1,885 members for 2009, he says, although he adds that number might be optimistic.

The decline in the association's membership is in line with a statewide drop in the number of licensed real estate agents, says Christine Anthony, spokeswoman for the Washington state Department of Licensing.

The 28,586 active agents in the state as of Dec. 31 amounts to a 12 percent drop from the 32,516 agents a year earlier, Anthony says.

Ken Lewis, the broker at Prudential Spokane Real Estate, which has offices in Spokane and Spokane Valley and a total of about 70 agents, says he's lost one or two agents due to the languishing real estate market.

Some agents find it too expensive to keep their licenses and memberships when sales are slow, he says.

Agents must renew their licenses every two years at a cost of $146, and that doesn't count the cost of continuing education courses to qualify for license renewal. On top of that, members of the Spokane Association of Realtors pay annual dues of $430, which also covers membership fees in Washington Realtors, which is the state association, and the National Association of Realtors.

Most members here pay another $40 a month to subscribe to the association's Multiple Listing Service, a computer-based resource that provides descriptions of all homes listed for sale in the Spokane metropolitan area by cooperating real estate brokers.

If unemployment continues to rise, some professionals outside of the industry may look to real estate as an avenue for income, Lewis says, although new rules are increasing the amount of education and training time that new agents must go through by 50 percent, to 90 hours.

Lewis says the ability of a real estate office to retain agents has more to do with training and generating leads than with the size of the office.

"There's no disproportionate number of agents leaving big or small companies," he says.

He predicts, though, that the exodus will slow, because the market shows signs of improving, and there may be help on the way in the form of federal incentives.

"The stimulus package will probably invite more possibilities for home ownership and perk up the market," he says.

Incentives under consideration include tax credits of up to $15,000 for some first-time home buyers that wouldn't have to be repaid. The current $7,500 tax credit for first-time home buyers requires repayment of the credit within 15 years.

"If they make it an outright grant, that should help," Higgins says of the proposed tax credit.

Agent numbers usually track a year or so behind sales trends, he says.

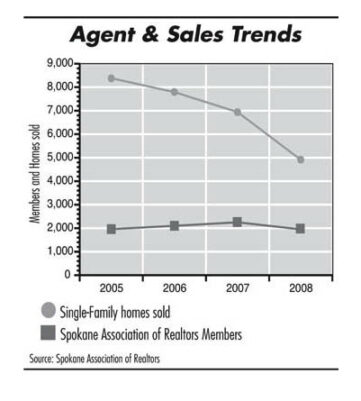

Though the number of homes sold in Spokane County through the MLS peaked in 2005, at 8,373, membership in the Spokane Association of Realtors didn't peak until two years later.

Likewise, membership numbers haven't fallen as far as sales numbers have, Higgins adds.

In 2008, 4,911 homes sold in Spokane County, down 29 percent from 6,935 homes sold in 2007. The sales volume here was $1.01 billion in 2008, a 31 percent drop from $1.47 billion in 2007.

Higgins, like Lewis, also says there are some signs that the market is stabilizing.

Long-term home values, for example, are holding up well here, he says.

Although the median home sales price in Spokane County for December was $192,636, down 7 percent from the year-earlier month, the median sales price for 2008, at $184,500, was down less than 1 percent from $185,000 for 2007.

The 2008 median sales price, though, was 53 percent higher than the 2003 median sales price of $119,900, he says.

Meanwhile, December was the first month in two years in which the inventory of homes on the market was below that of the year-earlier month.

Although the association hasn't finished compiling January numbers, Higgins says he expects that month, too, will show a slightly smaller inventory of homes on the market than the year-earlier month.

"That's important, because people in real estate want to see more balance of supply and demand," he says.

Related Articles

_c.webp?t=1763626051)

_web.webp?t=1764835652)