Sterling sees '09 return to profitability

Spokane financial company won't provide guidance on expected level of profit

Sterling Financial Corp. expects to return to profitability this year after posting a steep loss in 2008, but says it won't provide guidance to investors on how much profit it might earn in 2009.

Dan Byrne, the company's executive vice president and chief financial officer, told securities analysts in a conference call Jan. 28 that Sterling plans to get back in the black this year. Byrne made his comments a day after Sterling announced a net loss of $336.7 million, or $6.51 a share, for 2008, down from a net gain of $93.3 million, or $1.86 a share, in 2007. The Spokane bank-holding company lost $356.3 million, or $6.87 a share, in the fourth quarter last year.

Publicly traded companies such as Sterling often provide so-called "guidance," or profit projections, to give investors some idea of how the businesses expect to perform, but Byrne told the analysts, "We will not be providing specific earnings guidance for 2009 only because there are numerous headwinds and uncertainties that make it very difficult to project. I would like to state that we do not anticipate a repeat of the fourth quarter; nonetheless, we are cognizant and realistic about the challenges our industry continues to face in 2009. The national and regional economies will be a significant factor in our success in 2009."

Sterling ended 2008 with one of the strongest capital positions it has had in its history, thanks in part to $303 million it raised by selling preferred shares of its stock to the U.S. Treasury under the Troubled Asset Relief Program (TARP), Harold Gilkey, Sterling's chairman, president, and CEO, told the analysts.

Last week, President Barack Obama criticized executive compensation at some banks that have accepted capital from the government and said new regulations would be set down shortly to cap the salaries of senior executives at $500,000 a year.

"Basically, we will comply with whatever the regulations provide," Byrne said in a phone interview Feb. 6. "We're within the parameters of the regulations that we currently have in place."

Because Sterling already had concluded its agreement with the government before the new regulations will go into effect, they wouldn't apply to the company unless it sought additional capital, but Byrne added, "Certainly, within the spirit of what Obama has been talking about, our management already has taken action." He pointed out that before Obama leveled his comments about executive salaries, Sterling said its executive officers and senior managers would not receive cash bonuses for 2008.

"We were doing it in light of the earnings and to take care of investors," Byrne said. "I don't necessarily disagree with Obama in concept," he said, adding that he didn't know why executive compensation had gotten so high at some banks.

Some U.S. banks have been criticized for not loaning the capital they obtained through TARP, which Congress enacted to jump-start the economy, but Gilkey told the analysts the capital Sterling received "will allow Sterling to support credit demands in economic development in the communities which we serve."

"Specifically, Sterling will support business lending to small and medium-sized businesses and of course consumer borrowings," he said. Gilkey also said Sterling will "sustain higher levels of residential mortgage financing" for certain kinds of low-interest mortgages "to first-time and lower- to moderate-income buyers. Whenever possible, we will help owner-occupied mortgage holders who are delinquent in their payments to avoid foreclosure."

Sterling, which owns Sterling Savings Bank and Golf Savings Bank, a residential lending unit, would like to increase loans and deposits in 2009, but the marketplace "is poised to be more like flat at best," Byrne said. Still, he added, "We expect to return to profitable operations in 2009 even with the expectation for a continued elevation in our loan-loss provisions." By an "elevation" in Sterling's loan-loss provision, Byrne says, he meant only that Sterling expects its loan-loss provision will be higher than in normal times, and not that it will be as high as it was in 2008.

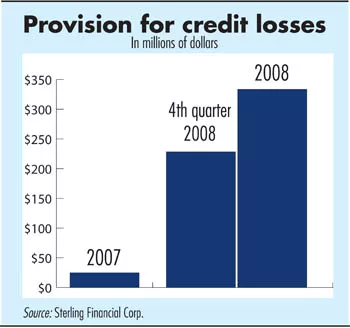

Through Sterling's provision for credit losses, which is charged off against earnings, Sterling added $333.6 million in 2008 to its so-called allowance for credit losses, which Byrne said can be seen as a reserve to cover loans for which Sterling might not be repaid. The 2008 provision was up dramatically from $25 million in 2007, and in the fourth quarter of 2008 alone, Sterling made a provision for credit losses of $228.5 million.

Byrne said the increase in the provision for credit losses stemmed in part from a decline in the appraised value of real estate in the markets Sterling serves. Adverse trends on values began early in the fourth quarter, and appraised values fell significantly in many of Sterling's markets in December, Byrne said. Also, the company made adjustments in how it calculates its provision for credit losses and applied those adjustments throughout its portfolio.

Also in the fourth quarter, Sterling said it reported a noncash charge of $223.8 million related to the impairment of goodwill because of "a protracted decline in Sterling's stock price and market capitalization." In addition, during the year, it wrote down the value of its real estate owned, which generally means real estate acquired through foreclosure or through deeds of trust granted in lieu of foreclosure, by $17.6 million, and it reversed $28.6 million in accrued interest income on nonperforming loans, or loans that are at least 90 days delinquent and on which Sterling has stopped accruing interest.

Gilkey told the analysts, "When you add back the noncash charge and these credit-related expenses, you will see that the underlying earnings generation of Sterling's core banking operation remains solid. Sterling continues to generate quarterly, pre-tax, pre-provision income of nearly $45 million."

He added, "Operationally, we made progress. Total deposits grew 9 percent to a record $8.315 billion. Importantly, non-interest-bearing accounts that are typically held by our commercial customers increased 3 percent year-over-year."

Golf enjoyed a surge of more than 30 percent in loan applications in the fourth quarter, he said.

Sterling continues to experience stress in its residential construction portfolio, mainly from the Portland area, where real estate values have declined, Gilkey said. Byrne said Sterling's largest increase in nonperforming assets, which include both nonperforming loans and real estate and equipment on which the bank has foreclosed, occurred in northern California, where nonperforming assets grew by $52.8 million in the fourth quarter. Such problem assets grew by $42 million in the Puget Sound area in the fourth quarter.

The Puget Sound, which is Sterling's largest market, continues to hold up a little better than most markets, especially near Seattle, Byrne said. "Fortunately, most of our residential construction in the Puget Sound region is weighted toward vertical construction," or tall buildings, although Sterling is "a bit guarded toward future prospects" there.

Sterling said in its earnings release that "a large project in northern Idaho also entered nonperforming status," but Byrne says Sterling doesn't identify a troubled borrower even when it has said the borrower's project is problematical.

As of Dec. 31, Sterling's nonperforming assets, were $610.7 million, up nearly 40 percent from the end of the third quarter, Byrne said.

"We believe our capital position is adequate to enable Sterling to see its way through this cycle," Gilkey said. "We do not anticipate the need for further capital."

Related Articles

_c.webp?t=1763626051)

_web.webp?t=1764835652)