Home » Stimulus bill's tax tools can boost businesses

Stimulus bill's tax tools can boost businesses

Higher Section 179 limit extended for 2009, loss carry-back rule enhanced

March 12, 2009

l economic stimulus bill has extended provisions that make it more attractive for businesses to buy new equipment and also has broadened a tax tool that allows businesses to apply losses in the current year to earlier years.

Among other tax changes, the new legislation also includes tax help for individuals, they say.

Chris Hesse, director of taxation for the Spokane-based certified public accounting firm LeMaster Daniels PLLC, says the American Recovery and Reinvestment Act (ARRA) of 2009 includes provisions that benefit businesses of all types and sizes, especially smaller businesses.

"Businesses benefit from the ARRA by lowering the effective income-tax rate through accelerating deductions," says Hesse. "But the ARRA also benefits businesses with losses—(those) not currently paying income tax—because of the flexible net operating loss carry-back provisions."

He says, however, that consistent with recent tax law changes, the provisions are complex, which adds to the cost of compliance.

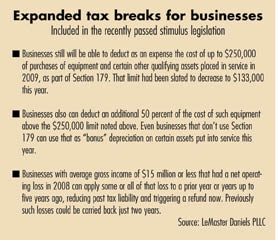

Among the more notable changes in the measure is an extension of an increase in the maximum deduction allowed under what's called the Section 179 provision. That tool allows small and medium-sized businesses to deduct as an expense at least some of the cost of equipment and certain other qualifying depreciable assets in the year they buy the assets, rather than depreciating the value of the assets over time.

Thanks to that change, up to $250,000 of the cost of a qualified asset can be deducted from taxable income for the 2009 tax year. That limit was scheduled to fall to $133,000 in 2009, Hesse says.

Keith Schmidt, a partner at Spokane-based McDirmid, Mikkelsen & Secrest PS, says the extension serves as a "huge incentive for businesses to go out and make capital expenditures."

Also extended for another year is a separate rule that gives businesses bonus depreciation—on top of the Section 179 provision—of 50 percent of the value of an asset that exceeds the $250,000 Section 179 limit for expensing the asset. The business also then can deduct the first year of normal depreciation on the remaining value of the asset.

For instance, if a business buys a $400,000 piece of equipment, it could write off $250,000 of that purchase as an expense under Section 179, plus take bonus depreciation of $75,000 (half of the $150,000 that's left of the asset's value), as well as normal first year of depreciation, which would be $15,000 under a five-year depreciation schedule applied to the remaining $75,000 of value. So the total first-year write off would be $340,000.

Hesse says that a business can take the 50 percent bonus depreciation even if it doesn't take the Section 179 provision. The bonus depreciation is available only for brand new assets, rather than used assets, and the assets must have depreciable lives of 20 years or less.

"Sidewalks, landscaping, certain leasehold improvements, certain vehicles, and other equipment used in business qualify," Hesse says. He cautions, "Claiming bonus depreciation now means that the business will have less depreciation expense to claim in future years."

Loss carry back

Businesses that are suffering losses also can benefit from the new federal legislation, both Hesse and Schmidt says.

Schmidt says if a business's average gross income is $15 million or less and it had a net operating loss in 2008, it can apply some or all of that loss to a prior year or years up to five years ago, reducing a past tax liability and triggering a refund.

Previously, such a "loss carry back" could be applied only two years back.

"It gives businesses a tremendous amount of flexibility to carry back losses to the years which would provide them the most tax benefit," Schmidt says.

Hesse says the provision allows taxpayers to choose which prior year—although they can't choose the immediate prior year—to carry back the net operating loss. If the loss is not fully absorbed by net income in the chosen year, businesses can carry forward the remaining loss to the next prior year, Hesse says.

Also included in the new stimulus bill are additional or expanded tax credits businesses can take advantage of, Hesse says. Because credits are applied directly to a business's taxes, as opposed to being deducted from taxable income, credits provide a greater tax benefit, he says.

With the so-called work opportunity credit, employers can claim a credit of up to 40 percent of the first $6,000 of wages paid to employees in certain target groups, such as ex-felons, food stamp recipients, and disabled veterans, Hesse says. He says the federal act expands that eligible target group to include unemployed veterans and what the government calls "disconnected youth."

The expanded benefit applies to such workers hired in 2009 and 2010, Hesse says. The use of the credit is subject to limitations imposed by the alternative minimum tax (AMT), he says.

The provisions are very complex, Hesse says. If a tax return for the year ended in 2008 already has been filed, the taxpayer has until April 17 to change the previous filing.

Help for individuals

dividuals that many thought wouldn't be enacted until later in the year, but that was included in the stimulus package, is the extension of AMT relief. The AMT was intended to prevent wealthy individuals from taking excessive advantage of loopholes to avoid taxes, but hasn't been indexed for inflation, so the number of people who are subject to the AMT has been increasing, particularly in the middle-income category.

The act provides another one-year "patch" that boosts the AMT exemption, helping to insulate most middle-income taxpayers from the AMT, he says. The 2009 exemption covers married couples who file their tax returns jointly and whose joint adjusted gross income is less than $70,950. For individuals and heads of households, it is $46,700, and for married filing separately, it is $35,475, he says.

Another new provision is what's called "making work pay," which will apply to the 2009 and 2010 tax years and essentially will boost workers' take-home pay. Specifically, the provision provides a refundable tax credit of up to $400 for working individuals and $800 for working married taxpayers filing joint returns. People get the refundable tax credit whether they owe taxes or not, Hesse says. Because of it, the average family will take home at least $65 more in pay every month.

Many higher-income taxpayers will see little or no change in their take-home pay. That's because the making work pay credit is phased out when the adjusted gross income of a married couple who files a joint tax return falls between $150,000 and $190,000 and the adjusted gross income of other taxpayers is between $75,000 and $95,000.

The Internal Revenue Service says that for most taxpayers, the additional credit will automatically start showing up in their paychecks this spring.

Also, qualifying taxpayers who are buying their first home now can claim a tax credit of up to $8,000, or $4,000 for married individuals filing separately, on their 2009 tax returns. The home must be purchased after Dec. 31, 2008, and before Dec. 1, 2009.

Unlike the previous credit, this credit won't have to be paid back by taxpayers who claim it, provided the house remains their primary home for three years after the purchase date.

The credit previously in place applied to homes purchased last year between April 8 and Dec. 31, and provided a maximum credit of 10 percent of the home's purchase price, up to $7,500, or $3,750 for married individuals filing separately. Also, the credit had to be repaid in 15 equal installments over 15 years, beginning with the 2010 tax year.

The amount of the credit begins to phase out for taxpayers whose adjusted gross income is more than $75,000, or $150,000 for joint filers.

The federal government says first-time home buyers represent a significant portion of single-family home sales. In 2008, nearly one of every two home buyers was buying a house for the first time.

For purposes of the credit, a person is considered a first-time home buyer if he or she, and their spouse if they're married, did not own any other main home during the previous three years.

Taxpayers who buy new vehicles in 2009 and pay sales tax on their purchases will receive benefit from another provision in the federal stimulus act.

The act creates a deduction for state and local sales and excise taxes paid when purchasing brand new cars, light trucks, motorcycles, and recreational vehicles from Feb. 17 through the end of 2009. The deduction applies to sales tax on the first $49,500 of the vehicle's price.

In the last few years, U.S. residents have been allowed to deduct sales taxes if they itemized deductions and elected not to deduct state income taxes, which has benefited Washington residents because the state doesn't have an income tax, Hesse says. That break, which already had been extended for 2009, gives taxpayers who itemize a deduction based on their income and the tax rate where they live and also allowed them to add to their deduction taxes paid on certain big-ticket items, including cars, boats, and RVs. It remains on the books.

Under the provision in the stimulus act, taxpayers who don't itemize their deductions will qualify for the new sales-tax deduction, Hesse says. The new deduction, however, is limited to taxes paid when buying a brand new vehicle, he adds.

Schmidt points out that the deduction phases out for joint filers with adjusted gross income exceeding $250,000 and for single individuals when their income exceeds $125,000.

Those receiving Social Security benefits and individuals on disability will receive a one-time payment of $250 in 2009.

The federal act also provides help to laid-off workers. For 2009, the act suspends the federal income tax on the first $2,400 of unemployment benefits for each recipient, says Hesse. Many also will get a $25 weekly boost in their unemployment check.

Latest News

Related Articles

![Brad head shot[1] web](https://www.spokanejournal.com/ext/resources/2025/03/10/thumb/Brad-Head-Shot[1]_web.jpg?1741642753)