Home » All is glitter again in mining sector

All is glitter again in mining sector

December 23, 2009

At this time last year, mining executives were saying how much difference a year had made. With metals prices down and capital markets frozen, solemn executives were yearning for the days just 12 months earlier when the sun was shining on their industry.

Today, while many industries are suffering the effects of a poor economy, the mining industry is basking in soaring metals prices, solid demand, and ample capital.

"We're very excited about what we see happening 2010, '11, '12, all those upcoming years," says Don Poirier, vice president for corporate development at Coeur d'Alene-based Hecla Mining Co.

That also was the mood at the recent annual convention in Nevada of the Spokane-based Northwest Mining Association, says Executive Director Laura Skaer.

"Everybody I talked to was very upbeat," Skaer says of the participants. "It was 180 degrees opposite of the year before."

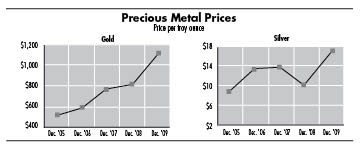

Precious metals prices have surged this year. Gold has been selling for roughly $1,150 a troy ounce recently, up from about $825 an ounce this time last year, while silver has been priced recently at about $18 an ounce, nearly double the price it was fetching a year earlier.

The surge could continue. Poirier says that based on what he hears from Wall Street, gold could reach as high as $1,300 to $1,400 an ounce next year, fueled in part by the weak U.S. dollar and continued strong demand as the economies of industrialized nations abroad improve. Silver prices—a staple for Inland Northwest mining companies—also should continue to rise, as should the base metals that typically are important byproducts of silver mining here, he says.

Higher metals prices and better markets for raising capital have breathed new life into Hecla, which at this time last year was struggling with debt obligations and softer metals prices. By fall, Hecla had paid off all its debt and posted third-quarter earnings that were the second highest in its history.

Last year, Hecla spent $750 million for the about 70 percent stake in the Greens Creek mine, in Alaska, that it didn't already own, a purchase that roughly doubled the company's overall silver output. Poirer says Hecla expects to produce 10.5 million to 11 million ounces of silver this year, up from about 5.7 million ounces just two years earlier. Its production cash costs, meanwhile, have plummeted in the past year.

The big story for Hecla next year might be at its Lucky Friday mine, near Mullan, Idaho, which currently employs about 250 people. Hecla expects to complete sometime late in the first half of next year a feasibility study that could result in an additional shaft being constructed far deeper into the underground mine, opening up additional ore resources.

"We fully anticipate that this program will be going forward, barring any unforeseen problem," says Poirier. "This will set the stage for Lucky Friday for the next several decades."

Coeur d'Alene Mines Corp. also reported surging production, in its case mostly due to two new mines it has brought into production, the Palmarejo, in Mexico, and the San Bartolome, in Bolivia. Coeur expects to finish the year with total silver production of 18 million ounces, and company spokesman Tony Ebersole says next year's production should be higher.

Also next year, Coeur expects to open its long-awaited Kensington gold mine in Alaska, and has begun the process of possibly resuming mining at its Rochester mine in Nevada, where it continues to produce silver through residual leaching from past mining. Ebersole says. It suspended operations at its Cerro Bayo mine in Chile late last year.

Latest News

Related Articles