Home » Bank's life after NASDAQ

Bank's life after NASDAQ

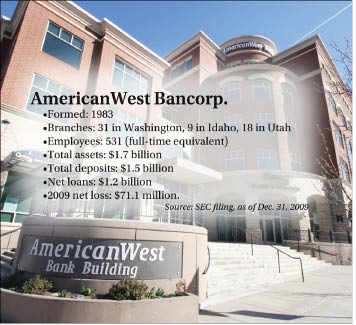

AmericanWest says it doesn't expect exit from stock exchange to hinder capital pursuit

March 25, 2010

The recent decision by AmericanWest Bancorp., Spokane-based parent of AmericanWest Bank, to pull its common stock off of the Nasdaq exchange shuts off its access to a large potential source of capital at a time when the company is hungry for a cash infusion.

CEO Patrick Rusnak says, though, that he doesn't expect the action to have a debilitating effect on AmericanWest's ongoing efforts to raise additional capital or to rebound financially, since its main focus now is on attracting private investors.

"The bottom line is, it really doesn't" have a negative impact, he asserts.

Prospective private investors are interested in the bank's fundamental soundness and—if convinced of its strengths—acquiring an ownership interest at the best possible price, and aren't going to be scared off by the delisting of its stock, Rusnak says.

"Some of them need to 'price' their funds, and having a bulletin-board quote is adequate for them," he says, noting that he expects the bank's common stock to continue to be quoted for trade on the OTC Bulletin Board, an electronic quotation system for unlisted public securities.

"If they're happy, we're happy," Rusnak says.

Companies that have been delisted from stock exchanges for falling below minimum capitalization, minimum share price, or other requirements often end up being quoted on the OTCBB. AmericanWest's common stock continues to be registered with the U.S. Securities and Exchange Commission, and Rusnak says, "It's my expectation that we will continue to adhere to the (Nasdaq) governance requirements," such as one requiring it to have a majority of independent board members.

"We're set up to do that, and there's no reason not to do it," he says. "A lot of it for us boils down to best practices. We want to always be doing the best practices from a governance perspective."

Also, he says, there's nothing that prevents AmericanWest from relisting its stock at some point. As part of the bank's recapitalization, "my expectation is there will be a reverse stock split that will resolve the issue of a minimum bid price" that led to the bank's delisting, Rusnak says.

AmericanWest voluntarily delisted its stock effective March 24, but was facing a deadline this month by which Nasdaq had said the minimum bid price of the bank's common stock needed to exceed $1 a share to avoid delisting for noncompliance with its rules. AmericanWest had announced last October that it had been notified by Nasdaq of its noncompliant status, after the bank's stock had fallen below $1 a share for 30 consecutive days.

It closed trading on March 12 at 30 cents a share, down from a 52-week peak of $1.59 and from a five-year peak of more than $26 a share. With 17.21 million shares outstanding, its closing trading price equated to a market capitalization—or total value of all its shares—of just $5.2 million, though the bank ended last year with reported assets of $1.65 billion.

In announcing earlier this month that it planned to delist its stock, AmericanWest said it considered strategies to cure the minimum bid price deficiency, along with the costs of Nasdaq listing and compliance and other factors, and concluded that continuation of the listing wasn't in its best interest. Rusnak says one of the things the delisting does is eliminate about $50,000 a year in direct listing fees.

AmericanWest isn't the only Spokane-based financial institution having to wrestle with delisting-related considerations.

Sterling Financial Corp. said in a regulatory filing that it received a letter from Nasdaq Dec. 7 notifying it that the bid price for its shares, too, had slipped below the $1 threshold for 30 consecutive days and that its stock will be subject to delisting if it doesn't correct that deficiency by June 7.

The Spokane company said in a regulatory filing that it is evaluating its options "and intends to take appropriate actions in order to retain the listing of its common stock" on Nasdaq, However, it added, "There can be no assurance that Sterling will be successful at reestablishing compliance with the Bid Price Rule, and a delisting from Nasdaq would have a negative impact on the value and liquidity of our common stock and our ability to access the capital markets."

National statistics on how many publicly traded financial institutions have been delisted during the economic downturn are difficult to come by, but Rusnak says, "There's probably a bank a week going through this."

AmericanWest last month reported a fourth-quarter net loss of $17.7 million, or $1.03 a share, which—though substantial—was a major improvement over a loss of $57.7 million, or $3.35 a share, in the year-earlier period. For all of 2009, the company said it lost $71.1 million, or $4.13 a share, compared with a 2008 net loss of $192.4 million, or $11.18 a share.

Rusnak says the bank has been making strong headway in shedding its problem loans, most of them for residential construction and development projects in a couple of markets outside of Spokane, and adds, "I think we're showing evidence that the asset quality is stabilizing."

He says, "The bank's loan problems are in particular product types and geographies. Over 90 percent of our company is a good-performing company. We have a great underlying franchise, and that's why I think a lot of investors have interest here."

None of the interest that Rusnak says he's seeing has translated yet into announced investments in the bank, and he acknowledges that there's "a big difference between investor interest and investor commitment." Nevertheless, based on the activity he's seeing, he says, "I'm probably more encouraged than at any time in the last six months."

AmericanWest announced last month that it had hired Cappello Capital Corp., of Santa Monica, Calif., to serve as its financial adviser in connection with its recapitalization efforts. Sandler O'Neill & Partners LP, which it had hired to serve as its financial adviser for capital-raising efforts during 2008, agreed to continue its efforts to secure commitments from prospective investors in cooperation with Cappello.

Cappello specializes in what is called PIPE financing, which stands for private investment in public equity and is popular because it's considered a relatively speedy and cost-effective way for some companies to raise capital.

Part of the challenge, Rusnak says, is that "you have to get enough capital raised to conclusively solve the problem." Through Cappello, he says, AmericanWest is working to identify some leadership, or "cow bell" investors, who have the reputation to help draw in others.

"It really comes down to some basic blocking and tackling of community banking," in terms of internal improvements, and convincing investors that AmericanWest is a good bet, he says.

"Clearly, time is of the essence," he adds. Aside from the need to improve regulatory capital ratios, he says, "It's hard for our group of bankers here not to be out making loans," but a capital infusion is what it's going to take to get the loan pipeline substantially reopened.

AmericanWest operates 58 branches in Washington, North Idaho, and Utah.

Latest News

Related Articles

_web.jpg?1729753270)